New Zealand’s economy is sliding into a deepening recession.

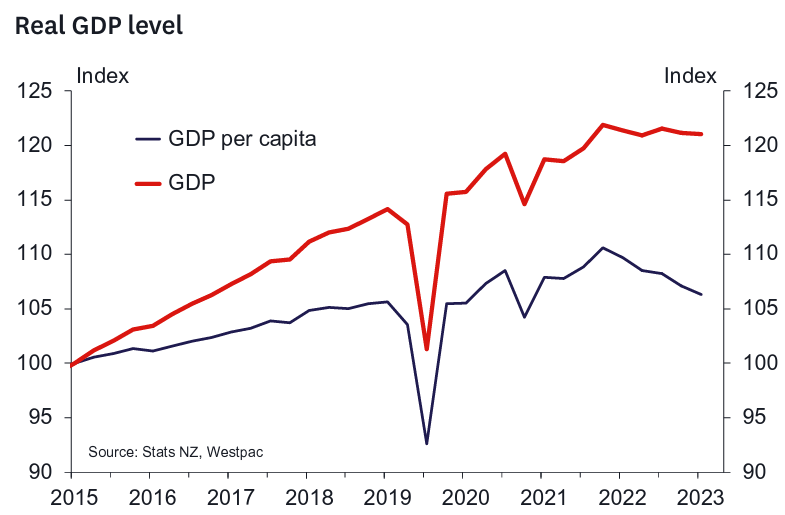

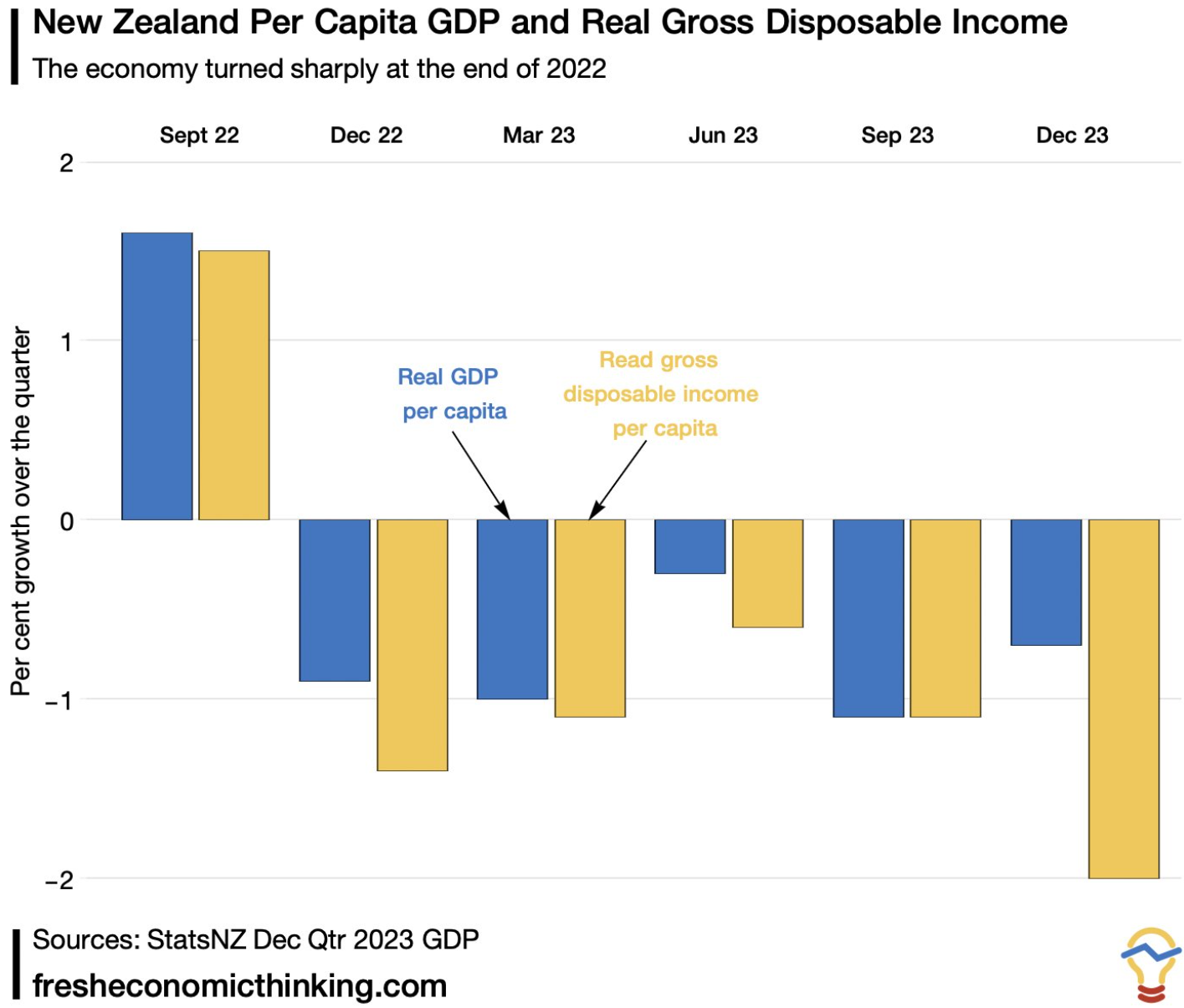

Overall GDP growth is falling, while per capita outcomes are collapsing amid a 2.7% surge in New Zealand’s population in 2023.

