My previous article, The Truth about the US Housing Market, has obviously divided opinion on the important issues of housing affordability and the causes of housing bubbles. In only 48 hours, this article has been read by over 5,000 people, making it my second most popular article of all time, behind Australian Housing: a Bubble in Search of a Prick (8,600 views).

Comments have ranged from highly complimentary to outright opposition. Regardless of your view, I appreciate your feedback and am honoured that so many people read my articles and use this blog as a forum for debate. I apologise that I don’t always post comments quickly. This is because I work full-time and cannot access my blog from work. I would turn the moderation function off, except that I receive lots of spam comments. But please rest assured that I post all comments received, both positive and negative, provided they are not abusive.

Anyway, on to today’s post. I want to take readers through an example of how excessive planning regulations, like those discussed in my previous post, are pushing-up the cost of fringe housing in Australia’s cities and significantly reducing housing affordability across-the-board. To illustrate this point, please consider the following examples taken from Victoria, Australia and Houston and Dallas, Texas.

Example 1: Wallan, Victoria (50kms north of Melbourne):

For readers not familiar with Wallan, it’s a country town 50kms north of Melbourne, just off the Hume Highway – the main roadway between Melbourne and Sydney. Wallan is around 25kms north of Craigieburn, which is on the outskirts of Melbourne.

Here is Wallan on a map:

And here is a shot of Wallan’s topography. As you can see, it’s nothing but flat paddocks all the way between Wallan and Craigieburn.

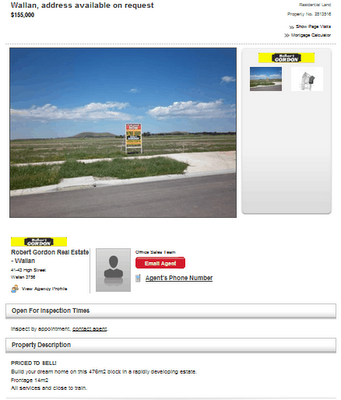

Given that Wallan is so far from Melbourne and surrounded by a plethora of flat paddocks, you would expect residential land blocks to be cheap, right? So, how much would you expect to pay for a small 476 square metre block? $10,000, $20,000, $30,000… keep going. $50,000, $100,000, $150,000. Close but no cigar. No, 476 square metre blocks are selling in Wallan for a whopping $155,000! Check out the below add for yourself:

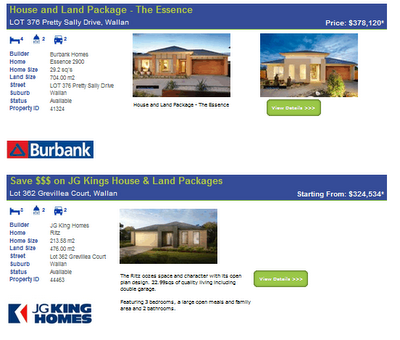

And how much would you expect to pay for a new family home? Well these are selling in Wallan for an ‘affordable’ $320,000 plus (see below listings):

Note that the bottom add for $324,534 has land size of 476 square metres. So based on our $155,000 example above, nearly 50% of the cost of this home is in the land.

Example 2: Houston and Dallas, Texas:

Texas is the fastest growing state in the United States, having added a whopping 4.3 million people over the past decade. In fact Texas’ population, which stood at 25.1 million in 2010, is larger than the entire Australian population.

With these facts in mind, let’s consider new house and land packages in the coastal area of Houston, home to the largest city in Texas and the fourth largest city in the United States. The metropolitan population of Houston was around 5.9 million in 2009.

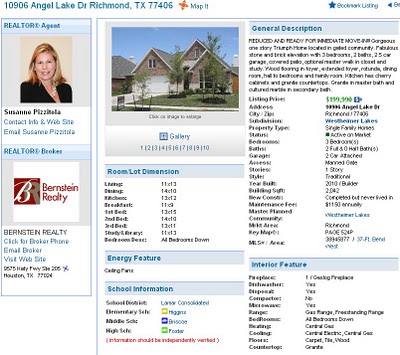

Amazingly, despite the rapid population growth, one can buy brand new large family homes within 50kms of Houston’s CBD for under $200,000. Check out the below example:

And the map for this home:

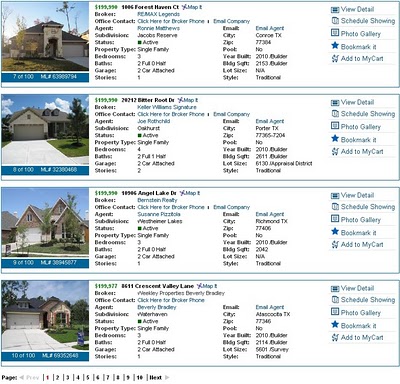

And check out these brand new homes – all priced below $200,000 – in the greater Houston area:

In fact, there are literally hundreds of new family homes for sale in the Houston area – all for under $200,000 and all closer to the CBD than Wallan. Search for yourself here.

Feeling ripped-off yet? Well how about the area of Dallas, Texas – the largest metropolitan area in the South and the fourth largest metropolitan area in the United States, with a population of some 6.9 million people.

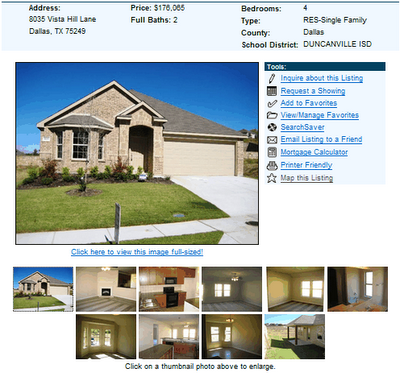

Well, one can buy large new family homes here for under $180,000. Check out the below example, which is only around 30kms from the Dallas CBD:

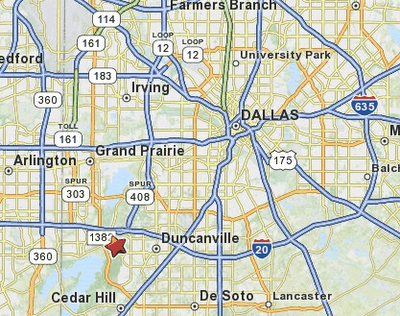

And the map for this home:

Once again, search for yourself here.

Planning gone mad:

The fact remains that the discrepancy in housing affordability between Australia and Texas is largely due to differences in planning regimes. Australia (and New Zealand) operates restrictive urban planning structures, whereby the release of residential land plots are controlled and rationed by the government. This control on supply restricts the market for land, in-turn enabling developers to land-bank and drip feed supply onto the market, thereby significantly raising its price. In turn, the higher land prices push-up the end cost of housing.

By contrast, liberal land markets like Texas are contestable, due to the lack of government interference. As a result, developers are unable to land-bank, since housing can be built down the road. As a result, large residential blocks typically sell for around $30,000 in Texas (versus $150,000 plus in Australia), which obviously keeps the cost of housing significantly lower. The contestable nature of the Texan land market also discourages speculation, since any meaningful rise in price is quickly met with increased supply.

The final word:

I hope that this post has illustrated just how ripped-off we Australians are with respect to housing. And that much of the house price inflation experienced in Australia is due to failed planning policies by Government, mixed with easy credit, heavy offshore borrowings by our banks, and tax-induced speculation (e.g. negative gearing).

I’ll dig deeper into these supply-side issues in my next post. In the meantime, I recommend that readers check out this article, Houston: we have a (housing affordability) problem, by Hugh Pavletich – Co-Author of the Demographia International Housing Affordability Survey (next survey due out on 24 January 2011).

Cheers Leith