Recently, I took the liberty of writing a few articles to provide some sectoral macroeconomic analysis of the Australian economy. I did this because I thought it was important to push back on what I perceived as a growing divide between what Australians are being told about the economy and what is actually transpiring.

Although a level of misinformation is expected from the political class, I find it somewhat infuriating that the national media can’t manage to dig up the real story. So, once again, it seems it is left to a couple of “punk” bloggers to attempt to provide a measured counterbalance.

Over the last week I have built a case that the Australian economy is structured somewhat differently to what the public is being told and for this reason there is growing confusion as to why the mining boom isn’t providing the economic benefits that were “expected”. For those who haven’t read through my previous posts on this thread my major points are:

- The mining boom is having a positive influence on national income, but its magnitude is of insufficient size to offset the larger outflows of interest payments and profits to non-residents as a result of over three decades of growth in external debt.

- Private sector credit growth has been the major influencing factor in national income growth over the last few decades, but its rate of growth is slowing as households change their preferences towards saving over consumption after the GFC.

- The government initially offset the private sector’s change in consumption preferences by increasing government spending.This has now stopped, as the government has set an agenda for surpluses.

So yesterday afternoon I was happy to note that Glenn Stevens delivered a speech to the Credit Suisse 15th Asian Investment Conference 2012 in Hong Kong about the risks and opportunities of Australia’s future engagement with Asia. Find the full speech below.

The speech begins with the usual global analysis, including Australia’s position in Asia, the woefulness of the Europeans and the fact that the US looks to be improving somewhat. We then move on to China, which is slowing but Australia remains optimistic about its future:

China will have cycles like other economies, but it seems likely that the Chinese economy will grow pretty strongly on average for a while yet. It will be a very large economy. Even at the new growth target of 7½ per cent, a lower target than in the past five years (all of which were, of course, exceeded), Chinese GDP will equal that of the United States, in Purchasing Power Parity terms, in about a decade. It will exceed that of the euro area within the next few years.

There are issues of rebalancing the sources of growth in Asia, to which I shall return shortly. But the main point for now is that the global economy is faced at present with a year of sub-trend growth in 2012, according to international forecasters. This is a subdued but not disastrous outcome. And Asia in particular is well-placed to do fairly well, given sensible policies. Downside risks certainly do remain, and are easier at this point to imagine than upside ones. At this point though they remain risks, rather than outcomes.

Certainly nothing new there. To Australia then:

What then about Australia? At the moment, the viewpoints of those inside Australia differ somewhat from those of people outside Australia.

Viewed from abroad, judging by what people say, observers see an economy that experienced only a relatively mild downturn in 2008–2009, that made up the decline in output within a few months, and that has continued to expand, albeit at only moderate pace, since then. They see an economy that has not experienced a significant recession for 20 years, that has strong banks and little government debt – and that debt remains AAA-rated. Some observers worry about high levels of housing prices and household debt. This is understandable given the problems that have occurred in some other countries. But then others point out that the arrears rate on mortgages, at 60 basis points, is quite low, and that the rate of new construction of dwellings in recent years has been low relative to population needs.

Foreign investors see a country that remains quite open to them, and that, reflecting its economic circumstances, offers rates of return that are high by international standards, even though they are low by Australian historical standards. They understand the potential returns on the mineral and energy wealth stored in or around the Australian continent, and that our terms of trade have over the past year been higher than at any time for more than a century. There has been increased appetite for Australian dollar denominated assets, particularly sovereign debt, and the Australian dollar has risen strongly, to be at its highest level in three decades.

This is an interesting point, but I don’t think it is too hard to understand. Australia is an attractive place to invest as a non-resident for all the reasons Mr Stevens mentions in addition to political stability, but that doesn’t necessarily translate into greater well-being for residents.

Over the last 12 months, household wealth has declined as the slow-down in mortgage issuance has led to falling house prices. Along with stagnating national income, slowing GDP growth and a national government talking down the economy due to poor budget forecasting, it is no real surprise that locals have a different view to non-residents, many of who continue to receive a very good ROI (return on investment) from Australia.

Back to the speech:

Those at home see this as well. As consumers, they have responded to the higher exchange rate with record levels of international travel. As producers, however, they also see, with increasing clarity, that the rise in the relative price of natural resources amounts to a global and epochal shift, which carries important implications for economic structure in Australia, as it does everywhere else. Some sectors of the economy will grow in importance as they invest and employ to take advantage of higher prices. Other sectors will get relatively smaller, particularly in the traded sector, as they face relatively lower prices for their products and competition for inputs from the stronger sectors. The exchange rate response to this shift in fundamentals is sending very clearly the signal to shift the industry mix, though this would occur at any exchange rate. The shift in relative prices is a shift in global prices that is more or less invariant to the level of the Australian dollar.

