It was a global November manufacturing PMI avalanche overnight and that included data from Eurozone. Once again the chief economist at Markit , Chris Williamson, provides a good wrap of the data:

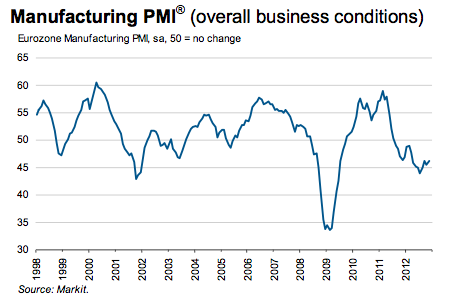

The November PMI indicated that manufacturing conditions deteriorated at the slowest rate for eight months, but the downturn clearly remains severe. The ongoing steep pace of manufacturing decline suggests that the region’s recession will have deepened in the final quarter of the year, extending into a third successive quarter. With official data lagging the PMI, the rate of GDP decline is likely to have gathered pace markedly on the surprisingly modest 0.1% decline seen in the third quarter.

The picture is nevertheless starting to brighten somewhat, with the PMI appearing to have bottomed out back in July. Production and employment look set to fall at reduced rates in coming months as export demand slowly revives in markets such as the US and Asia.

However, the ongoing uncertainty caused by the region’s debt crisis means business confidence clearly remains fragile and companies continue to focus on tight cost control, meaning any robust recovery still looks a long way off and prone to a set-back if the crisis worsens.

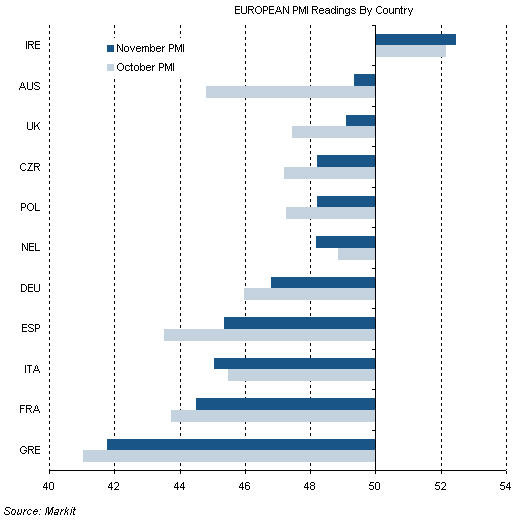

As you can see from the chart below November was certainly an improvement from October in all but The Netherlands and Italy, but apart from Ireland manufacturing is still contracting across the zone.

So on average the data looks more positive than the previous month which could point to a bottoming, but as you can see from the chart below you could have said the same back in early 2012 and been incorrect.

European bonds also had a good night as the announcement of the Greek buy-back set a higher offer price range than expected with a minimum between 30.2-38.1% and a maximum of 32.2-40.1% dependent on the bond maturity. The rally in periphery bonds was also helped by words from Angela Merkel who hinted that further help for Greece in the form of a true debt write-down may be an option in a year or so as long as it stuck to the program… again with the carrot and stick.

Periphery bonds are now approaching their best position in over a year, with Italian bonds leading the pack, however I’m a little concerned that markets have got ahead of themselves yet again.

Portugal is now warning of worse to come, Spain’s Rajoy is doing much the same , the Netherlands appears to be caught up in the downward movement as well as years of poor housing policy come home to roost and the latest French data also looks poor. Italy also continues on what is really a multi-decade structural decline in GDP with the latest figure showing no improvement despite the keen words of Mario Monti, and we know much worse is yet to come in Greece as over €10bn in cuts has been front loaded into the budget in order to get the latest bailout deal.

As I’ve said over the last few months my expectation was that European leaders would concoct a plan for Greece to push it off the radar until after the German election. I definitely think they have been successful in achieving that, but this deal really needs to be put in that context. The issues of the country are far from being resolved and it is just one small problem in a growing line of them for the Eurozone. This latest PMI data may suggest a bottom is in for manufacturing, but given what I expect for 2013 I’m sceptical that this is the case.

We get the services and composite PMI on Wednesday night which will provide a broader view of what is happening, in the meantime national reports are below:

- Greek Manufacturing PMI

- German Manufacturing PMI

- French Manufacturing PMI

- Italian Manufacturing PMI

- Spanish Manufacturing PMI

- Irish Manufacturing PMI

MarkIt Eurozone Manufacturing PMI