Apartment developer Tim Gurner let the cat out of the bag when he admitted that easing planning rules won’t magically boost housing construction:

“Rich Lister and Melbourne developer Tim Gurner says while the anti-development stance adopted by many councils is a major roadblock, it is only a part of problem”.

“He estimated that less than half of the 51,000 new dwellings approved in Victoria last year would actually get built, due to poor pre-sales, financing or developer capability”.

“The Municipal Association of Victoria says that, as of September, 120,000 houses, townhouses and units had been approved with construction yet to begin, with councils using this to hit back at claims they are to blame for the housing bottleneck”.

A recent Daily Telegraph article likewise reported that “Almost one billion worth of housing in one of Sydney’s most affordable local government areas is yet to be built despite the DAs being approved up to five years ago”:

“The dead zones – also known as “zombie DAs” are located in Liverpool – one of the most affordable local government areas in Sydney”.

“Each has been approved for a residential flat development, including one for a 25-storey complex worth more than $40 million that was lodged in 2016”.

“The DAs represent potential homes for an estimated 1600 families, but are yet to be activated with construction and labour costs, rising interest rates and government taxes blamed for the delays”…

Liverpool Mayor Ned Mannoun said it was taking between five to seven years from DA approval to a “key in the door”.

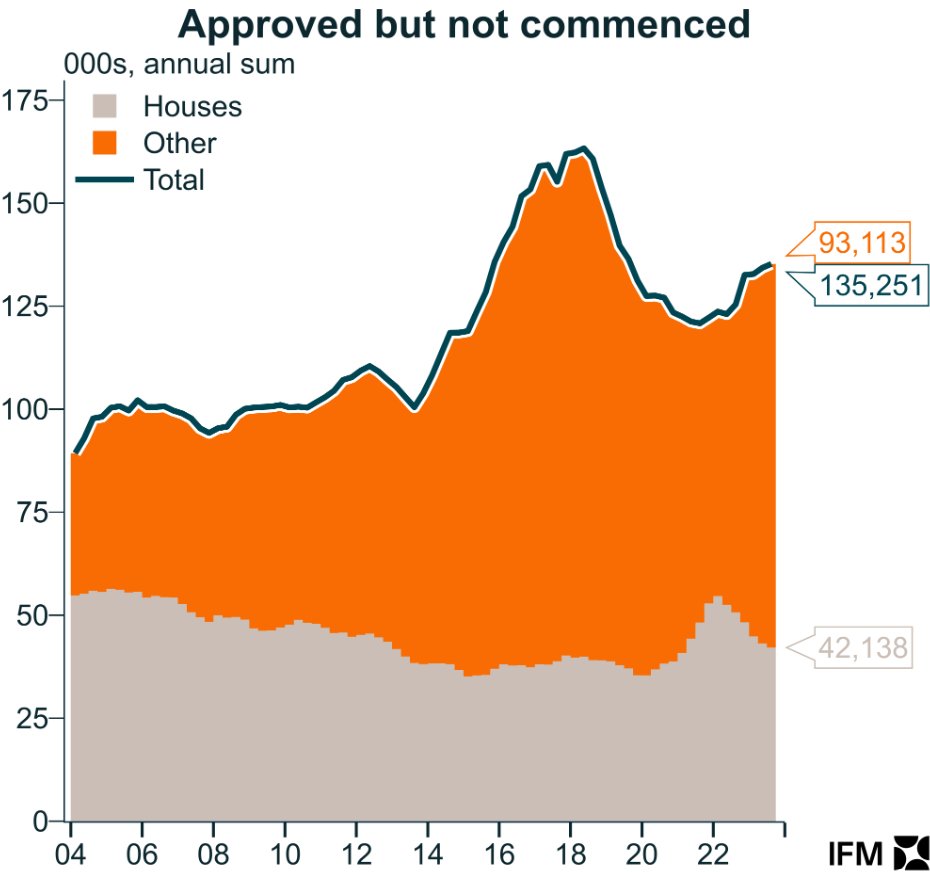

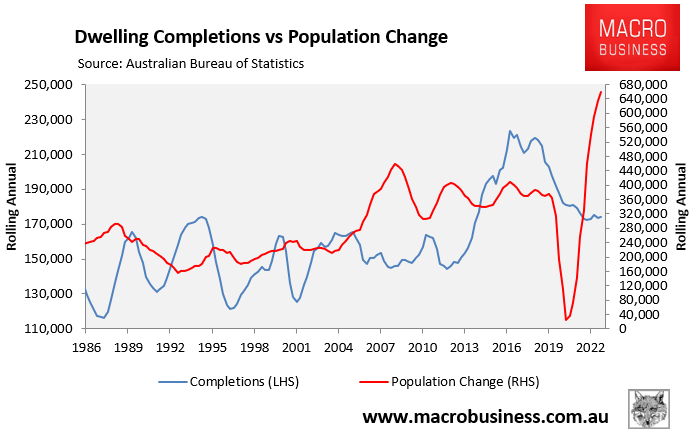

The following chart from Alex Joiner, chief economist at IFM Investors, illustrates the point. It shows that a large pipeline of 135,250 dwellings has been approved for development, but work has yet to begin:

Tens of thousands of home approvals in Australia are withering on the vine because builders cannot afford to proceed.

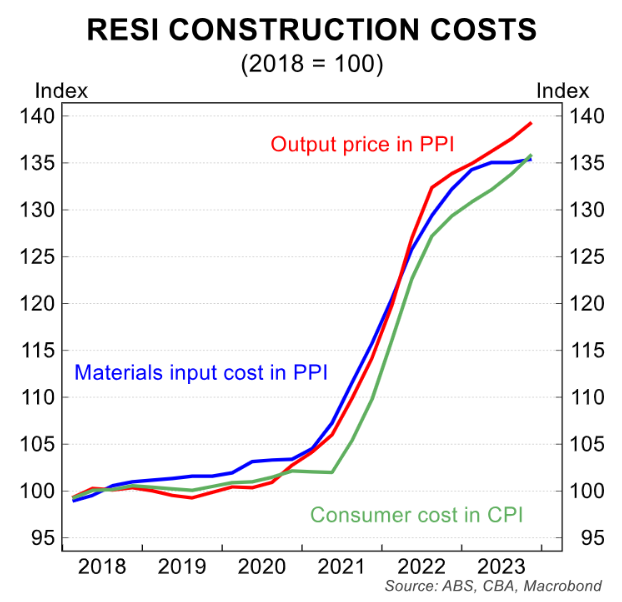

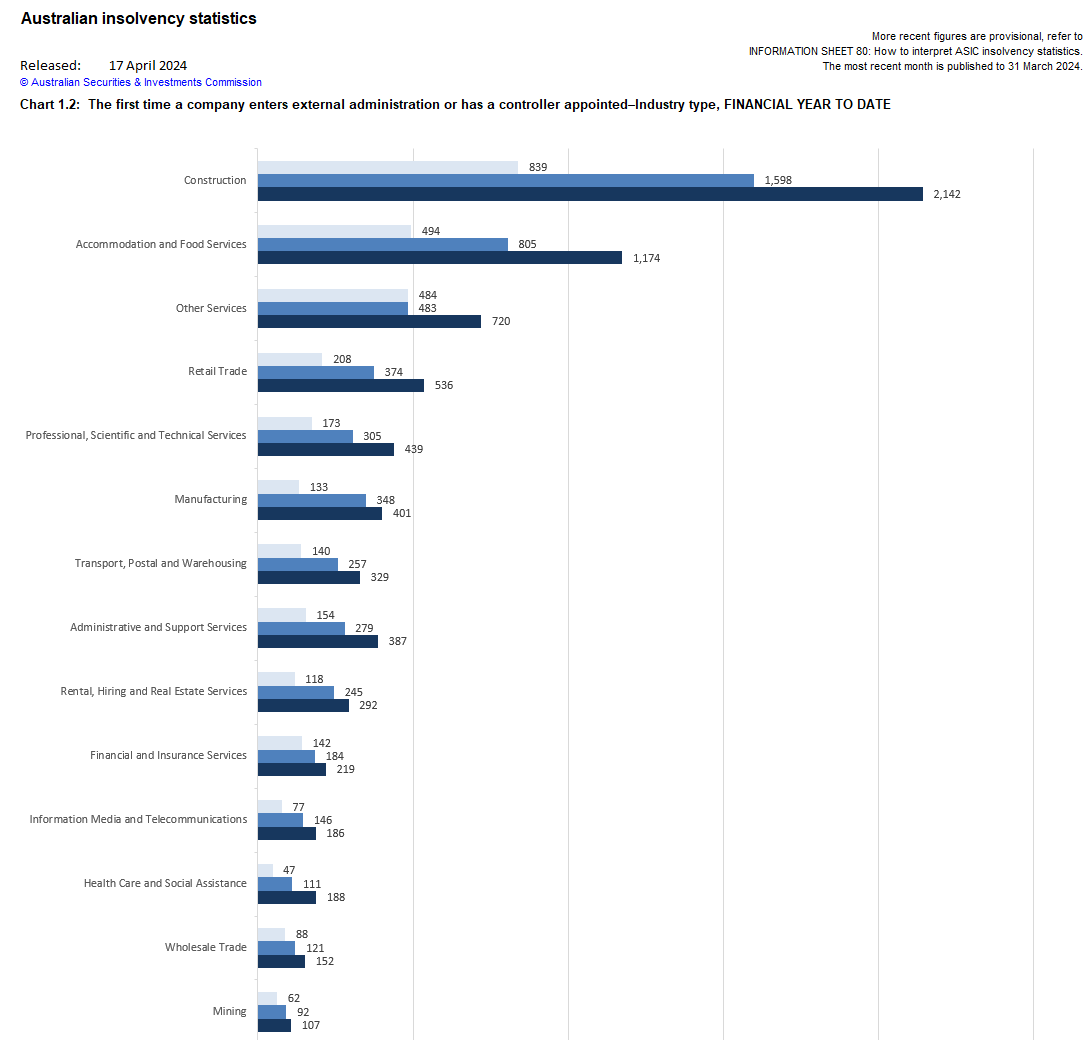

Financing costs are excessive, material costs have skyrocketed, and home builders are going bankrupt at an alarming pace.

Furthermore, home builders compete for workers with state government infrastructure projects.

Thus, easing planning rules to allow high-rises everywhere, as urged, will not magically solve the “supply” issue.