Per capita retail spending in New Zealand has collapsed, while forward-looking growth indicators point to further falls over the first quarter of 2024:

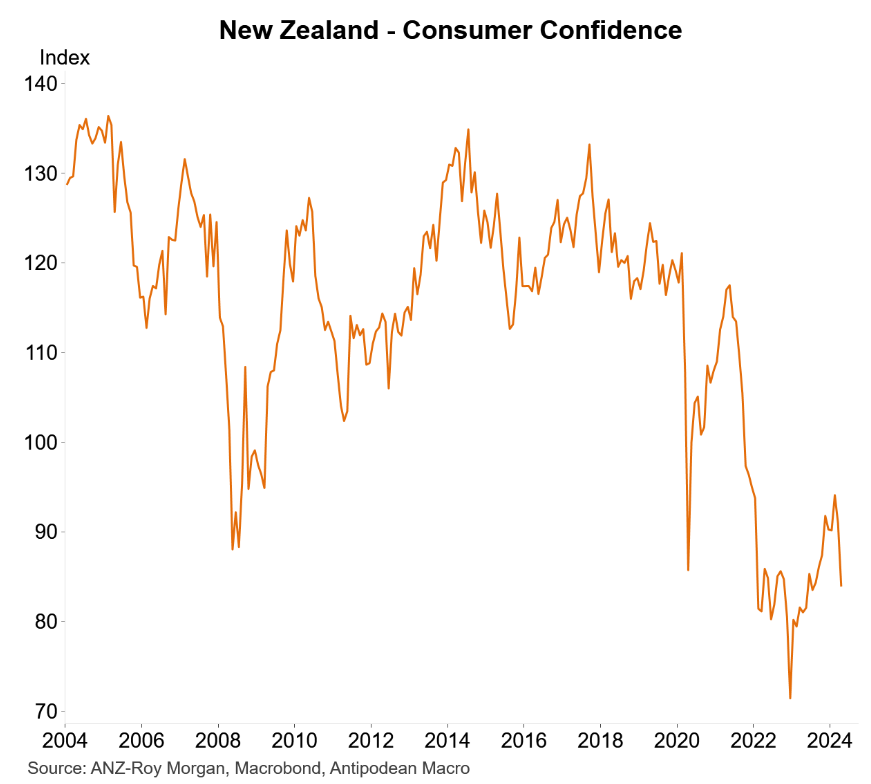

New Zealand’s consumer confidence is also falling after a short-lived post-election bounce:

