Last week, some got really excited about China’s so-called RMB1 trillion stimulus. Notably, Bank of America Merrill Lynch got out of bad to get a note out alerting everyone in the middle of the night.

I remain unimpressed. So is Dong Tao of Credit Suisse. Now UBS joins the skeptics with Tao Wang not impressed either. In fact, she found that most of last week’s wave of announcements are not even new investments. Many have been announced before, and the NDRC merely published its approval:

But a closer look at the newly announced approvals shows that these projects have been approved in the past 2-3 months, some as early as April and May, and most of these projects are part of the local governments’ 12th Five Year Plans (see Table 1 for the details). In other words, many readers believed that the government suddenly rolled out a RMB 1 trillion stimulus package in the past week ahead of the weak August data, but the truth is that the NDRC just suddenly PUBLISHED the project approvals of the past few months, perhaps to demonstrate that the government’s policy support in the form of infrastructure investment has already been underway.

The bottom-line: everyone should calm down.

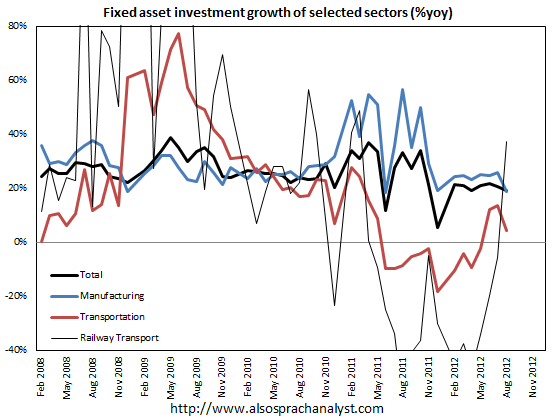

As we know, fixed asset investment (FAI) growth slowed further in August. On a year-on-year basis, FAI dropped to 19.4% year on year.

Fixed asset investment growth is under pressure from real estate we know. What is less widely understood is investment in manufacturing is also having a big impact, with FAI in manufacturing slowing to 18.8% year on year. Manufacturing FAI accounts for more than a third of the non-rural total. Indeed, manufacturing is the biggest contributor to the total volume of FAI, and it is unlikely to see any sustainable recovering owing to overcapacity.

But, if one is looking for clear bright spots in the August macro data dump from China, there are a few. I pointed out yesterday that real estate investment picked up slightly in August:

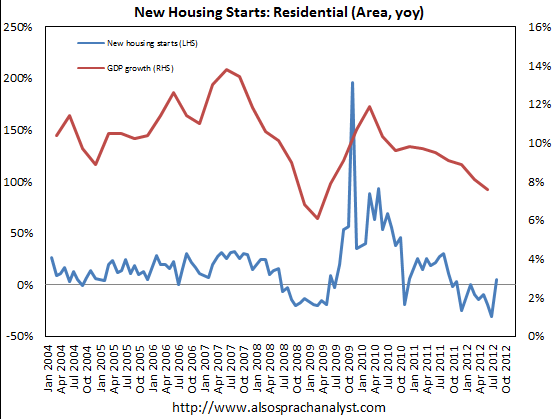

Interestingly, residential housing starts decreased by 11.1 for January-August, but increased to 4.96% for August alone, a decent pick from the big slump in July.

Meanwhile, residential housing sales growth in terms of floor area improved further for January-August, picking up from -7.5% yoy for January-July to –4.8% yoy for January-August. However, sales growth slowed slightly from 14.5% yoy for July to 13.3% yoy.

Another bright spot is rail roads investment, which increased massively by 37.4% year on year and is clearly emerging from its weakness:

However, one should remain very sceptical about the government’s ambition in providing massive stimulus in terms of infrastructure investments. The “stimulus” being talked about for many months now is indeed flowing through, but it is far from enough to offset the slowdown elsewhere.