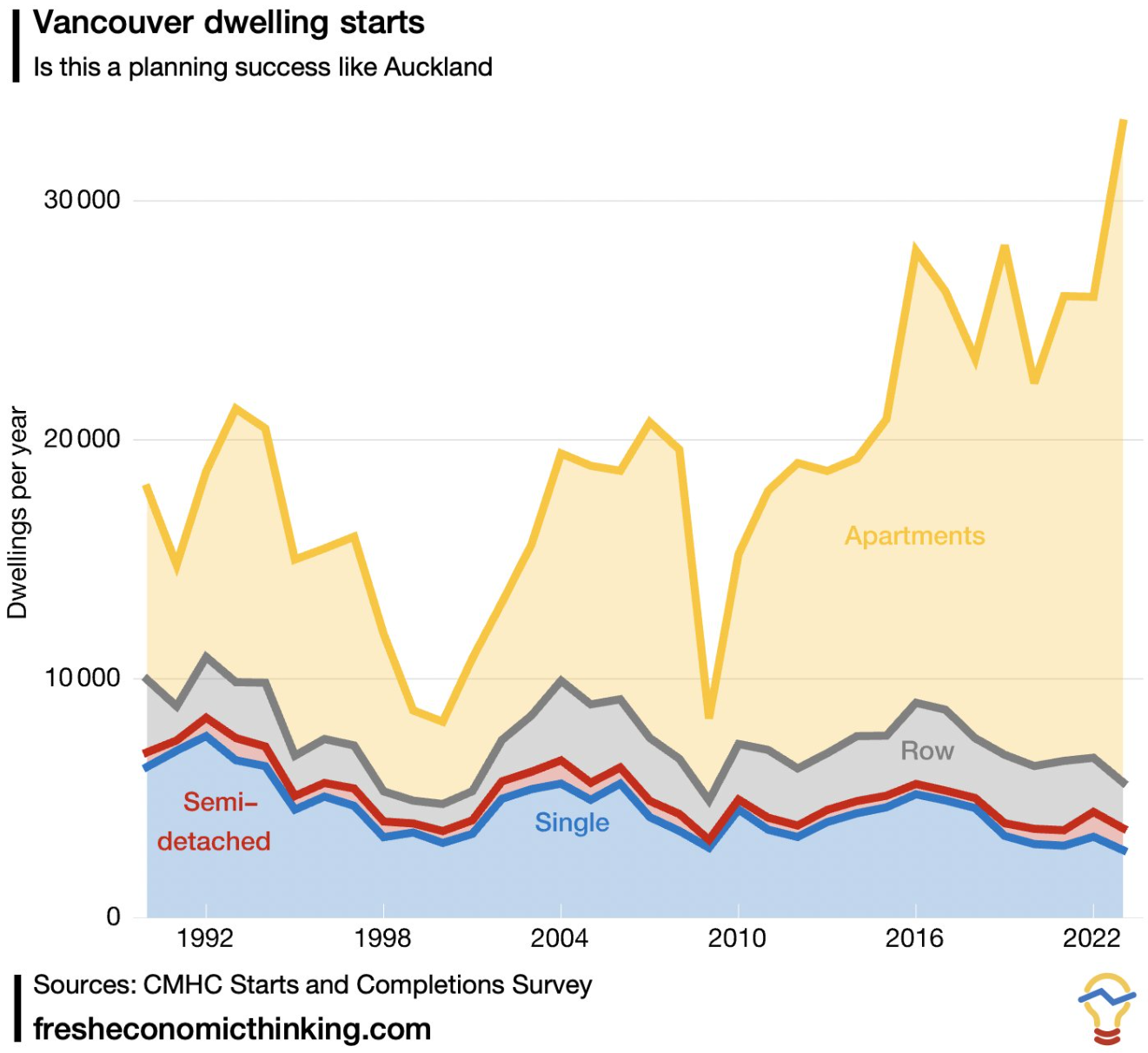

If this were true, Vancouver, Canada, would not be the least affordable city in North America to own or rent.

We must also acknowledge that flooding the housing market with fresh supply is not in the developers’ best interests because it reduces profitability.

Developers benefit financially by drip-feeding supply to maintain high pricing and margins.

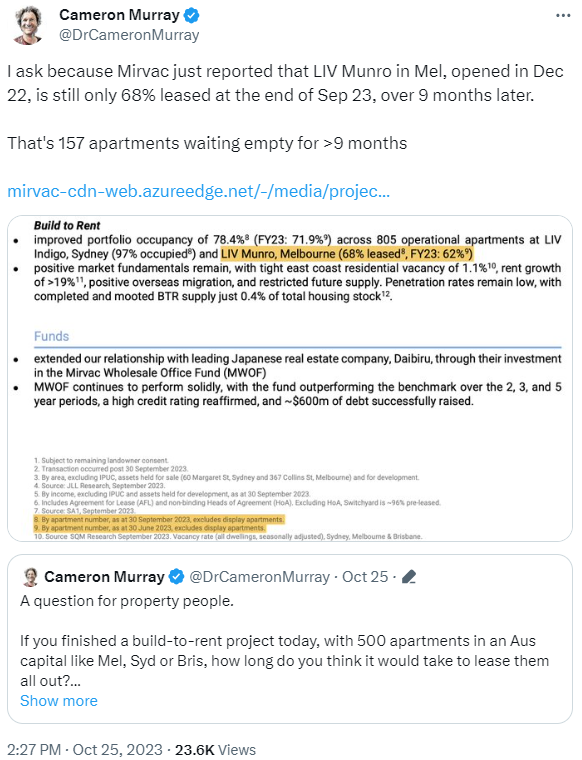

For example, Mirvac retained 157 unoccupied units at their LIV Munro development in Melbourne for nine months during the worst rental crisis in history.

Developers earn higher margins from maintaining a housing shortage and creating FOMO (Fear of Missing Out). This situation will persist unless our governments regulate land release to force development and sale.

