David Koch is an interesting chap. Not because I think he is able to provide valuable economic insight, but because I feel he is the average Aussie’s TV economist. So once Koshee says something it means two things to me.

- Whatever it is happened six months ago.

- Everyone in the country now knows about it.

Now to his credit Koshee has been warning about the Australian housing market for a good six months, even if his first warning wasn’t particularly clear. But as of yesterday he has cleared up his message and therefore there is no denying that it is now “mainstream” news.

The property downturn is just beginning. Over the past three years we’ve been suggesting readers direct spare cash towards paying down their mortgage and thereby increasing their home equity. The fear has always been that when times are tough in property, banks tighten their lending criteria and target borrowers who are highly geared.

There’s nothing more frightening than being a forced seller in a falling property market. Those of you who have heeded that advice should be well-positioned to ride the slide.

Every boom is followed by a bust and every bust is followed by a recovery. The property downturn will end eventually. It’s just a matter of timing. But given present conditions, any pick-up will be a long way off. There are several factors working against a recovery in residential property values:

- Banks continue tight lending policies which is demanding higher deposits and lower repayment to income ratios.

- Clearance rates remain low which means there is a continuing build-up in stock. The time it takes to sell a property has lengthened considerably which means, for example, property which didn’t sell last spring is more than likely hanging around this autumn.

- Sellers of old stock get desperate and slash their prices, which then puts downward pressure on the value of new stock coming on the market.

- The dramatic fall in skilled migration numbers means there are fewer potential new buyers in the market.

- Expat Australians who were buying up big when the Australian dollar was weak are now selling up big time to cash in on the higher dollar. They take the money back to where they live now as it goes a lot further.

- The two-speed economy means there are significant parts of the economy doing it tough and putting people and business under financial stress.

That last point has been made very clear by the latest JP Morgan and Fujitsu Australian equity research report on the Australian Mortgage market which states.

Households are delicately poised at current interest rates

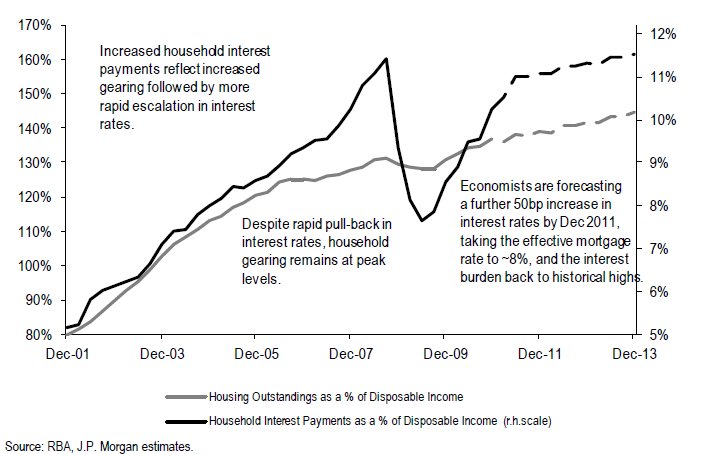

Whilst there was a loss of momentum at the onset of the GFC, the level of gearing remains at historical highs, which retains the burden on household incomes to service interest requirements. To highlight the leverage build-up in the Australian economy, ~10% of disposable income is being used to service interest at a standard variable mortgage rate of ~7.8%. In late-2007, the same burden resulted from a standard variable mortgage rate of 8.5%. This heightened leverage to rates is due to household debt relative to GDP increasing from 127% to 137% over this time. To highlight the sensitivity of Australian households to interest rates, we note that if mortgage rates increase by 50bp by the end of 2011 (mirroring the increase in the Official Cash Rate predicted by market economists), then the proportion of disposable income servicing interest payments will return to historical highs above ~11%.

This sensitivity is something I have mentioned previously in regards to the RBA’s efforts to balance a two speed economy while the private sector has such onerous debt. The report also provides some very interesting insight into the housing market.

Overall growth continues to oscillate in the ‘mid to high single digit’ range over the past 12 months

The average 3 month annualized growth rate was 7.3%. This range, and average, is consistent with data going back to April 2008. Looking specifically at underlying monthly trends during the past 12 months, housing credit growth has softened as the year has progressed, with recent weakness due to the November 2010 interest rate increase and recent natural disasters.

Major banks continue to represent the primary source of mortgage funding, but their growth rate has slowed to high single digits from low double-digits

The shift towards the major banks at the expense of other ADI’s and wholesale lenders slowed over the course of 2010. This is consistent with our views published in preceding volumes of this report, which highlighted that the major banks were unable to ‘swim against the tide’ of lower system housing credit growth dynamics forever.

