DXY eased last night:

AUD marched higher:

Aided by a reversal in JPY:

Brent looks ready to break lower. Gold has flamed out:

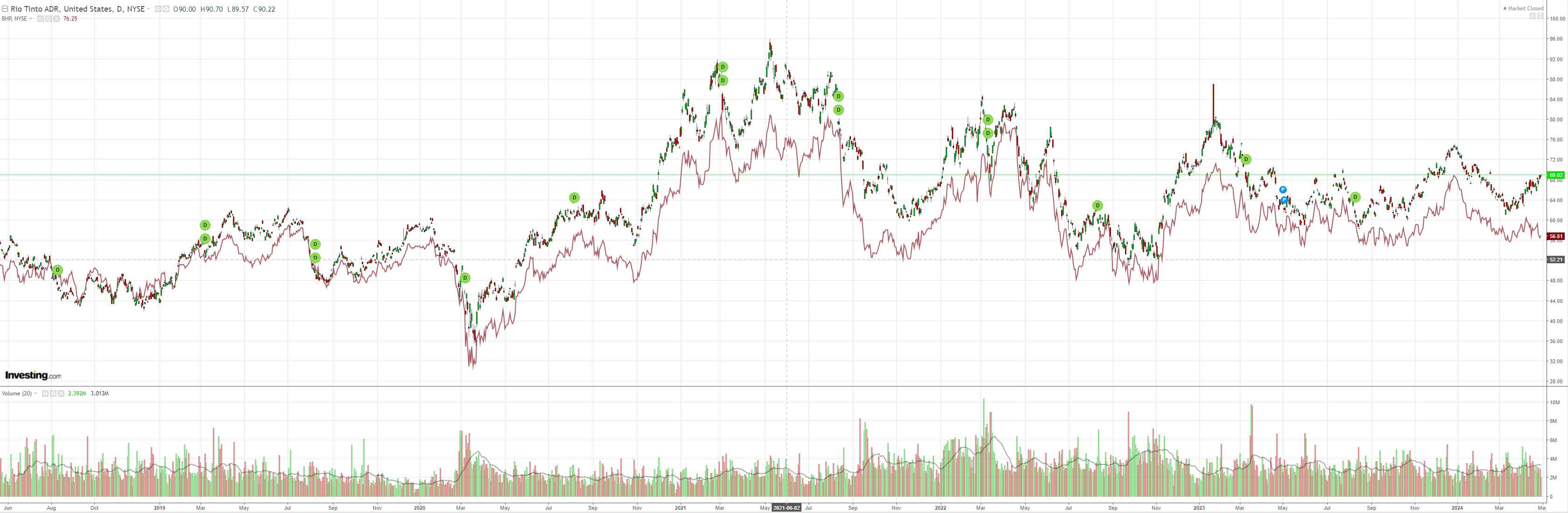

Big miners have bifurcated as Wall St pushes RIO with copper:

Copper squeeze ongoing:

EM more promising:

Junk not so good:

