Courtesy of Also Sprach Analyst

China has reported the 3rd quarter GDP at 7.4% year on year. The slowest in years, but given the consistently disappointing data throughout the year, this has surprised nobody.

The reality, of course, is that Chinese statistics are odd and sometimes unreliable, so unreliable that even the vice premier pointed this out.

While China’s GDP growth for the third quarter was 7.4% in real and year-on-year terms, on a quarterly basis, growth was 2.2%. At an annualised rate, that means 9.1%. And perhaps more bizarrely, while everyone thinks that Chinese growth has been slowing month by month, the latest heavily revised data quarterly growth data points to a pick up in growth since 2011 of Q4. Sequential growth rates since Q1 through Q3 were 1.5%, 2.0% and 2.2% respectively, or in annualised annual rate, 6.16%, 8.24%, and 9.09% respectively. Compared that with the year-on-year growth of 8.1%, 7.6% and 7.4%.

Of course, it is entirely possible to have divergence between year-on-year basis vs. sequential basis for a while, but the arithmetic is getting impossible at this point with two trends diverging so much for so long. And perhaps more importantly, it simply does not match the reality (or most people’s perception of the reality). For instance, in the purchasing manager’s index, the survey asked the panel how things were doing compared to last month. This measure, particularly the HSBC/Markit manufacturing PMI, does not point to any sequential improvement since the first quarter.

Source: HSBC/Markit, Bloomberg

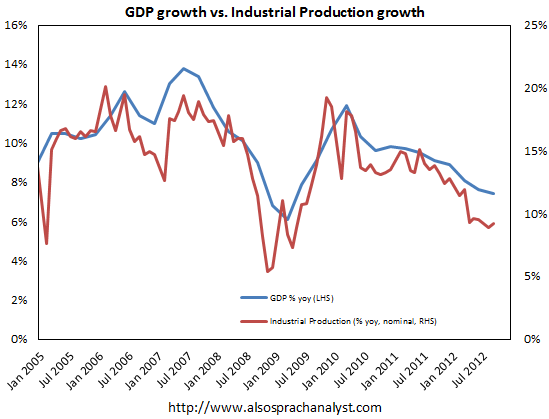

Let’s say we ignore the reported sequential growth completely (blame seasonal adjustment), then we’re left with the question of whether the economy was really growing at 7.4% yoy. Industrial production growth does not agree:

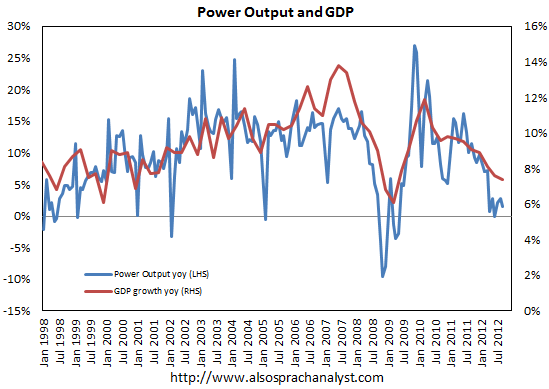

And perhaps more interestingly, electricity consumption/production data, the favourite alternative gauge of the a fore mentioned vice premier, which suggests that even though you can say a lot about China shifting towards services and China suddenly become much more energy efficient, one would still question why growth is not a bit lower.

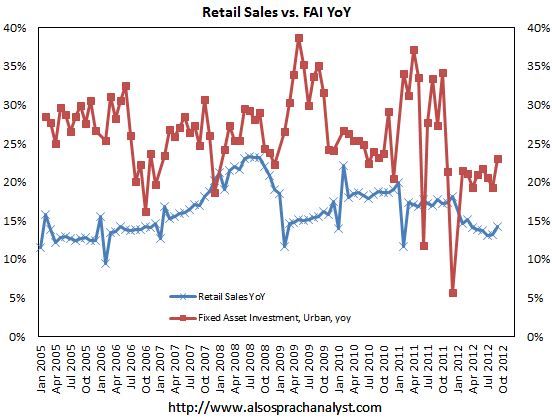

Another inconsistency is the numbers provided by the National Bureau of Statistics regarding the contributions to growth. In the press conference, it was reported that final consumption expenditure contributed 55% of growth for the first 3 quarters, capital formation contributed 50.5%, while net export contributes –5.5%. Final consumption also includes government consumption expenditure. If retail sales and fixed asset investments are the proxies (which is not entirely comparable, but bear with us), consumption is probably still growing slower than fixed assets investment.

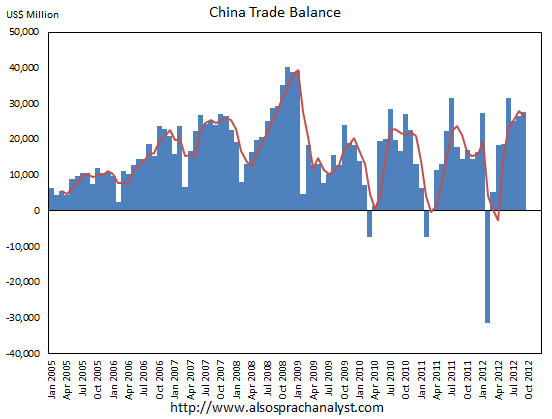

And perhaps more bizarrely, the trade surplus this year is larger than last year’s, yet an official from the National Bureau of Statistics told the press that net export made a negative contribution to GDP growth. The “strong” net exports are largely due to weaker import growth, not stronger export. Nevertheless, it adds more to GDP. How is it possible that the official can report with a brave face that net export made a negative contribution is something for you to speculate.