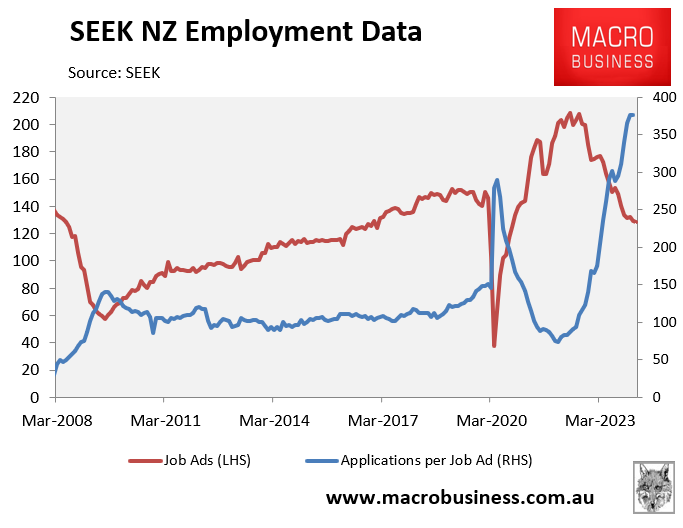

The signs have been poor for New Zealand’s labour market, which is battling surging immigration-driven labour supply amid weakening job creation.

Seek’s applications per job ads index has surged way above the pre-pandemic peak, pointing to rising unemployment in the period ahead:

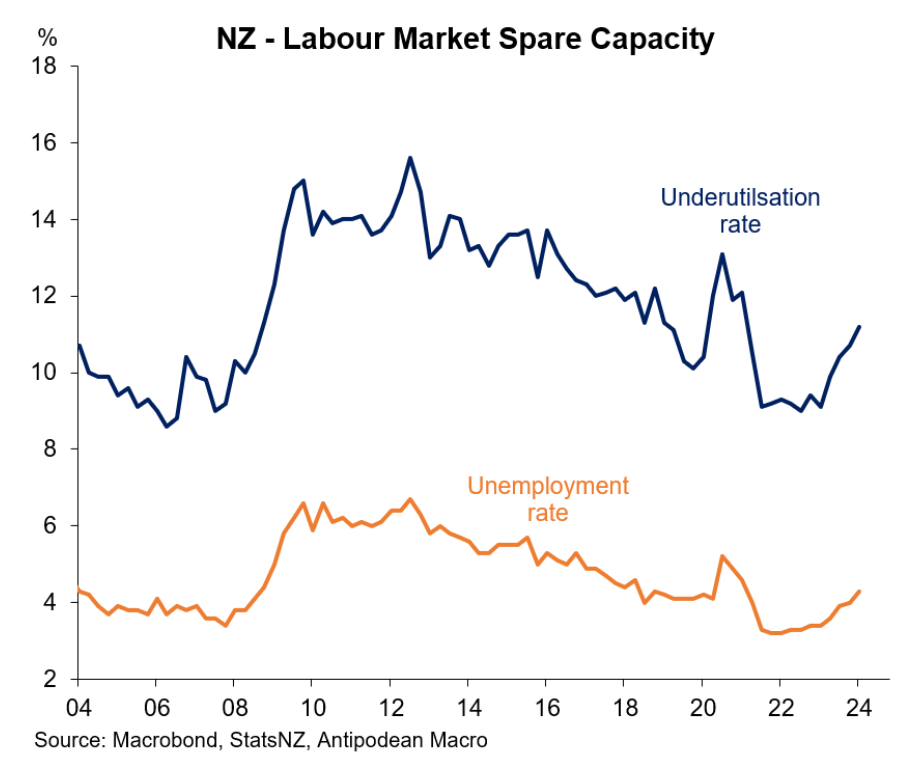

This was confirmed on Wednesday, with Statistics New Zealand recording larger than expected rises in unemployment and underemployment over the March quarter.