Short of compelling developers to build homes, the only way to expand the housing supply is for governments to produce additional housing stock directly through public housing programs. However, doing so is expensive.

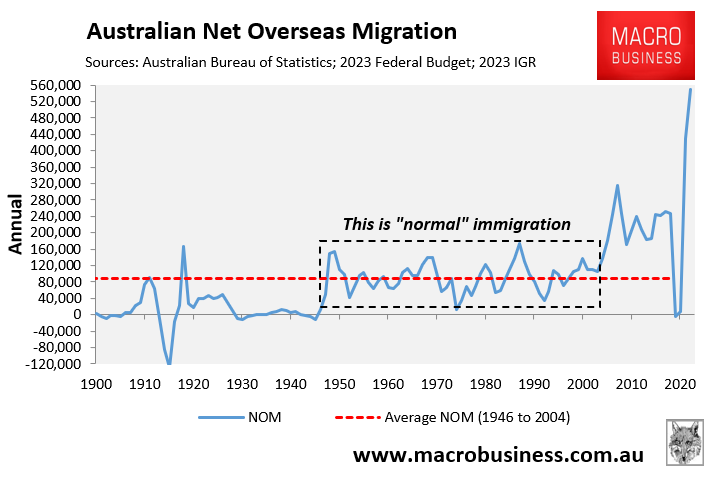

Reducing net overseas migration to historical levels of less than 120,000 per year would be a lower-cost, faster, and more sustainable approach.

To address the nation’s housing deficit, net overseas migration must be decreased to a level lower than the country’s capacity to create housing and infrastructure.

Otherwise, population demand will always outweigh supply.