On Wednesday, the Australian Bureau of Statistics (ABS) released its cost-of-living indices for the March quarter, revealing that employee households are the hardest hit.

Source: Australian Bureau of Statistics

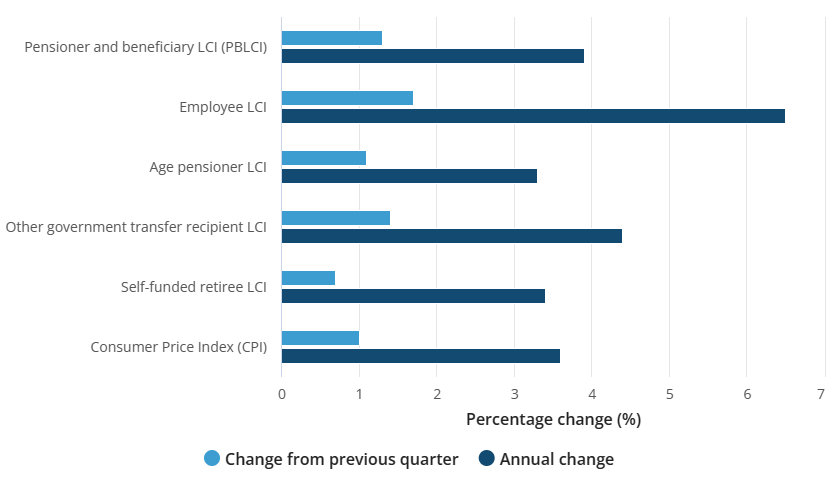

Employee household costs of living increased by 6.5% in the year to March 2024, easily exceeding the 3.6% increase in CPI inflation.

The rise in employee cost of living also easily exceeded the 4.2% increase in wage growth over the year to December (the latest available observation).

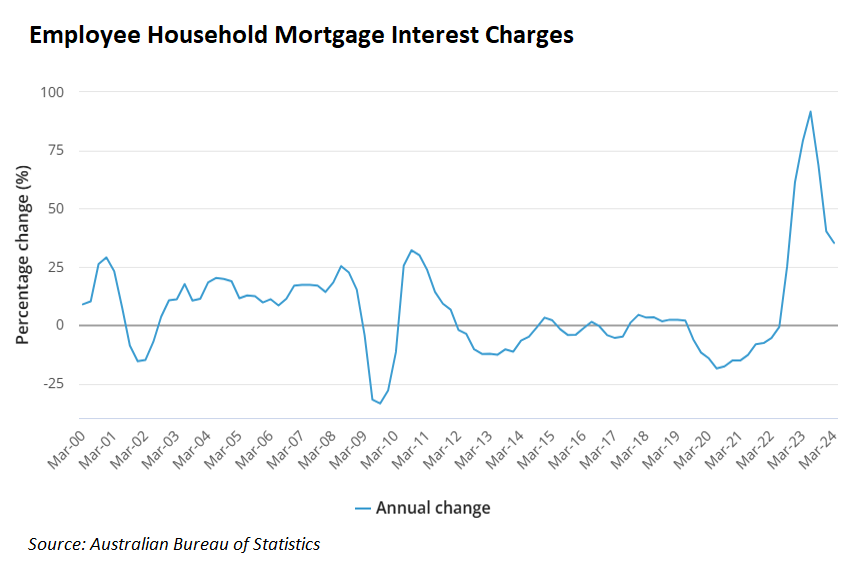

According to the ABS, the significant increase in employee cost-of-living was caused by increases in mortgage interest charges.

“Mortgage interest charges rose 7.0% in the March 2024 quarter, up from 5.4% in the December 2023 quarter”, ABS head of prices statistics Michelle Marquardt said.

“The rise reflects the continued rollover of some expired fixed rate to higher variable rate mortgages, as well as flow on effects from an increase in the Reserve Bank of Australia’s cash rate of 25 basis points in November 2023”.