In other words, while the global shift in relative prices is income-enhancing for Australians overall, it is also structural change-inducing. A former leader once quipped that ‘microeconomic reform’ was such a common topic in Australian discussion that even the parrots in pet shops were talking about it.

I think the same is increasingly true of structural change: it is a term that will be on everyone’s lips over the next few years.

And there is the China gamble laid bare for all to see. It is true that in relative pricing terms Australia’s income has increased but, as the Governor alludes to, the prices we are paying for cheaper imports is a hollowing out of some industries and a corresponding restructuring of the labour force. By not intervening via monetary and/or fiscal policy in the capital flows associated with the commodities boom the government and the RBA have made it clear that a restructure of the economy will be the outcome.

However, as I have pointed out in my analysis of Europe , and Mr Stevens goes on to say later in the speech, structural change is difficult and expensive. By allowing the economy to restructure in this way we are making a one-way bet on China. That is, if we’ve got it wrong on Beijing, we are in seriously deep trouble because there is no Plan B.

I will revisit this point again later:

Structural adaptation is hard work. Few volunteer for it. But we have little choice but to do it, not just to make the most of the new opportunities that have been presented, but to respond to the changed circumstances that some industries face as a result. In this sense, Australia, though blessed with many natural endowments, is in the same position as most other nations. We have to adapt to changing times. This perhaps helps to explain the sense of concern in some parts of the Australian community and the tendency to focus on the difficulties, rather than the opportunities, which come with our situation.

This difference in perceptions between foreigners and locals is quite unusual. For most of my career, the difference has tended to be in the opposite direction. We always seemed to struggle to get foreign observers and investors to give us credit for performance we thought was pretty reasonable. And it is only little more than a decade ago that Australia was being described as an ‘old economy’. Now perceptions have changed, at least in a relative sense.

The shift in global portfolio allocation that seems to be associated with this is potentially very important. In a more risk averse world, the supply of genuinely low-risk assets seems smaller. Countries that have offered a reasonably stable economic environment and relatively sound public finances – of which Australia is one – are attracting greater flows of official capital now than they did a decade ago. This has recently been adding to the upward pressure on the exchange rate, independently of the rise in the terms of trade.

As is so often the case in economics, there are two sides to this. On the one hand, the additional rise in the exchange rate pushes our cost structure in the tradable sectors of the economy up relative to other countries. This is a contractionary force and adds further to the already considerable pressure for structural change.

On the other hand, it amounts to a reduction in the cost of international capital for Australian borrowers, particularly government borrowers. At the margin, this has to make the task of ensuring fiscal soundness a little easier. Even for private borrowers the unusually low level of long-term rates for the official sector offsets a good deal of the widening in spreads due to perceptions of higher private credit risk (that being, of course, a global phenomenon).

A greater flow of cheaper capital to a country is an advantage. It is important, of course, that it is used wisely. When risk appetite is strong, and risk assessment by lenders too loose, such conditions can result in problems. For example, it has been argued that the flow of capital to the United States looking for low-risk assets was channelled by the US financial system into structured products that had the illusion of high quality, but which ultimately resulted in the sub-prime mortgage crisis.

So I guess it is time to pose the question. Have we used it wisely?

Australia has been net importers of foreign capital for over 30 years. One would hope that this would have led to a country that is not only wealthy, which we are, but also relatively productive because we have invested a good proportion of that inflow in ways that have had a positive return on investment to the nation. However, the structure of our balance of payments and fact that Australia’s foreign debt has grown unabated for over 3 decades is probably evidence enough that this hasn’t been the case.

And this is where it starts to get interesting:

At this point, however, we do not seem to have that problem in Australia. If anything, households, businesses and governments are looking, to varying degrees, to reduce their debt. The financial sector is quite risk averse in its lending practices, particularly towards some of the business sectors that might be willing to take on additional debt. In such circumstances, the competitiveness-dampening effect of the higher exchange rate on the traded sector that results from the portfolio shifts may, for some period of time, outweigh the expansionary effect of a lower cost of capital.

The economic background to this shift is an economy where a range of indicators had been tending to suggest that growth was running close to average. Key business surveys, for example, have suggested average performance compared with the past 20 years; the rate of unemployment has been little changed at what remains, by the standards of the past three decades at least, a reasonably low level. On the other hand, recent national accounts data suggest growth in the non-farm economy somewhat below trend over 2011.

Overall, recent economic performance in Australia is not too bad, particularly when compared, over a run of years, to a number of other advanced economies. But neither is it so good that it cannot be improved. The full range of policies – macroeconomic and structural – need to play their part in seeking that improvement.

