Overruled

Ok, we all know that anyone who says “this time it is different” is to be treated at best as misinformed, at worst as a fool. “They are the five most dangerous words in the English language” etc. etc. But, to repeat my question: “Are things always the same?” Mostly, yes. Modern housing bubbles are not unlike 17th century Holland’s Tulipmania, government debt crises have not changed all that much since Henry VIII reduced the gold in coinage, greed, profligacy, irresponsible plutocracies are always with us.

But in global finance there are some things happening that are genuinely different. Dangerously so. It is becoming a hall of mirrors, money referring to itself in an infinite regress. Little wonder that people are attracted to gold, because gold seems to be a tangible, solid measure of value, something we can rest on in an environment where everything seems relative. Yet this, too, is an illusion. The yellow metal only has value because it has a history of being deemed to have value. It is no more an objective measure of value than the pieces of coloured plastic, notes, that make up legal tender.

To explain what I mean, let’s start with a definition of what money is. It is rules. Rules about value and obligation. Those rules are usually based on legally enforced structures, although that need not be the case. In the case of cross border capital markets, the enforcement is informal because there is no supranational government to impose penalties. Disputes are resolved by a handful of law firms, the main penalty is to be prevented from participating for a period.

Now if money is rules, then what does it mean to “de-regulate financial markets” as was claimed in the 1990s? Can you de-regulate rules? Obviously not. So what happened? The place where rules were set shifted.

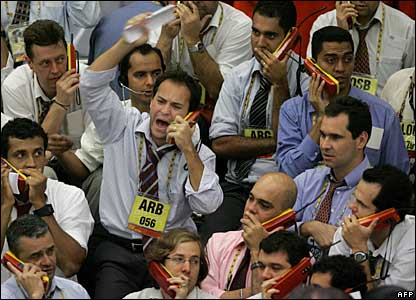

Instead of government for the most part making the rules, the traders started making the rules. The logic was, as Alan Greenspan argued, that because everyone was acting in their self interest then nothing could possibly go wrong. Pricing would be accurate, the less formal self organisation of the market would be superior to the formal oversight of governments (what would governments, which are always bad, know?) and everyone would win. Free lunches as far as the eye can see.

So the rules proliferated, especially after the advent of the Black and Scholes pricing of risk, a clever piece of maths based on what is probably circular argument, but one that is sufficiently concealed to give traders the impression that they are handing off risk accurately. This led to the explosion of derivatives and securities markets, including such instruments as collateralised debt obligations, credit default swaps and endless hedging games (my personl favourite is a derivative on “volatility”).

Now the point about rules is that they are based on agreement, and their creation can be without any limit provided traders are prepared to agree, to trust each other enough to transact. They are not finite in the way that, say, gold is. And so the rule making exploded. The global stock of derivatives is $US600 trillion, about twice the capital stock of the world (all the shares, property, equities, bonds and bank deposits). Far from deregulation making the rules of finance more more streamlined and more efficient — as if the efficiency of money could be measured anyway, given that it would mean measuring money with itself — the rule making expanded wildly. And we all know what happened when the trust that underlies those rules collapsed. The Global Financial Crisis. We are lucky to have a financial system left.

This era of meta-money, I submit, is different. It is “different this time”. Some versions of it have appeared on the margin before. Hedging has a long history, for instance. But meta-money has never been the centre of the action before. In the past it has always been, for want of a better phrase, “normal” money: bank debt, equities, bonds, property and so on.

The massive volume of meta money, the ever expanding hall of mirrors, now dominates and distorts more conventional forms of money. For instance, the $3.8 trillion that is transacted every day in the US dollar makes the annual budget deficit of over $1 trillion look like chump change. About 8 hours trading. There will not be a crisis in demand for US debt, causing an economic collapse, while there is such intense demand for US dollars in the foreign exchange markets.

What is happening instead is that the logics of “normal” money are being used by the meta traders as a game (a game mainly of signs, semiotics) to try to make profits out of their exploitation of the rules of meta money. If the US government looks like it will reduce its government debt, then traders can make a play in the foreign exchange markets that the US dollar will rise. So the US dollar rises. Not because an imbalance is being corrected, changing the dynamics of supply and demand, but because a signal has been sent that an imbalance has been corrected, giving the traders something they can exploit. The rules of normal money are being overridden by the rules of meta money.

That is the world we are now in. It is why such huge distortions are appearing in areas like quantitative easing, extremely low interest rates, an ailing cost of capital, the hankering after something solid in precious metals like gold and silver, equity markets whose pricing seems strange. Governments have given up oversight of the financial markets, handing it over to the traders. We must now suffer the consequences as the traders try to outdo each other in an infinite game of pass the parcel. Or, more accurately, taking out bets on who will pass the parcel to whom.

Eventually, I suspect, GFC version 2 will come along, and the rules will finally collapse. Governments will have to come in and re-set them. There will be a huge re-regulation backlash. But how is it that governments allowed it to get to this stage? What ever happened to governing?