The ABS also noted that “quarterly increases in living costs for Employee households have been higher than the CPI since September 2022”.

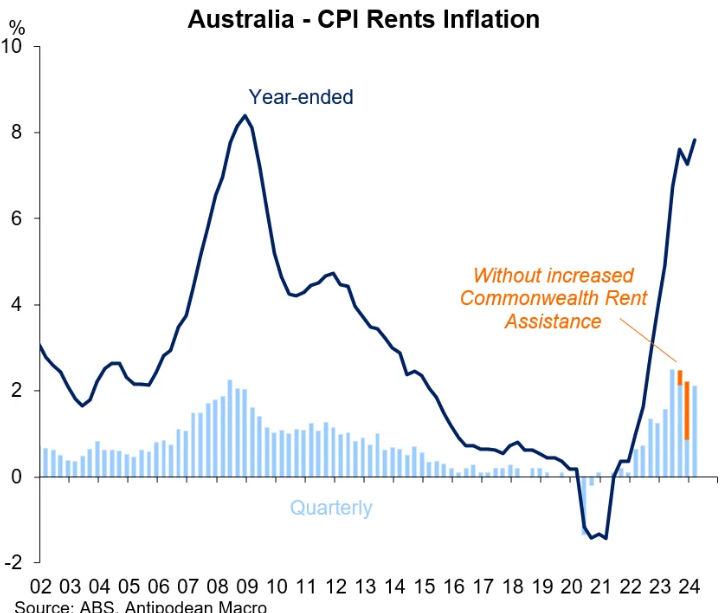

Soaring rental costs have also driven up living costs, especially for those reliant on government transfer recipients; albeit were moderated by the increases to Commonwealth Rent Assistance:

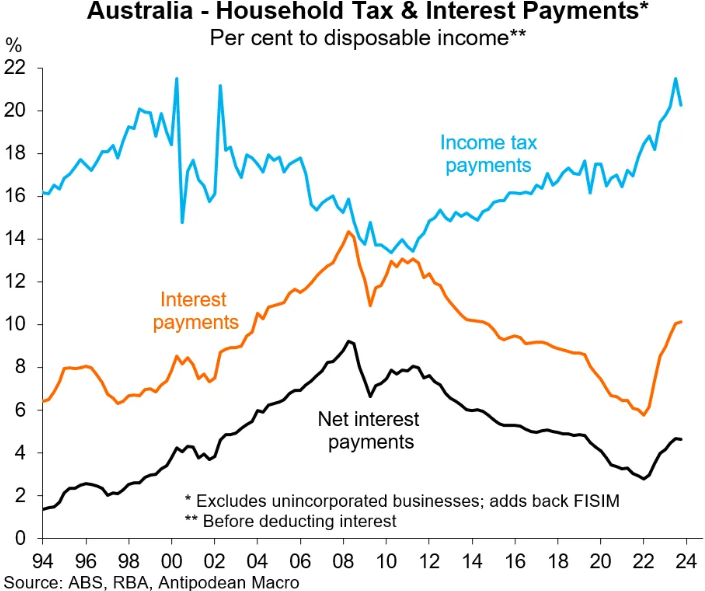

Employee households are also hurting from the world-record increase in income tax payments, which have risen alongside mortgage payments and rents:

The spike in employee cost of living can be traced, in large part, to ‘Alboflation’ – i.e., juicing demand by running an immigration program well above the supply-side of the economy (especially the housing market).

Alboflation is directly increasing the cost of living and the CPI (for example, through rents), forcing the RBA to keep interest rates higher than otherwise to restrain demand and bring inflation down.

Self-funded retirees and aged pensioners, who typically own their homes outright, are the segments of the population that have remained relatively undisturbed by surging mortgage repayments, rents, and personal income taxes.

They had the lowest increase in cost of living—i.e., 3.3% and 3.4%—in the year to March, which was lower than the headline inflation rate (3.6%).