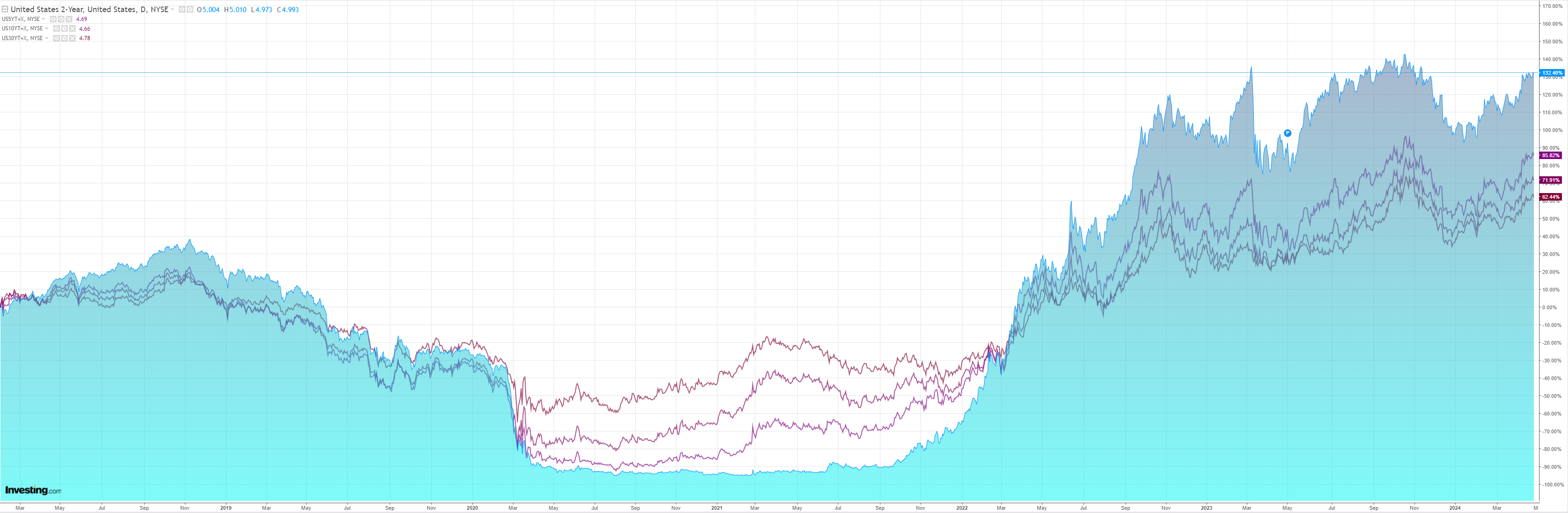

As yields eased:

And stocks firmed:

There was some rumoured yen intervention, which helped stabilise things.

Oil’s decline is looking hopeful as the Rafah invasion gets underway. The price probably has $5-10 of Middle East risk, so more falls are a good prospect. The sleeper is Ukraine’s attacks on Russia, which are curtailing its refining capacity.

If oil corrects to Brent $80, which is should given the speculative long, then expect the disinflationary soft landing narrative to return, with yields down, stocks up, and commodities cooling off. In that event, AUD will drift higher as safe havens unwind. This is still my base case.

The overnight TGA borrowing estimate for Q2 and Q3 came in below consensus, so it was mildly bullish for bonds and stocks without delivering a rocket.

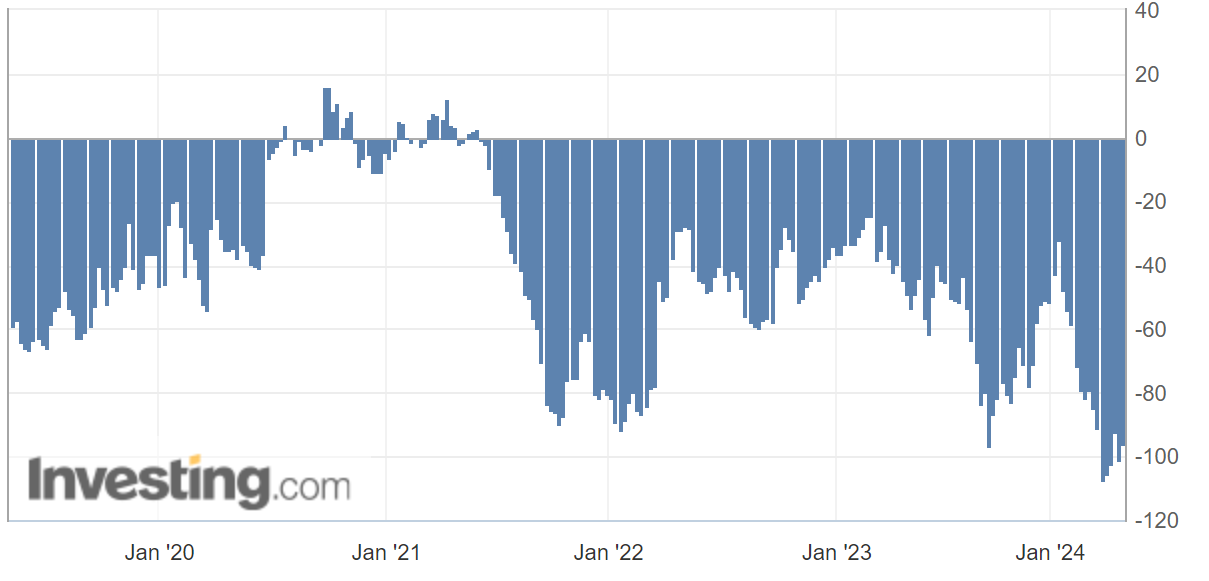

The AUD megashort has acted as a 63-64 cent base now for all market convulsions since November 2022:

It is hard to see this base breaking.

Yet, equally, it will take full-blown global reflation to drive us back up the top of the trading range at 68 cents and face a ripping short squeeze to get us above it. That is a risk case ‘no landing’ scenario that I still can’t grasp while China falls quietly apart and US bond vigilantes riot at every data pop.

AUD still still appears stuck in the mid-60s.