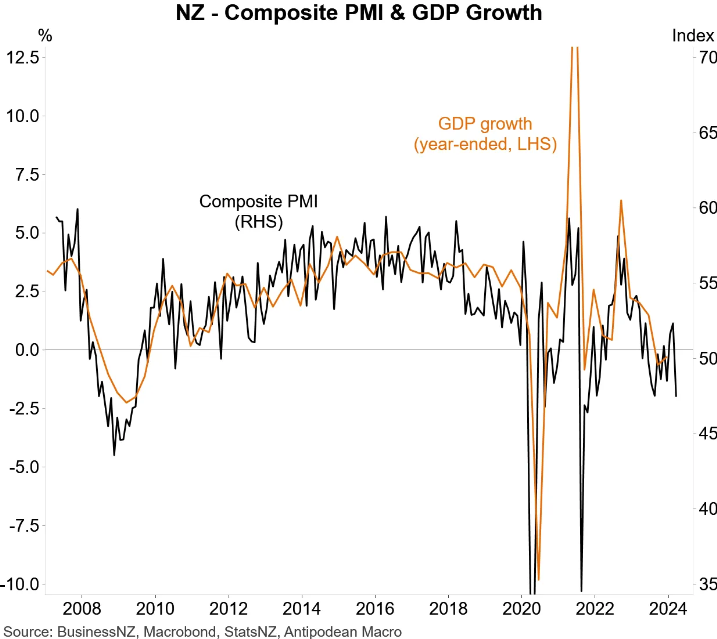

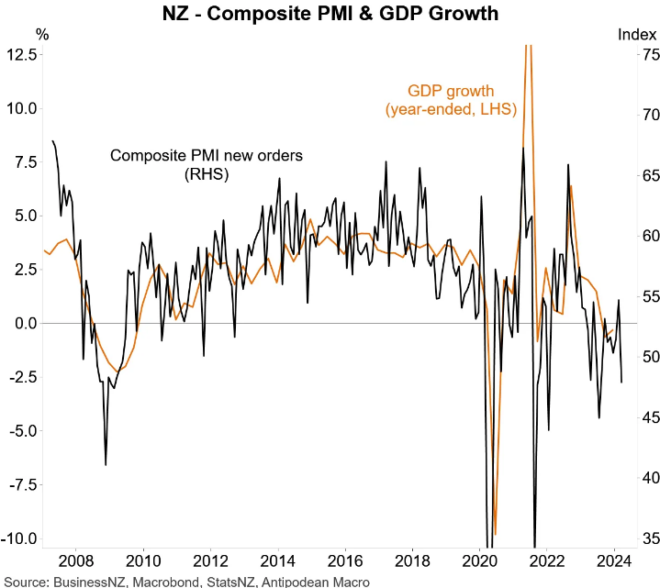

The below charts from Justin Fabo at Antipodean Macro tell the story.

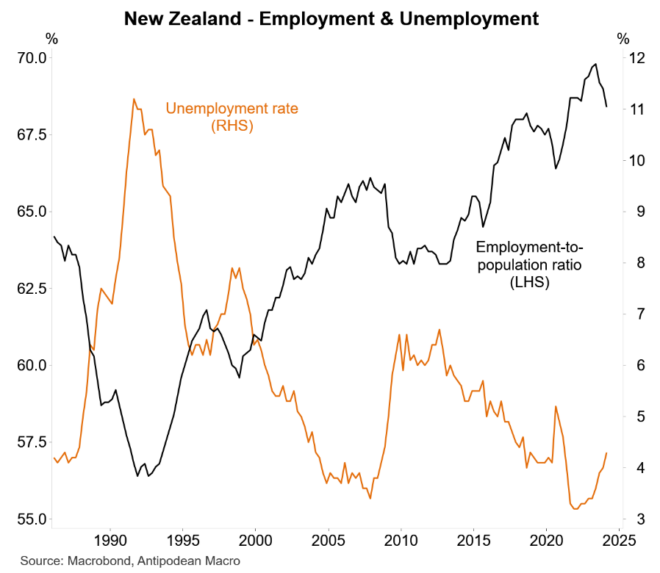

New Zealand’s unemployment rate rose by more than consensus and the Reserve Bank expected in Q1 to 4.3% (+1.1ppts from the trough). Labour underutilisation also jumped higher:

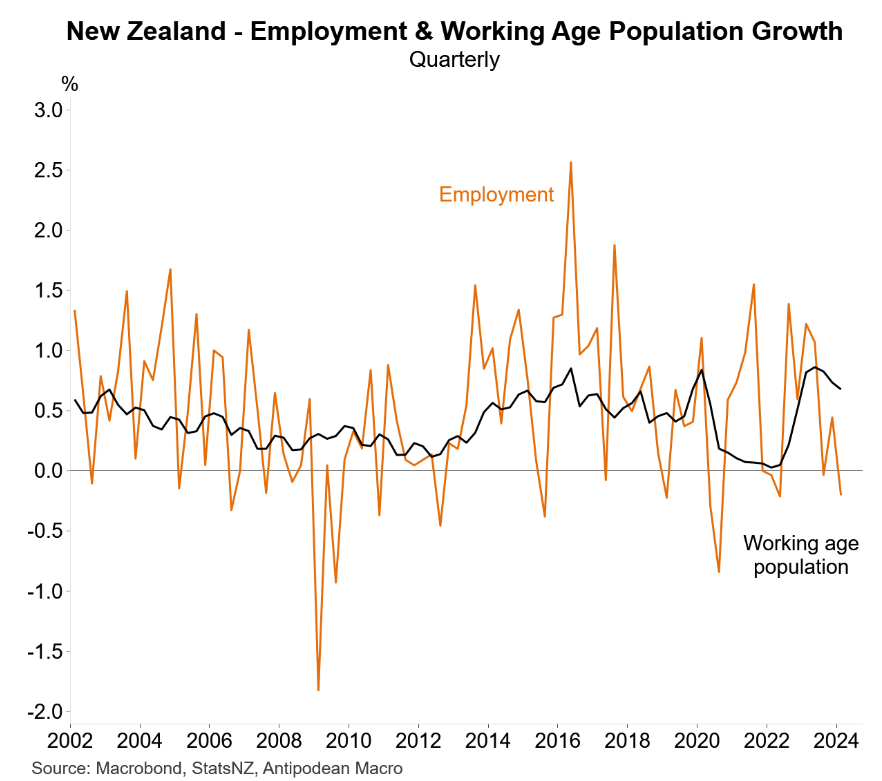

The jump in unemployment and underutilisation occurred alongside a 0.2% quarterly decline in employment and a large 0.6% fall in the employment-to-population ratio:

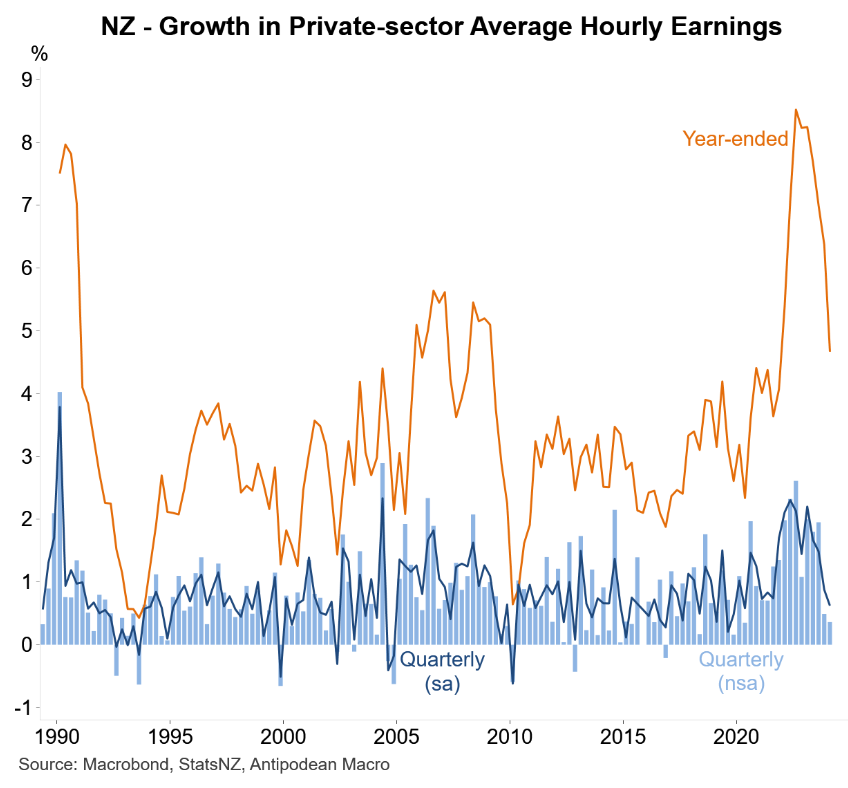

Wage inflation pressures are also easing across New Zealand amid the loosening of the labour market:

The data suggests that New Zealand’s recession is deepening.

The Reserve Bank will need to cut rates soon or risk a hefty increase in unemployment.