Specialisation as an instrument of economic growth is close to an undisputable fact. Whether there are limitations to this process, I am not sure, but for me there is a more significant question that really needs a satisfactory answer if we are to understand economic growth – if specialisation causes economic growth, what causes specialisation?

Intuitively is appears that knowledge is the driver of specialisation and our ability to expand the production frontier. It is new knowledge, especially in the realm of scientific understanding of the material world that enables us to use natural resources more productively, while knowledge of social systems and psychology enables us to share productive gains effectively.

Knowledge as a means to growth is an idea being investigated by a group of physicists-turned-economists at Harvard who have mapped the complexity national economies in an effort to gain an understanding of the relationship between knowledge, and the way knowledge is shared, and economic growth. In their Atlas of Economic Complexity they explain the transmission mechanism between knowledge and economic growth using the ideas of complexity.

… products are made with knowledge. Consider toothpaste. Is toothpaste just some paste in a tube? Or do the paste and the tube allow us to access knowledge about the properties of sodium fluoride on teeth and about how to achieve its synthesis? The true value of a tube of toothpaste, in other words, is that it manifests knowledge about the chemicals that facilitate brushing, and that kill the germs that cause bad breath, cavities and gum disease.

They go further to explain how it is the way specialised knowledge gained by individuals, then shared throughout society, that promotes both complexity and growth.

We rely on dentists, plumbers, lawyers, meteorologists and car mechanics to sustain our standard of living, because few of us know how to fill cavities, repair leaks, write contracts, predict the weather or fix our cars. Many of us, however, can get our cavities filled, our cars repaired and our weather predicted. Markets and organizations allow the knowledge that is held by few to reach many. In other words, they make us collectively wiser.

…

The amount of knowledge embedded in a society, however, does not depend mainly on how much knowledge each individual holds. It depends, instead, on the diversity of knowledge across individuals and on their ability to combine this knowledge, and make use of it, through complex webs of interaction. A hunter-gatherer in the Arctic must know a lot of things to survive. Without the knowledge embedded in an Inuit, most of us would die in the Arctic, as has been demonstrated by the number of Westerners who have tried and failed. Yet, the total amount of knowledge embedded in a hunter-gatherer society is not very different from that which is embedded in each one of its members. The secret of modern societies is not that each person holds much more productive knowledge than those in a more traditional society. The secret to modernity is that we collectively use large volumes of knowledge, while each one of us holds only

a few bits of it. Society functions because its members form webs that allow them to specialize and share their knowledge with others.

Analysis of complexity requires no assumptions about marginal costs, supply and demand curves, nor any other of the neoclassical dogma that espouses how society should function to maximise productive capacity. The linkage from knowledge, to complexity, to economic growth, occurs under any political system and method of trade. As long as knowledge is accumulated and shared effectively, the result will be continued prosperity.

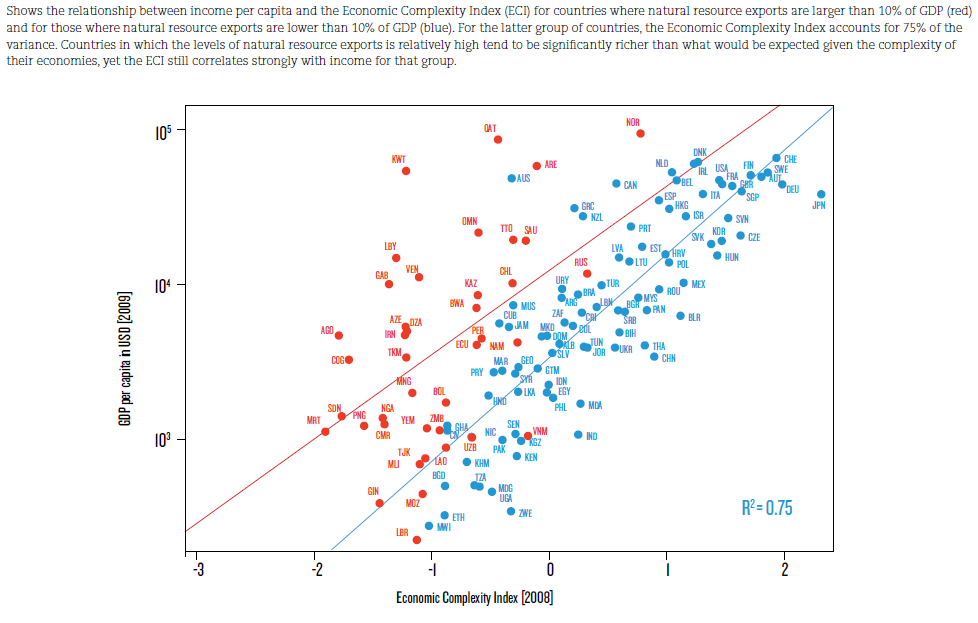

The plot below shows a global comparison of the relationship between estimated economic complexity and GDP per capita. The red points are countries that have natural resource exports greater than 10% of GDP, while the blue points show the remainder of countries. The research clearly reveals that countries with strong reliance on natural resource exports have higher GDPs per capita for a given level of complexity than less resource intensive economies. Australia did not qualify for as a high natural resource exporting nation in 2009, in part because our total exports are just 21% of GDP (compared to, say, 50% in resource poor Switzerland), and in part because of the slump in resource prices during 2009, particularly of coal and iron ore. All other years since 2007 would probably have seen Australia marked in red.

