Economic networks – a new macro?

Economists have hard a hard time explaining the nature of business cycles with internally consistent models. Indeed, while psychologists and sociologists have gained a broad understanding of the nature of individual and social interactions, when it comes the that mystical place called “the market”, economists prefer to throw out the key findings of these disciplines and derive models of people with robotic perfection.

Looking at the economy in terms of networks can overcome some of these problems, while still allowing internally consistent reasoning. Economic and social networks demonstrate the pay-offs to loyalty and trust, and advantages to monopolies with relative bargaining power in markets. And most importantly from a macro viewpoint, the way in which the business cycle occurs.

The most important link between economic principles and networks is the idea of externalities in individual transactions. While the fundamental principle that voluntary contracts for trade are mutually beneficial remains, that doesn’t necessarily mean that all contracts are perfect, equal, or have anticipated outcomes.

A situation where one side cannot fulfil their obligation results in what we might call an externality – to the party whose business is dependent on the fulfilment of those contract obligations. While this is currently understood as risk, something that businesses address every day of the week, when modelling the economy as a whole it is completely ignored.

Indeed, externalities in networks can work both ways. When new technology or production processes are developed, the originating firm may benefit for some time, but the buyers of their products also benefit, as do others further distant in the production chain and the economy as a whole.

The idea that only parties to the contract are affected by that contract should be clearly seen as a very wrong and unhelpful assumption in economic analysis.

So while economists often assume that markets adjust perfectly to shocks – be they a tightening of credit, a new technology, a large shift in interest rates or the exchange rate – the actual day-to-day business of organising production is imperfect and agents not party to a transaction are affected by them. The failure of one ‘node’ or business has externalities, or flow on effects through the economic network. At the worst case, a cascading failure.

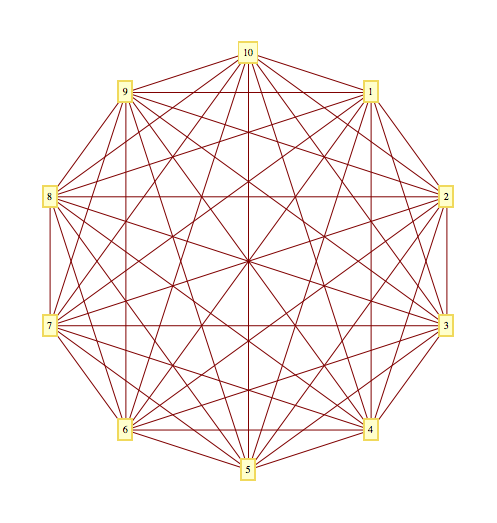

Consider the network shown below, representing a small part of a production chain. It is probably easy to imagine the goods passing from left to right as value if added, and that node 1 is the retailer. Nodes 7, 9 and 10 provide ‘raw’ materials in this chain (noting that they themselves require inputs to extract or cultivate the raw materials).

Now picture a situation where the a tightening of credit means demand contracts for the good at a retail level (demand at node 1). Node 5, who was precariously leveraged, but could survive as long as the demand for the retail goods from node 1 was sustained, and the production chain kept growing its output, is now going into administration.

Growth in orders along the chain turns from positive to negative. Indeed, there are major consequence if node 5 actually fails. Node 5 is network bridge because no other path is available to keep the whole network connected. This not only provides it with bargaining power in the production chain (many economists might call it a monopoly or a production bottleneck, such a rail lines on the coal production chain), its very function provides an externality to others in the production chain. If it didn’t exist there would be not other feasible way to produce this good. So when it fails, and cannot fulfil its contractual obligations, or even simply meet informal expectations of an ongoing productive relationship, there are negative externalities on others in the production network.

If this crucial node 5 business is forced to shut down because no buyers can be found (there is a credit crunch remember), the employees go home and capital equipment is left idle as it waits to be sold, we see flow on effects to other businesses involved in this market. Perhaps they can band together to purchase node 5. Perhaps not. Indeed, all other firms will be looking to reorganise at the same time because of lower demand.

At worst, the effects can flow through other nodes to their suppliers, into a cascading network failure. When we consider the business cycle as cascading effects within networks, we can go a step further in explaining why some countries are better able to handle credit shocks than others.

Following the financial crisis, the common German reaction of reducing work time instead of reducing the workforce preserved the employer-employee network links, for example, which ensured lower employment effects and a quicker return to growth.

In our example network if node 2 or 3 alone failed, there would be minimal disruption to the network because of the existence of redundant links. Indeed, a network representation of most economic models would look much like the network graph below, where the failure of one node has close to no impact on the function of the whole (especially when the number of nodes becomes very high). Hence the great confusion about the business cycle.

So how does economic reasoning change when thinking in terms of networks? I guess the most important thing that changes is that you can’t understand the prospect of a single industry or market in isolation without acknowledging the impacts of the performance of other markets, and the economy as a whole. We are all connected.

It goes some way to showing that the idea that recession in Europe will be balanced by growth in China is off base. These two areas are tightly connected by trade networks. And the more tightly connect the economic network, the more likely the performance of each part will be closely correlated.

Networks demonstrate clearly the degree of monopoly power held by businesses at different points in the production chain, and I have seen some analysis by competition regulators that recognises the nodes and links, but ignores the well established results from sociology about power balance in networks. I believe that network analysis of markets will be a common tool for regulators in due course.

A remaining area of research is how networks evolve and change. One key finding is the networks are very persistent, they are not easily broken and reorganised. Nor can new links be easily formed, although it is commonly assumed that this is the role of the entrepreneur in society.

Expect to hear and read more about economic networks in the coming years.

Tips, suggestions, comments and requests to rumplestatskin@gmail.com + follow me on Twitter @rumplestatskin