Following on from my earlier posts on the German, UK and Swedish housing markets, I now want to turn your attention to the Netherlands – a country that, in my view, offers a prime example of how not to run housing policy.

The Dutch have devised a system that all but guarantees unaffordable housing and a susceptibility to housing bubbles: (i) ridiculously easy credit, with a third of mortgages guaranteed by the government; (ii) mortgage interest tax relief and generous subsidies offered to home buyers; (iii) a dysfunctional rental market that encourages households to strive for owner-occupation; and (iv) severely restricted housing supply, which ensures that changes in demand flow predominantly into homes prices rather than new construction.

Each of these factors are explained in detail below, with most of the information sourced from the 2009 RICS European Housing Review.

But before I kick-off, consider the below charts summarising the key macro factors pertaining to the Dutch housing market.

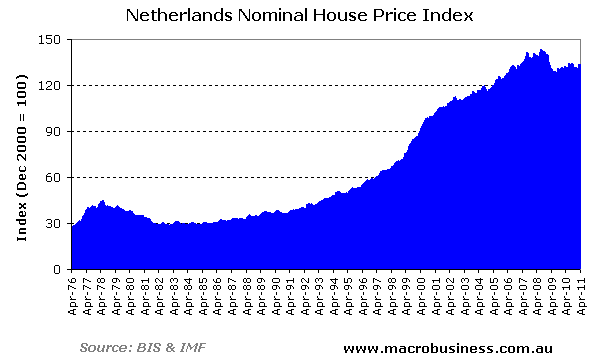

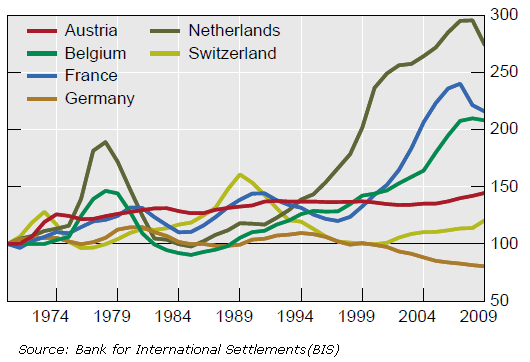

First, nominal and real house prices:

As you can see from the above charts, the Netherlands has experienced two ‘bubbles’ since 1970 – one in the late 1970s and the current episode.

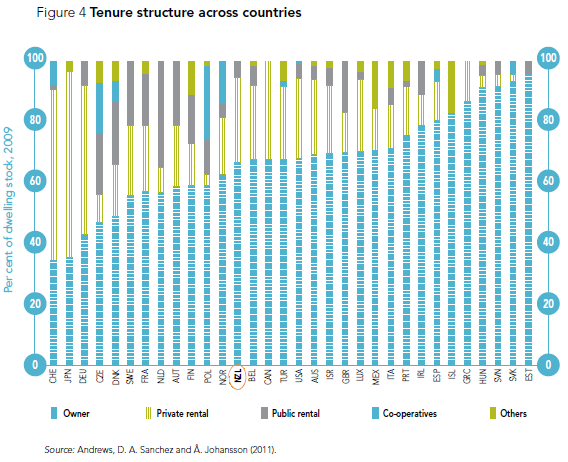

Second, consider the Dutch housing tenure, split-out by owner-occupation, public rental and private rental (courtesy of the NZ Productivity Commission).

Around 60% of homes in the Netherlands are owner-occupied, with the overwhelming majority of rental properties publicly owned.

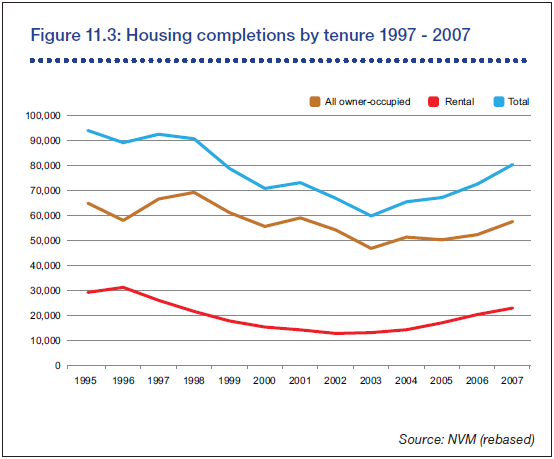

Third, consider the rate of home construction in the Netherlands (courtesy of RICS):

Amazingly, the annual rate of home building actually fell between 1993 and 2004 at a time when home prices surged, suggesting significant constraints on land/housing supply (discussed below).

