Yesterday we got a few remarks from China’s Premier Wen Jiabao. According to Mingpao, Premier Wen said that control of food prices remains an important priority, with the usual problems that have been discussed here and there, including his concern on the supply situation, the costs of logistics (note that moving stuff within China can be more expensive than moving it to New York), and the need to build up reserves. He also believes that now is a critical time in regulating the property market, as well as construction of affordable housing, giving no hint of any easing.

But at the same time, Reuters also reports that Premier Wen suggested that in the face of global economic slowdown, job creation will also be a priority. Not surprisingly, as the export sector feeling the pain of the global slowdown (as we have seen in the underwhelming rebound of manufacturing PMI in September), and as bosses run from their shadow bank burdens, businesses are being closed, inevitably, and jobs are lost as a result.

The problem, of course, is that price stability and property market cooling on one hand and job creation on the other are incompatible goals. On the whole, the price stability remark by Premier Wen suggests no easing (at least on hold), while job creation remark suggests easing. While inflation has begun to ease and property market moves past the turning point, it is still a bit early to say that the mission is completed, so it is too early to call monetary easing. At the same time, jobs creation would probably require some easing in policy. Indeed, we have seen some fiscal easing on the SME front, but I am not sure if such minor measures can really be effective.

As I have said for many times, the task of inflation fighting and maintaining fast economic growth (or so-called soft landing) is a very difficult one, so difficult that I have long assigned a low probably of success.

Meanwhile, the current tightness of monetary policy is throwing up a parallel conflict in the property market. When prices are going up, we embrace capitalism. When prices are going down, we embrace socialism.

As the Chinese real estate market cools, developers come under pressure to cut prices more aggressively in order to generate cash flow. Some have wondered why prices haven’t really fallen even we all know that real estate developers are in trouble. One of the reasons, I believe, is that developers are hopeful that something like late 2008 and early 2009 would happen, with the government and the central bank easing policy dramatically, so that they try to be very patient and not to cut prices, and/or get funding from the shadow banking system. They are finding it increasingly hard to hold on.

Now imagine this: let’s say you have bought a flat from a developer for CNY5 million, and that is part of the first phase of the development. You were very happy, and expected that when the second phase of the development is sold, the prices will be higher. In that scenario, your CNY5 million is well spent.

But consider this: the developer is now in trouble, and is desperate to sell. It cuts prices such that the flat similar to yours is now being sold at CNY4 million only. You would be pretty unhappy.

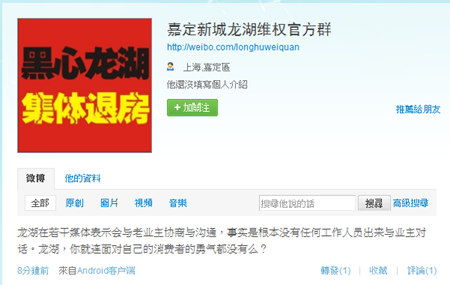

So here we are, home buyers of previous phases of various developments are now very cross. Xinhua pointed out 2 days ago that as 2 developers are cutting prices. Longfor (960.HK) cut prices in the latest phase of one project in Jiading Shanghai by 33%, and another project by as much as 40%. Tens of the owners who bought the previous phase rushed to the sales office and protested against prices cutting, as that means they will be losing money on their investment in the previous phase. And they have a Weibo account (a twitter-like microblogging thing in China):

But then, another report from 163.com on Friday, which appears to be referring to the same development, suggests that the discount will end as it has helped to sell most of the properties. Another report from Xinhua yesterday mentioned another bizarre anecdote: one fellow joined many others in protesting against prices cutting. At the same time, he was on the phone all the time, telling his friends that the prices are falling and they should come to buy.

In other cities like Hangzhou, Nanjing, and others, earlier homeowners are also asking for refunds according to Xinhua, although it is more easily said than done.