This is a bit of humble pie for the RBA, which has consistently overshot with its growth forecasts for the past few years. But the tone is defensive not inquiring. And as a result, Mr Steven’s neglects to address the magnitudes of the opposing forces in the economy. The fact that households and businesses are looking to increase their savings ratio and decrease credit growth is placing considerable downward pressure on the economy because the external sector is already in deficit and the government is also attempting to get back to saving. That is, even with expansionary private sector debt and high terms of trade it is structurally possible for the Australian economy to shrink:

Monetary policy can play a role in supporting demand, to the extent that inflation performance provides scope to do so. But monetary policy cannot raise the economy’s trend rate of growth. That lies in the realm of productivity-increasing behaviour at the enterprise, governmental and inter-governmental levels. Improving productivity growth is just about the sole source of improving living standards, once the terms of trade gain has been absorbed. This is increasingly being recognised in public discussion, but it is important we do more than just debate it.

Nor can monetary policy obviate the pressure for the production side of the economy to change in response to altered relative prices. These changes in relative prices are essentially given to us by the world economy; they are not driven by any policy in Australia.

So in Australia, reorienting our economy, adapting to structural changes and improving productivity performance are challenges we face. But we are hardly alone in facing adjustment challenges. More generally, reorienting economies in the Asian region, and around the world, remains a major challenge.

I agree, although I will note that it is very possible for monetary policy to raise the economy’s rate of growth. In fact, that is exactly what it did post-GFC. That point aside, productivity is absolutely the target for all economies, but given Australia’s fiscal policy is still very much targeted at consumption over research, development and industrial investment I struggle to rationalise the rhetroic with reality.

The next few paragraphs are more confusing:

Changes in the right direction have been occurring. Countries in this region have been prepared increasingly to develop and follow domestic policy frameworks that guide their behaviour in sensible ways (for example, inflation targeting). They have been prepared to accept some more movement in exchange rates, and to seek more domestic-led growth in demand. China in particular has seen the ratio of domestic demand to GDP rise over the past few years, reversing much of an earlier decline.

More of this will be required, however, over time, for at least three reasons.

First, it is not a sustainable model to expect developed world households to consume ever higher volumes of the output of Asian factories with borrowed money. That model cannot return, which means that the imperative to find domestic sources of growth is not just a cyclical one.

Second, the eventual sheer size of the Asian economy is such that it will have to absorb more of its own output as it continues to grow. Continental-size economies such as the United States and the euro area have long done so. Here it is important to note that for East Asia outside of China and Japan, the decline in domestic demand relative to GDP that understandably occurred during the crisis of 1997–98 largely remains in place, more than a decade later.

Third, and most important, it will surely be the most enriching strategy for the people of this region to turn more of their own savings to developing their own physical and human capital. Yet at present trillions of dollars are lent by taxpayers in Asia to some highly indebted advanced world governments at yields that seem extraordinarily low. It seems very unlikely that there are not better risk-adjusted returns in Asia than that.

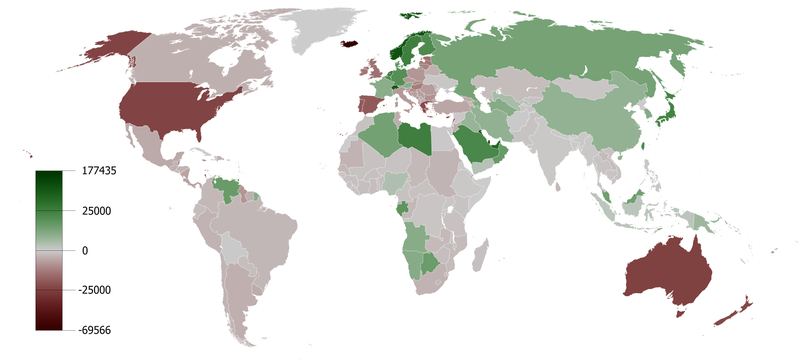

I applaud Mr Stevens for mentioning the global imbalances in balance of trades (see chart below) and questioning the sustainability of a world model based on the suppression of wages across Asia in order to support debt based consumption in western nations. To me, this is ‘beggar-thy-neighbour’ policy and I would much prefer to see something far more balanced in terms of equitable quality of life across the world:

That statement, however, doesn’t lessen my confusion in terms of the economic consequences. Mr Stevens made it very clear in the first half of his speech that Australia was restructuring in such a way that it will adjust the economy away from non-mining tradable goods and services. Yet, he is now telling Asia that it needs to move its own model towards internal consumption and therefore away from the structures that Australia has set about building.

If Asia moves towards a model of internal consumption then that will inevitably slow its need to build infrastructure. However, as I said above, Australia has no Plan B and remains highly indebted to the rest of the world with a structural deficit that requires ongoing capital inflows to maintain growth.

The RBA can see it is managing multiple structural adjustments in the local economy driven by price changes in tradable goods and the uses of debt. It also sees destructive imbalances in the external economies of Asia produced by specific fiscal and monetary settings. But, for some reason, it’s not yet talking about the underlying fiscal and monetary settings that produced the external imbalances that are part of the Australian adjustment. Until it does, it will miss its forecasts.