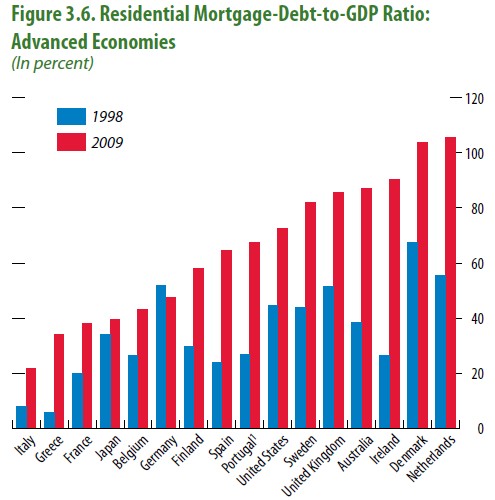

Finally, consider the growth and stock of mortgage debt in the Netherlands (chart courtesy of the IMF):

As you can see, the Netherlands has the highest mortgage debt to GDP ratio in the developed world.

Easy credit and policy incentives:

As suggested by the above chart, the level of mortgage indebtedness in the Netherlands is exceptional by world standards. For example, according to RICS, 62% of new mortgages were classified as “very large mortgages” in 2005, with average loan-to-value ratios (LVRs) of over 100%, whilst the average LVR of first time buyers in 2007 was a spectacular 114%!

There are several factors that have conspired to produce these exceptionally large LVRs and high levels of overall mortgage debt.

First, mortgage interest is tax deductible in the Netherlands. When combined with the high marginal tax rates, Dutch households have an incentive to load debt onto housing.

Second, the Netherlands Government provides loan subsidies to first home buyers as well as subsidies the purchase of homes by lower income households.

Finally, around a third of mortgages are guaranteed by the Government via the National Mortgage Guarantee scheme. Of course, the existence of this scheme encourages lenders to provide larger sums of credit than they otherwise would and/or encourages lending to marginal borrowers.

Dysfunctional rental market:

The Dutch rental market appears to also contribute to higher debt levels and home prices.

Rents are controlled in the Netherlands, with the same legislation applying to both the public (social) and private rental sectors. Rents are set based on a points system related to amenities and service charges, and bear little resemblance to market levels. And rents can only be raised annually by a rate set by the Government. Security of tenure is also guaranteed and temporary contracts are forbidden.

Because rental housing is regulated in this way, shortages are endemic in the more desirable locations. Further, existing tenants are favoured over new households and movers, leading to regressive distribution effects and social segregation.

The shortages of rental accommodation, therefore, encourages households to borrow large in order to become owner-occupiers, since that is the only ‘free market’ option available in most locations.

Supply-side squeeze:

Land supply is tightly constrained in the Netherlands, reflecting both planning constraints and geographical barriers from much of the nation’s land being located below sea level. From RICS:

Land release in the Netherlands is influenced both by a rigorous planning regime and because the land development process is organised such that local authorities provide the costly site infrastructure provision in a country where much of the land is below sea level or otherwise expensive to convert. Most housing is required in the Randstad core of the country but there is a long tradition of protecting the ‘green heart’ of that area from building. Added to this, general concerns about the environment have been increasingly interpreted in an anti-development way, familiar in other countries. The outcome of these pressures has been that development is severely curtailed in many parts of the country where housing is needed.

Recent planning strategies … have tried to direct most development to a limited number of brownfield sites and to a handful of large-scale, suburban localities – with the latter aimed at creating environmentally sustainable, mini-new towns… 80% of new housing is planned to be built on brownfield sites with an emphasis on self-contained communities…

The outcome is now widely recognised to have limited housing output. Problems arise in getting development underway, so it either does not happen or takes years to come on stream. Also, the mix of housing created is often inappropriate to satisfy market demand…

A feature of housebuilding is that the average completion time of dwellings from the point when a building permit is issued to the actual finished construction of the dwelling is long and rising…

In the mid-1990s almost half of all dwellings were completed in less than a year, and that number has now dropped to a fifth while those taking more than 2 years have risen from a negligible amount to 30% of all dwellings…

An extended length of building time, of course, tends to raise construction costs and in the Netherlands they typically rise faster than the general rate of price inflation. This means that the cost of housing construction is gradually rising over time, putting further strain on the country’s ability to increase its housing supply.

Another bubble factory?

Like the UK housing market, Netherlands housing appears to be particularly prone to bubbles and unaffordable housing. Dutch households are encouraged to borrow big for housing via deductible mortgage interest, direct Government subsidies to first home buyers and lower income earners, and the dysfunctional rental system. And Dutch banks are only too happy to lend, with a large proportion of the banks’ mortgages guaranteed by the Government.

At the same time, the straight jacket placed on land/housing supply ensures that the extra demand emanating from the above policies will manifest itself in rising prices instead of new home construction, and would likely contribute to steeper price falls in the event of a negative demand shock.

unconventionaleconomist@hotmail.com