As I stated yesterday, when it comes to Australian housing market analysis nothing is ever easy. AFG’s latest data is showing the boom is back, yet there isn’t any other leading indicator supporting this. Previous auction results still point to a subdued market and continue to follow a long term downwards trend that has been running since 2009. Stock on market continues to rise, however the rate of growth has slowed and the provider of that data now appears to have turned bullish.

As I have stated previously I prefer to wait to see a measurable trend appear in actual credit issuance data before making a call because there is some fairly good evidence to suggest that it is the only piece of data that genuinely matters when it comes to market direction. We have certainly seen a number of false starts over the latest 12 months and today’s employment figures may well put a damper on the latest exuberance.

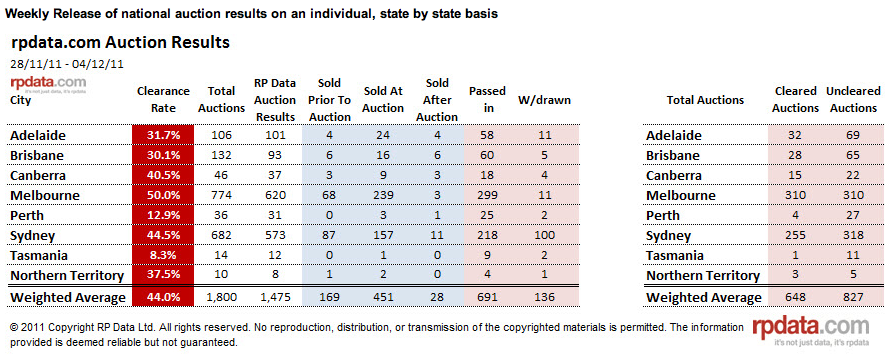

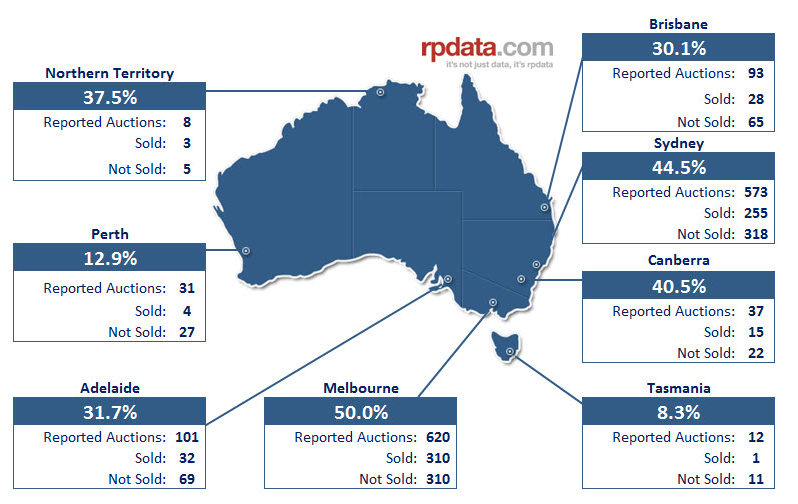

I note that R.P Data have released their latest auction results today and it certainly doesn’t scream “boom” to me. As far as I can tell the data is still holding trend:

Again we wait for more data.