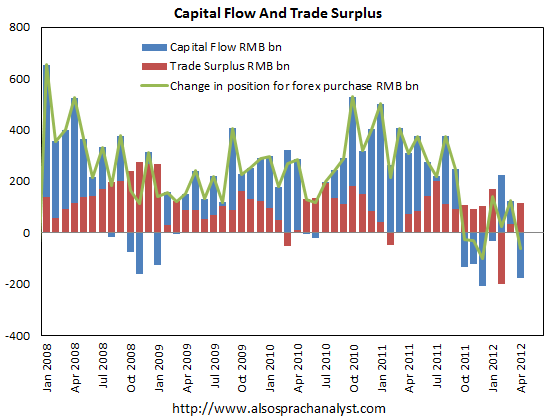

The detailed statistics from China’s April monetary statistics show that the change in the position of forex purchases has turned negative again in April.

With a relatively large trade surplus in April, this indicates that capital flow turned hugely negative. I estimate that excluding the trade surplus, capital outflow would be RMB177 billion (I don’t distinguish the type of flow). As explained in the past, under the current arrangements, a capital outflow will contribute to a tightening of monetary conditions within China. Thus we now know, more or less, the reason for last weekend’s decision to reduce Reserve Requirement Ratio. Indeed, while the 50bps cut of RRR would have made RMB421.14 billion available for banks to lend, almost half of that would have been offset by the April’s capital outflow:

On top the the negative shift in the forex position, more evidence emerged yesterday that Chinese banks are struggling with weak credit demand and deposit outflow.

We already know that last month’s figure for new loans was very mediocre. That appears to be continuing in May. Sina reports that the big 4 bank’s (ICBC, China Construction Bank, Agricultural Bank of China, Bank of China) net new loans for May is bascially zero for the first two weeks. According to sources, two of the big 4 banks have had new loans of RMB10 billion and a few billion, while another banks have net new loans in negative territory This suggests that demand for credit is extremely weak, perhaps much weaker than anyone is yet contemplating.

The big 4 banks have also lost RMB200 billion of deposits, according to the report. One of these banks lost RMB90 billion of deposits alone.

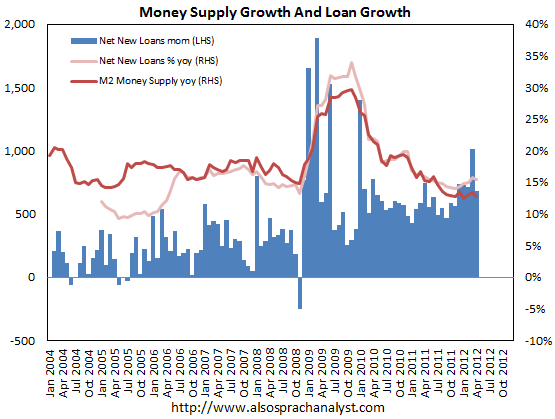

The chart below shows the latest official data from the PBOC up to April. If new loans for May turn out to be as disappointing as this report suggests, that will not bode well for the money supply growth, which is already below official targets:

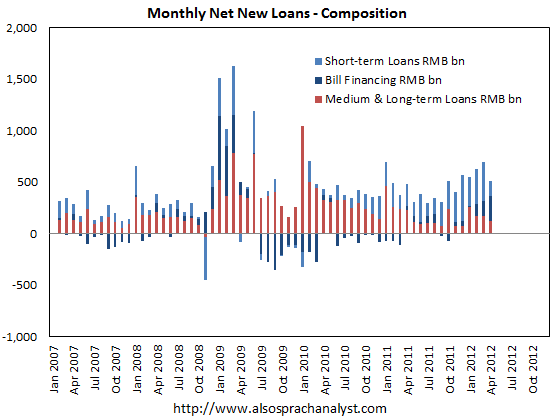

In addition to the weakness in credit demand, what new lending there is is dominated by shorter term loans and bills, which as Dong Tao of Credit Suisse suggested, indicates a lack of interest in taking on longer-term debt for investment:

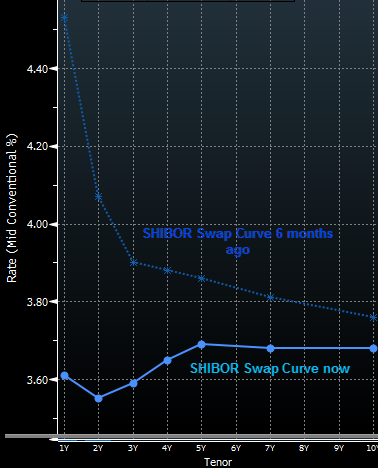

Finally, the blog Sober Look has look at the yield curve and finds ugly:

The slowdown (particularly the lack of demand for loans) is driving interest rates lower. The one-year SHIBOR swap rate is registering the sharpest decline since 2008. Again, swap rates show the market “consensus” of short term-rates in the future – a rate at which someone is willing to “lock in” short term rates for a year or longer (in this case locking in the 3-month SHIBOR rate for a year).

When we discussed China’s inverted yield curve a couple of months back, many dismissed it as supply/demand aberration. But as has been the case in the US, an inverted curve continues to be the best predictor of economic downturns:

Recently I have speculated that a debt deflation has begun in China. All of this new evidence supports that notion.