The GFC has resulted in divergent outcomes for the major banks, and we have seen a ‘changing of the guard’

As predicted in our mortgage report 12 months ago, there was a change in the growth dynamics amongst the major banks over the course of 2010 and this has continued during 2011. Specifically, following a period of extremely robust market share gains since the onset of the GFC (particularly during the peak of stimulus to the First Home Owners market in 2009), CBA and WBC pulled back on mortgage growth and have been growing below Total ADIs since August 2010, reducing their 3 month annualised growth rate from ~25% to ~5% over the last 18 months. Conversely, ANZ and NAB have filled in the growth gap. In particular, NAB reversed its negative trend with +1.0% market share growth since January 2010.

‘Mid to high single digits’ growth in housing credit is still likely

We expect system housing credit growth to remain at ‘mid to high single digits’ over the coming years. The coming 12 months are, however, likely to remain fragile with housing credit growth to remain at the lower end of this range. In the absence of meaningful house price appreciation, housing growth will increasingly reflect recovering construction activity. Based on normalized housing starts of circa 150,000 p.a. and a typical “home renovation cycle” any growth in housing credit over and above 4% p.a. is entirely attributable to rising house prices and / or an increasing Loan to Valuation Ratio on new lending. The coming 12 months will reflect the cross-over of fading house price appreciation and stable housing starts (160,000 p.a.), particularly as reconstruction commences in QLD after the recent floods.

That last point is an interesting one that is little discussed. Housing construction and renovations take a big chunk of credit growth that add marginal value to existing dwellings. You can view HIA forecast data about the amount of money expected to be spent on these two items, and it is worth noting that big increases in the volume of new builds without corresponding increases in credit will mean that the overall housing market is going backwards.

I also note that the report mentions my own little mystery about AFG data, yet disappointingly still doesn’t clear it up for me.

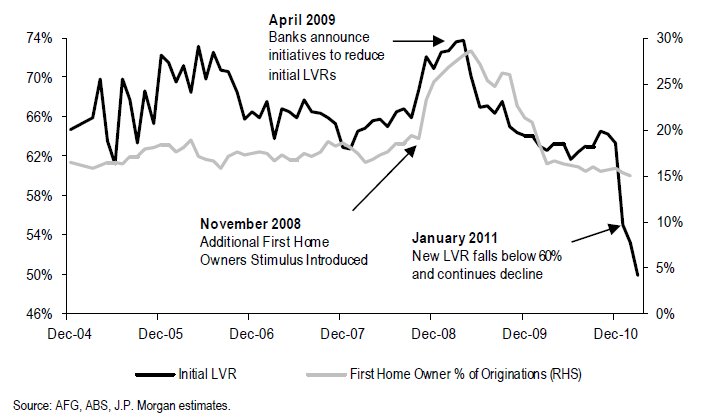

Initial LVRs are continuing to trend down to ‘normal levels’ after the skew of approvals in 2009 towards first home owners. As discussed earlier, new mortgage volumes have been very soft in early 2011, which also led AFG to observe a pronounced statistical fall in initial LVR’s below 60% during 1Q11 .

…. median expectations are based on a normalized initial LVR range of 60% to 70%, which is more typical of the current demand bias (and stronger financial circumstances) of upgraders and investors. We expect first home buyer activity to remain subdued given current interest rate settings and consensus expectations of further interest rate rises during 2HCY11. We also note that the proportion of new housing finance originations attributable to investors has fallen slightly from ~33% in 2010 to ~31% in 2011. Given that average initial LVR’s for owner-occupiers (excluding first home buyers) are lower than investors and first home buyers, then total average initial LVR’s are likely to remain at the lower end of our range.

The chart doesn’t seem to match the words, so I still haven’t cemented in my mind what the huge fall in LVR’s in the AFG dataset actually means. But you can see from the graph that something very interesting happened in January 2011 and continues to drive the market. With those largely unexplained changes in loan dynamics in mind JP Morgan and Fujitsu seem a little apprehensive to give a solid prediction on the housing markets future.

We expect house price growth to remain relatively subdued in the short to medium term due to the impact of interest rate settings aimed at managing a strong domestic economy.

….. our expectations are based on ‘low to mid single digit’ house price growth during the forecast period. This is in line with 2010, where the national average house price increased by ~4% . If we see strong house price elevation in the near term, housing credit growth rates may begin to emerge in the ‘low double digit’ range, however it may then appear vulnerable, with ongoing funding capacity issues for mortgage providers and forecast higher Official Cash Rate settings.

I personally can’t see ‘low to mid single digit’ growth happening. I think I will side with Koshee on this one.