Of course, one can continue to point out just how odd Chinese data looks, and argue that growth is actually at 0%, or 3%, or 5%, or 10%. Beyond the inconsistencies (of which there are many), what most are really interested in is what’s next. After the August macro data dump, we noted that the market had turned most pessimistic on Chinese growth in more than a year, with the sell-side cutting forecasts one after another. I wrote that for the first time I was less pessimistic about the short-term than the consensus.

With the Fed’s QE-Infinity and ECB’s OMT, I suggested that there is a chance that things might improve toward the 4th quarter (finally), so long as money is flowing back (whether QE and OMT will boost inflow sustainably is another matter). If my read on the recent strength of the Chinese Yuan is right, money flow might have indeed turned into inflow after QE-Infinity, which is good for liquidity conditions, as confirmed by the fact that despite PBOC being in net withdrawal for the first time in weeks, interbank rates remain low. Not to mention the now-very-noticeable pick-up in investment in some infrastructure, such as railways.

There are a few other things that optimists can finally feel cheerful about. First, the trade data were a surprise to the upside.

To put this into perspective, even the “surprisingly good” number for September was actually very weak when compared with previous years. With only two and a half months left for the year, no matter how great this round of Christmas orders is, the possibility of meeting the full-year target of 10% growth in total trade (i.e. export and import included) is very small.

But September was a surprise on the upside nonetheless and there are some good reasons to believe that export growth will continue to improve towards November. This is partly due to seasonality (Christmas, obviously). As we cited Dong Tao of Credit Suisse last month, that export orders were finally picking up after a very bad summer:

Meanwhile, in our recent trip to Dongguan, Guangdong, one of China’s export hubs, manufacturing exporters indicated that orders have picked up in the past weeks after a very bad July and early August. Exporters suggested that the pace of orders have picked up by at least 20% from a month ago, though the volume is still below what was seen the same time last year. August and September are critical times for Christmas orders. The late arrival of orders from US and emerging markets is good news for the exporters, although none of them know if the recent pick up can be sustained. A similar trend has been reported by Taiwanese electronics producers, who produce a large part of their products in Guangdong as well.

It is a little too early to call a turning point, but this is an interesting new development that has yet shown in the statistics. Typically, the pick up in orders should be materialised in the export data in November. Rush orders in late September or early October should be reflected in trading volume of late November or early December.

And then, there is the iPhone 5. Last month, Barclays noted that iPhone 5 and other Apple’s products alone can add more than one percentage point in export growth from September through to November.

We estimate that for September through November 2012, Chinese export growth will be boosted by 135bps each month based on the incremental jump in iPhone, ultrabooks and iPad sales above 2011 levels.

Foxconn may not be too happy, but as far as GDP accounting is concerned, Apple’s products turn out to be a boost.

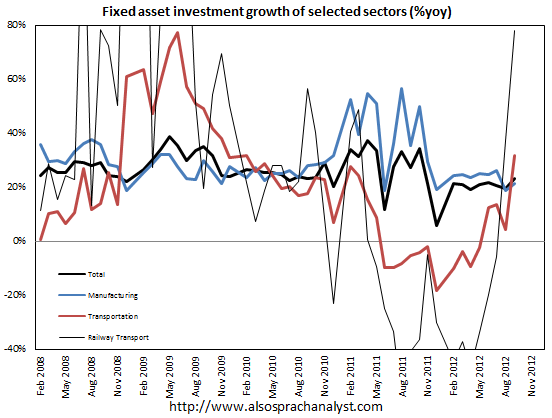

The second thing is the pick up in infrastructure investment, which is not a good news as far as the longer-term rebalancing of the economy is concerned, even is we are nowhere near the RMB4 trillion of 2009. For the short-term, however, this is good news as it partly offsets weakness in investments in other sectors, such as manufacturing.

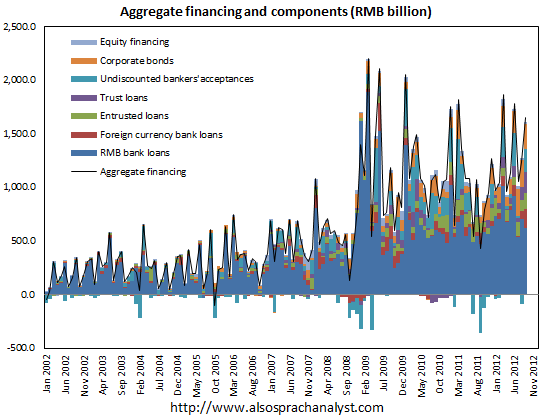

Third, while bank loans remain relatively weak and liquidity in the banking system remains tight, funding conditions outside the banking system seem to be improving, as shown in the aggregate financing data, which indicate a pick-up in funding from bonds and trusts. This, of course, is in no way in-line with the objective of cleaning up China’s shadow banking mess ( or maybe they have never been serious about that), but at least it keeps the party going for longer.

Source: PBOC

The seeming resilience of the real estate market in September’s data, together with better liquidity conditions (thanks to QE-Infinity and OMT), makes any large-scale stimulus programme as unlikely as it was 3 months ago. Structurally, the challenges such as over-capacity, permanently weaker external demand, and demographics do not disappear with this set of data, and growth will continue to slow in the longer term. In the time frame of the next 3 months, however, we think the market will probably not receive many new nasty surprises.