HSBC has an awesome report out on intensifying currency wars. The report is a great primer on where we’re at and who is winning:

The currency war is intensifying: the number of participants is rising, fresh policy tools are being used to fight, and the scale of influence on the wider FX market is increasing.

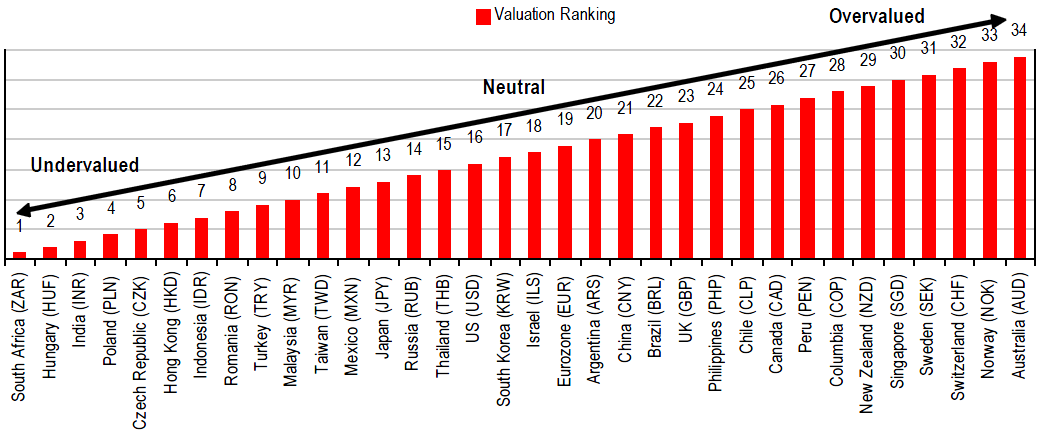

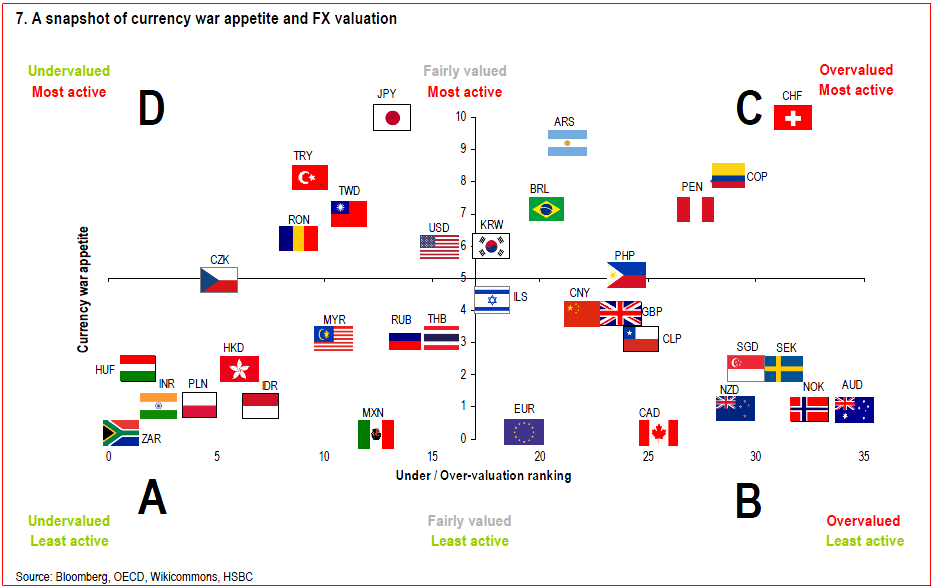

We examine 36 currencies and demonstrate that there has been an increase in currency war appetite over the last year. We grade each country based on a scale of 0 to 10, with the highest score for those we believe are most open to the idea of acting in currency markets, one of the drivers of which may be to secure an economic advantage. The average score has risen over the last year. We also determine whether such activism could be justified on the basis of FX valuations, comparing currency war appetite against their relative under or overvaluation.

Countries that have become more activist include Japan and Switzerland in G10, and a number of countries in LatAm. EMEA has been relatively less embroiled, though the CZK and TRY feature. Interestingly, our score for Asia ex-Japan has declined as central bank intervention is increasingly targeted at lowering volatility rather than seeking a more competitive exchange rate. However, scores in this region remain high given their past appetite for intervention. The fear for the market will be that any additional JPY weakness might stir central banks to be more active, ratcheting up the currency war.

There are a number of investment implications:

1 Those currencies not actively participating in the war will likely see further upside should the conflict worsen. This grouping includes the EUR and G10 commodity currencies.

2 The JPY now appears undervalued, and Japan is likely to face sterner international opposition, limiting further depreciation of the JPY.

3 The data matters once again, either strengthening or undermining the case for currency war. If the global economic recovery stalls once again, the scramble to secure a share of a limited economic prize will make the currency war even more bitter. By contrast, a stronger global upswing would see such FX tensions fade.

4 The currency war phenomenon means FX will lead other asset classes, rather than following them. FX is back in the driving seat.

Guess who’s coming last?