As I type this, the Greek PSI (private sector involvement) participation window for Greek law bonds has just closed. Latest reports are that the participation rate was somewhere around 75-80%, but there are some reports from Greek media of an even higher rate. At this point, however, there are obviously still some hold outs, so it looks like it is on to collective action.

We won’t know the final results until 600GMT Friday.

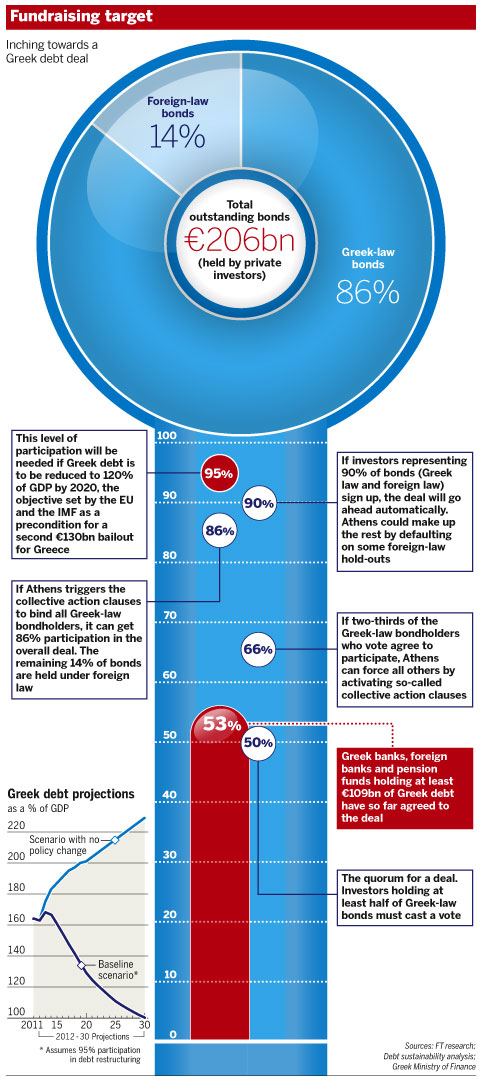

If collective action is used then all of the €177bn in Greek-law bonds will be swapped with new bonds (see here for details). This will instantly wipe out €100bn of Greece’s €350bn debt pile. Having said that, all of this effort is to ensure that Greece gets yet another €130bn bailout, so it isn’t as impressive as it sounds. On top of that, initial trading in the new Greek bonds (the ones that will be used post-swap) is already pointing to a post bailout default, remembering these bonds are 30 year in duration.

As the chart above shows, there are, however, still 14% of Greek bonds issued under non-Greek law and at this stage it is unknown exactly what the participation rate will be on these bonds. Given that they are the most likely target for anyone who is hoping to hold up the process, including hedge funds, it is possibly quite low. What needs to happen with those particular bonds is dependent on the outcome of today’s procedure, but resolution of that matter will not come until a meeting of international bondholders later this month.

I’ll bring you more details once we get the results from today.

In other news, Mario Draghi held a press conference overnight after the ECB held EuroZone rates steady. As usual, the interesting stuff was in the Q&A session after the statement. If you have the time I would recommend that you watch the whole thing (at the bottom of the post), even if just to remind yourself of the palpable disconnect between the ECB board and reality.

For those who don’t have time, here is a summary of the list of notes I took while watching Mr Draghi speak.

- There is stabilisation occurring in the EU economy, however there are downside risks and inflation is above 2%.

- There is limited credit expansion meaning internal inflation expectations are subdued.

- LTRO is temporary.

- All tools to avoid inflation are available.

- GDP growth in Q4 was-0.3%, however he expected Europe to grow this year. But balance sheet adjustment in banks and the private sector will dampen growth.

- There are downside risks presented by commodity prices and indirect taxes, and inflation is likely to stay above 2% in 2012, falling in 2013.

- Downside risks are present due to weaker than expected activity, including weaker than expected loan growth.

- It is essential for banks to re-capitalise by holding onto profits, but not stop lending.

- Governments need to continue to implement fiscal compact. Governments are making progress. The LTRO period should be used to make additional progress on structural reforms.

- LTRO was a success, credit markets have re-opened , Money Market funds have returned and interbank market is even working “slightly better”.

As usual there were reporters in the crowd who obviously knew nothing about central bank operations. However, there were quite a few interesting topics covered in the Q&A, including the politicking occurring between the ECB council and the German central bank. I will cover some of that discussion in a future post. For me, that wasn’t the most interesting part. That was left to the thread of conversation stemming from Mr Draghi’s statements that he expects to see growth return to the Eurozone shortly. He was asked directly where he thought this growth was going to come from given austerity was sapping growth, unemployment was extremely high in the periphery, and commodity prices were high.

He answered that [my summary]:

The recovery will be gradual, if not slow, but will come from a mix of foreign demand, low interest rates, an improvement in the risk environment, structural reforms, and a return of confidence due to the outcomes of the fiscal compact.

One look at those answers tells you that there is an ideology at work here which has very little to do with what is actually happening in the real economy of Europe. Forward orders for European goods are falling, interest rates have been low for years with no effect, the periphery economies are accelerating downwards while their unemployment continues to rise sharply. Additionally, he stated that commodity prices were a downside risk, yet saw no connection between the ECB’s own “non-standard” operations and commodity prices, and how on earth on the eve of the largest sovereign default in history he could claim that confidence is returning due to the “fiscal compact” is just surreal.

So, once again, Mr Draghi’s press conference leaves me feeling like I just took a journey to another dimension. See if you feel the same.