By Chris Becker

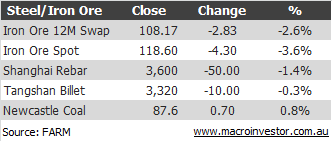

The thundering falls of iron ore continued overnight with spot prices falling almost 4%, and swap by nearly 3% with steel (rebar/billet) slipping slightly:

This was on the back of news that Chinese buyers have asked for deferrals on shipments – from the FT:

Traders and analysts said that Chinese buyers were deferring contracted iron ore shipments, putting further downward pressure on prices. “Cargoes are being deferred at the moment in China,” said Colin Hamilton, senior commodities analyst at Macquarie. “That is certainly going to lead to a bit of a distressed iron ore market this week.”

Commodities traders started to notice Chinese consumers of iron ore, used in steel manufacturing, and thermal coal, asking to defer cargoes and in some cases defaulting on their contracts around May this year as economic growth slowed. China is the world’s largest importer of iron ore, accounting for roughly 60 per cent of the seaborne market.

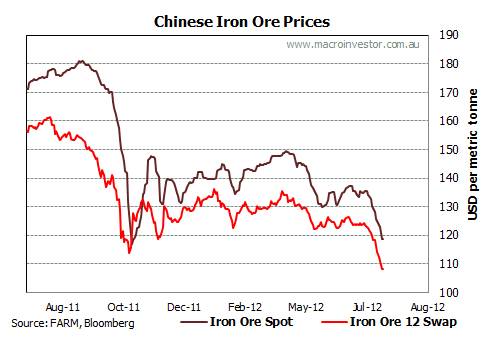

As Houses and Holes reported yesterday, this move is accelerating, having breached the October 2011 lows – heres the 1 year chart of spot and swap rates (Tianjin and Singapore respectively):

Meanwhile the heat intensifies domestically, after record production numbers from BHP, RIO and FMG, with Atlas Iron reporting yesterday that production will double by 2013 and will leverage its balance sheet to bring this to the market faster by rail – from The Cupboard:

The iron ore miner recently entered into an agreement with rail operator QR National to look at the feasibility of constructing an independent railway in Western Australia’s Pilbara region.

Atlas, which moves its iron ore to port by road, will bring three new mines into production over the next 18 months as it targets 12 million tonnes per annum by December 2013.

But analysts are concerned that an investment in significant rail or port infrastructure could lead Atlas to take on a mountain of debt.

The takeovers also keep coming – small cap producer Northern Iron (NFE) getting an even bigger bid from Aditya Birla – from WSJ:

Northern Iron Ltd. said Tuesday it received a revised takeover proposal from India’s Aditya Birla Group valuing the company at 518 million Australian dollars (US$532 million).

Northern Iron said the nonbinding proposal made late Monday was worth A$1.40 a share

But the big news is Brazil’s Vale – the biggest competitor to Australian iron ore extractors – which last night announced a Q2 profit decline of 59% – why?

Because of declining iron ore prices. From Bloomberg:

Net income dropped to $2.66 billion, or 52 cents, from $6.45 billion, or $1.22, a year earlier, Rio de Janeiro-based Vale said today in a regulatory filing. Vale was expected to post per-share profit of 73 cents excluding some items, the average of 12 analysts’ estimates compiled by Bloomberg.

Shares of Vale, the world’s second-largest mining company, dropped to the lowest in more than two months today after iron-ore prices slumped on slowing economic growth in China, the biggest steel producer, and a worsening debt crisis in Europe.

The selling price of iron ore and most of Vale’s main products is lower than in 2011, which explains the decline in earnings compared with last year, said Juliana Chu, an equity analyst at Votorantim Corretora.

Its not just declining prices, its declining sales as output rises:

Net sales fell 21 percent to $11.9 billion in the period after Vale sold its iron ore at an average $103.29 per metric

ton, down from $145.30 last year. That’s less than a $110 per ton estimate by Banco BTG Pactual SA.Vale’s iron-ore output rose 0.4 percent in the second quarter to 85 million metric tons, beating analysts’ estimates, after weather conditions improved at Carajas, its biggest mine, the company said July 18.

Vale is down 24% in the last 12 months, more interesting is the correlation with the spot iron ore price – with analysts forecasting even more weakness in FY13, and even though cost of production for the big Aussie extractors is well below the current spot price, is the market going to care?

And are those record sales going to keep coming?

Chris Becker is an investment strategist at Macro Investor, Australia’s independent investment newsletter covering stocks, trades, property and fixed interest. Each week Macro Investor publishes tables on the top ten most undervalued and overvalued stocks on the ASX. A free 21-day trial is available at the site. You can follow Chris on Twitter.