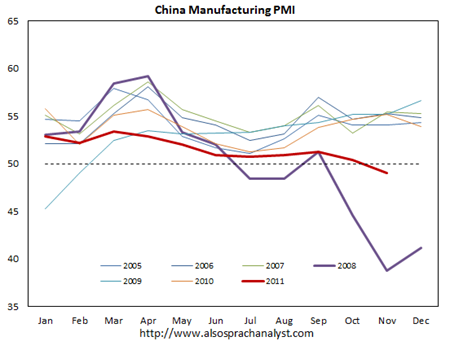

China’s official manufacturing purchasing managers index (PMI) dipped below 50 for the first time since the recovery yesterday. The headline PMI declined to 49, below consensus of 49.8.

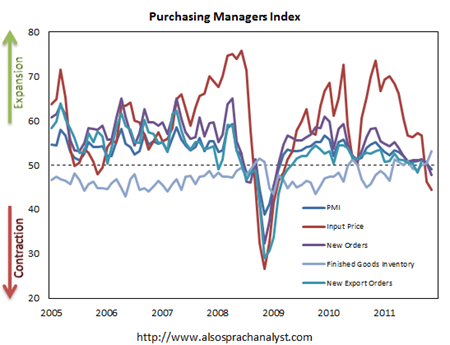

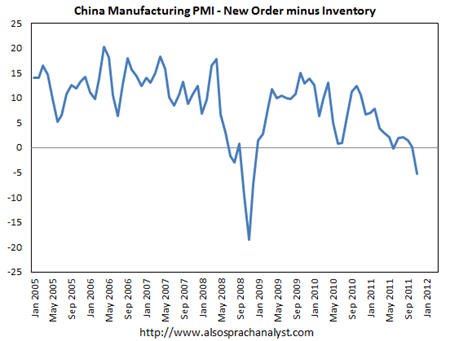

Looking into the components probably provides an even gloomier picture. New exports order declined further to 45.6 from 48.6, indicating continued deterioration of global demand. New orders also dropped below 50 to 47.8, while the finished goods inventory increased from 50.3 to 53.1. New order minus inventory, as a result, dipped decisively into negative territory. The only good news is that input prices dropped further below 50, offering more evidence of a peak in inflation:

The current November reading is the second worst since record began (the worst one was November 2008):

The headline PMI suggests a contraction in the manufacturing sector for the first time since the recovery. The only good news, it appears, is that the price component has fallen decisively, which should open some rooms for easing (as we saw yesterday with a 50bps snip to the RRR).