There are, of course, some fundamental limitations to the study. The first is the fact that it relies on measuring the diversity of goods actually produced as a proxy for knowledge. This overlooks problems inherent in global financing and currency values, especially the impact of Dutch Disease. Some industries, such as manufacturing, may relocate to cheaper developing countries if currency pressures render them globally uncompetitive. However, not all knowledge is lost in this process; at least not to the degree that measured levels of production are lost from the figures.

This study of complexity is also limited by the fact that national boundaries are quite arbitrary in terms of globally complex production systems. The Airbus A380, for example, is manufactured, in part, in possibly more than 20 countries. The complexity of production required is such a task is shared amongst many nations, potentially decreasing their measured complexity. But as a global system complexity has probably increased. Which leads to the more sensitive question of whether domestic complexity is necessary at all so long as a country has strong trade links to the globally complex economy?

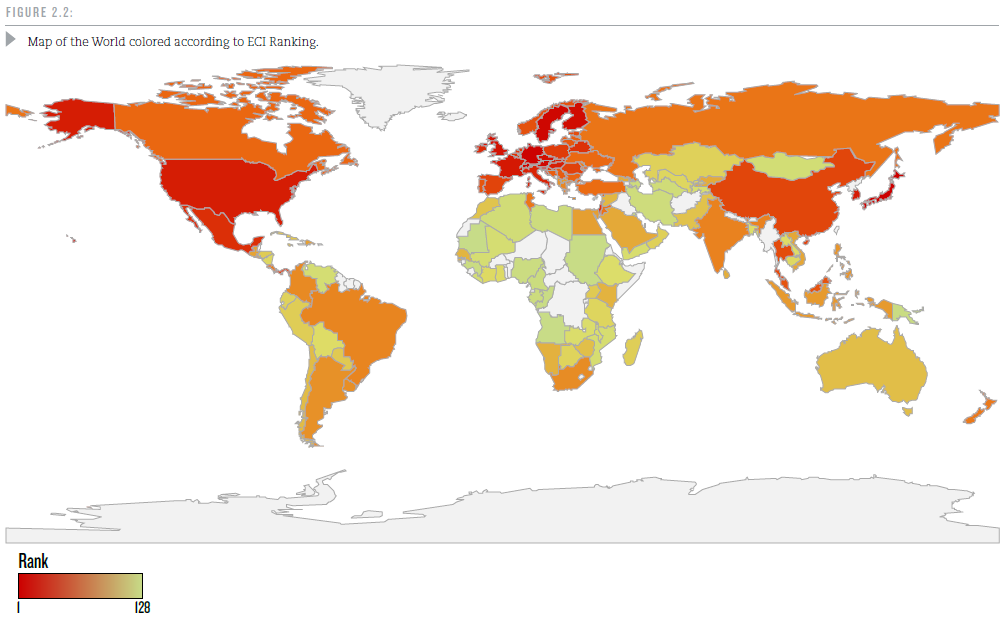

Before looking to the policy implications of this type of research, I want to quickly look at Australia’s relative position in the global complex. Australia ranks 79th on the measure of economic complexity, behind Albania, El Salvador, Guatemala, Kyrgyz Republic, Namibia, Kenya, Senegal and most importantly New Zealand (which is ranked 48). The top three complex economies are Japan, Germany and Switzerland.

In the measure of change in economic complexity between 1964 and 2008, Australia is ranked 95. In fact we fell from a rank of 32 to 54 over the period. Of course, much of this is due to the catch-up growth seen in Asia, the Middle East, and Latin America, and we would expect developed countries to perform poorly on this measure.

For me the most interesting figure is the measure of expected growth, which is derived from the mismatch between the complexity measure, and the GDP measure.

China, India and Thailand are at the top of this ranking, since they are countries with economies that are remarkably complex, given their current level of income, and are expected to catch up faster than other developing nations. Next come Belarus, Moldova, Zimbabwe, Ukraine and Bosnia-

Herzegovina, five countries where the current level of income is dramatically lower than what one would expect given their productive capabilities. This ranking shows that the two regions of the world where the potential of per capita growth is higher are East Asia and Eastern Europe (Map

At the bottom of this ranking we have Sudan, Angola and Mauritania. These are developing countries where the complexity of their economies does not provide a basis for future economic growth, and, where changes in income are dominated by fluctuations in the price and volume of natural resource activities

The map below shows the national complexity rankings.

If the theory of complexity and the empirical measurements of indicators of economic complexity have merit, what policy implications should be considered? My interpretation is that theories of economic complexity suggest that government needs to be an active player in facilitating a diverse and complex economy – from funding or facilitating infrastructure networks (fibre, ports, roads etc), to fostering education, to investing in new technology start-ups and supporting domestic emerging businesses through government purchasing decisions. In particular it would appear that governments have a role heavily investing in research, particularly ‘blue-sky’ research which often has no immediate commercial value but can open doors to other discoveries, and facilitating market investment in research.

Economic complexity relationships appear to also support notions of a resource curse. Australia sits far above the trendline for GDP given our level of complexity, meaning our economic performance is highly dependent on the whims of resource markets. It also appears we could trade-off some of this resource income for investment in diversity of production and maintain our standard of living in a more stable economy.

This research on complexity shows that while specialisation is effective within countries, specialisation of countries themselves usually inhibits growth. Some may argue that we should be considering complexity of the world economy as a whole, ignoring any within country declines in complexity, but to me this ignores geo-political realities and the principles of national democracy.

Tips, suggestions, comments and requests to rumplestatskin@gmail.com + follow me on Twitter @rumplestatskin