Cross-posted from FTAlphaville.

China’s shadowy and increasingly popular wealth management products are back in the headlines, most recently after dozens of investors protested outside a bank branch in Shanghai after they were told they would not receive their money back.

Their investment wasn’t with the bank itself, Huxia Bank, but with Zhongding Wealth Investment Centre. It led to a customer manager at Jiading branch of Huaxia Bank being apparently arrested, although several of the investors reportedly told the South China Morning Post that she had the bank’s approval to sell the product.

To refresh your memory: WMPs are high-yield investment products that can be marketed by banks, and often invested in illiquid and sometimes risky assets. Chinese investors, looking for something that yields a decent return, or even a real return at all, often believe that the products are as safe as deposits with the banks who market them.

More from the South China Morning Post’s report:

The Zhongding WMP provides a vivid snapshot of the practices the institutions engage in. Zhongding raised the money through Huaxia Bank to fund the construction of car dealerships in Henan province. The victims said Huaxia Bank informed them the borrower was found to have committed crimes.

“Shouldn’t Huaxia take responsibility?” said Zhou Guowu, an investor who spent 500,000 yuan on the Zhongding product.

“Our money was deposited into Huaxia’s accounts via the branch’s counters,” said one investor. “For ignorant investors like us, we were buying Huaxia Bank’s product and we want our money back from Huaxia.”

Anne Stevenson-Yang of J Capital Research says it’s not the first WMP to have failed; but we’re hearing a lot about this one because there were protests at a Huaxia branch in Jiading, Shanghai, rather than a smaller city. In fact, she says that, from piecingtogether news reports and a WMP operator’s company blog, it appears the WMP that is the source so much ire among Huaxia customers in Jiading may have been issued to pay for a default by the same company last year:

How do we know that a default in a city less exposed to international scrutiny would likely have been ignored? Because the same management company that offered this wealth product had defaulted in October 2011 on at least 430 million RMB in investor capital when its guarantee company went bust. Only this default was in Henan, and it didn’t make the papers. It seems that the wealth management product had been issued in the first place, with the apparent concurrence of Henan regulators, as part of a plan to settle claims from investors seeking to redeem their funds in Henan.

That’s one WMP tale. Just last week the FT ran an analysis piece by Simon Rabinovitch, on China’s shadow banking system, in which Simon looked into RiseSun Holding Company, the parent of one of the biggest developers in the small city of Langfang. RiseSun was the target investment for a WMP sold by Bank of Hebei:

To stay ahead of the competition, RiseSun has been scaling up quickly. Moneyweek, a Chinese financial magazine, said it had been “crazily buying up land”, funded by obtaining money from its parent company, which in turn had pledged equity as collateral to trust companies. The deal structure could allow RiseSun Real Estate, the listed entity, to appear less indebted since it is RiseSun Holding, the parent company, that is borrowing from outside sources.

Put simply, this means that customers at the Bank of Hebei who have been buying WMPs, reputed to be as safe as deposits, have actually been financing shadow loans to a property developer clocking up debt in a city with a frothy housing market.

If you want more, there’s also Reuters’ report on the ‘Golden Elephant’ WMP from October.

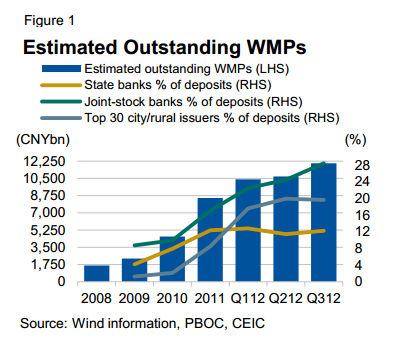

Meanwhile, shadow-banking-watcher extraordinaire Charlene Chu at Fitch wrote last week that WMP issuance had continued to grow in Q3:

More than half of the issuance this year is for tenors of 90 days or less; almost all of it matures in less than one year. They can also be handily moved on and off bank balance sheets, as deposits, in order to meet regulatory requirements — off balance sheet to reduce reserve requirements; or on balance sheet to meet loan/deposit ratios at the end of an accounting period. Chu again:

WMPs are vehicles that can borrow/lend, and banks engage in transactions with their own and each other’s WMPs. This makes the pools of assets and liabilities tied to WMPs in effect second balance sheets, but with nothing but on-balance-sheet liquidity, reserves, and capital to meet payouts and absorb losses. These hidden balance sheets are beginning to undermine the integrity of banks’ published balance sheets.

The possible effects of WMP popularity go beyond the risk of a few of the products blowing up and upsetting investors. As Chu notes, they are eroding the traditionally cheap and plentiful supply of deposits available to Chinese banks:

Higher cost, less stable funding presents new challenges for profitability and asset-liability management,

and makes it more difficult for banks to carry bad loans indefinitely, as they did in the past.

Chu also points out that the smaller banks are now by far the biggest issuers of WMPs; accounting for 85 per cent of the Rmb3.5tn rise in WMPs in the nine months to September.

This might explain why the big four Chinese banks are voicing their displeasure at WMPs; such as Bank of China’s chairman, Xiao Gang, who came right out and used the ‘Ponzi’ label, and an unnamed official from Industrial and Commercial Bank of China quoted in the SCMP report, who warned that “more scandals are set to surface” over WMPs.

Where are the regulators in this?

Turns out they may have a plan, of sorts:

(Reuters) – China will stop including 13 trillion yuan(1.30 trillion pounds) in short-term bank investment products in official estimates of the country’s shadow banking sector, sources said on Thursday, in a move to downplay risks posed by off-balance sheet lending.

There’s more (our emphasis):

WMPs should be brought on to bank balance sheets if they are capital guaranteed, said three sources familiar with a ruling from the China Banking Regulatory Commission.

WMPs that are not capital guaranteed can continue to be left off balance sheets, but will not be included in estimates of shadow banking, added the sources, who declined to be named because the ruling was not yet public.

So, if this goes ahead, the non-capital guaranteed WMPs just won’t be recorded in either bank balance sheets or official statistics.

Problem = solved!