Australia must find a Budget surplus before 2014 or it will lose its AAA rating, according Kyran Curry, S&P sovereign analyst via the AFR:

“If there’s a sustained delay in returning the balance to surplus, as the economy gathers momentum and as people start spending again, as the import demand picks up and current account blows out, we might not see the government’s fiscal position as being strong enough to offset weaknesses on the external side and that’s what worries us…Australia’s already, as we see it, got some credit metrics that are right off the scale when it comes to assessing Australia’s external position…It’s got high levels of external liabilities, it’s got very weak external liquidity and that basically means the banks are very highly indebted compared to their peers…For us, we look to Spain, which was Australia’s closest peer four or five years ago in terms of having a very strong fiscal position, very similar to what Australia has at the moment, its external position was weaker, like Australia’s, and it got routed very quickly…The government needed to provide support to the banks, it had to shore up growth in the economy and its debt levels more than doubled…We can see that happening in Australia’s case.”

I’ve feared this outcome since the GFC. Here’s what I wrote back in June:

In short, if the sovereign gets downgraded, so do the banks and their cost of funds rises, either raising the price of credit and/or restricting its distribution. The RBA will aim to offset this with rate cuts but how low can they go? In a global recession scenario, the RBA is probably also constrained by the need to keep some yield spread between our rates and those oversees so that capital doesn’t flee our shores. Potentially then, the resulting hit to asset prices raises unemployment further than otherwise and the automatic stabilisers become more onerous for the Budget requiring more cuts or borrowing or both. Another downgrade might follow, so on and so forth.

I would alter that now a little. Given the mining boom peak is in sight, there is no longer any need for a global recession scenario for this to play out. The RBA has already been forced into cutting interest rates to emergency levels. The great likelihood is that they will go lower still. In short, all that needs to happen is that China continue a steady adjustment towards consumption-led growth and bulk commodity prices remain in current ranges and the rating will come under pressure, risking the feedback loop.

The kicker of course is that it may happen anyway because fiscal tightening is already required to support the rating when the economy is not strong enough. That is, we are already in the feedback loop.

In this context it makes sense that we revisit the tax base, which is what the independents want to do. Also from the AFR, Rob Oakeshott:

“If we can’t make taxes like the GST more efficient to deal with pressing spending, then Australia is in a bad place…We need to look at broadening the base and in that get rid of some of the inefficient state taxes in a country where four taxes do 90 per cent of the work. We need to be brave – because without some solution, there is no money to do what the government needs to, particularly with an ageing population and programs like Gonski and the NDIS [national disability insurance scheme],”

Mr Windsor said middle-class welfare programs such as the $5000 baby bonus meant that policies such as the Gonski education overhaul, which would improve skills in the workforce, were being deprived of billions of dollars. “People want spending on health and education, not on hamburgers and milkshakes,” Mr Windsor said.

“The middle-class welfare started 10 years ago when we had the money to do it, that’s not the case any more, but it’s difficult once you’ve given someone something to take it away from them.”

Certainly anything that boosts productivity will help avoid the feedback loop but let’s not kid ourselves, raising the GST as the private sector disleverages, let alone deleverages, is going to hit consumption growth and government revenues. The middle class welfare we are discussing cuts across all groups, as the SMH makes clear today:

THE richest fifth of households receive nearly half of all the wages paid in Australia but also get about 12 per cent of all government handouts, new research by the Bureau of Statistics shows…the poorest 20 per cent of households receive just 2.5 per cent of the nation’s wages and salaries in 2009-10 while the richest 20 per cent gets about 47 per cent. When income, government cash payments and social transfers in kind (such as public education and healthcare) are taken into account the poorest fifth’s share of “adjusted disposable income” was 11 per cent and the richest fifth 36 per cent.

But maybe the most revealing finding was the amount of government assistance being transferred to high-income households. The preliminary results showed the richest quintile of households received about 12 per cent of social assistance benefits while the next highest quintile got 11 per cent.

Many high-income households qualify for the childcare rebate, which is not means tested, and the private health insurance rebate.

As I’ve said for three years, we’re in a feedback loop that is slowly gathering pace. Keep borrowing offshore and lose the AAA rating as the current account deficit blows out. Stop borrowing offshore and as growth slumps and governments can’t reach surplus to protect legacy private sector debts, taxes must rise, hitting growth…and government revenues.

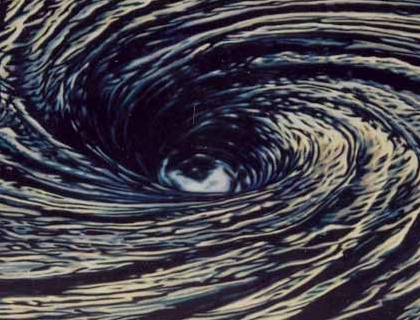

Our one real hope to sail clear is to boost exports and grow via external demand. But while we stuff around letting the high dollar hollow us out, the maelstrom draws us ever nearer.