Cross-posted with permission from The Macro Man

TMM thought it would be time to review their old friend, the Aussie. A couple of interesting research pieces have come out from the sellside at the same time as one member of TMM has been travelling downunder so we thought we would try to find some sense between the 10,000 ft world of the big picture and capital flows and slightly more granular information on capital expenditures from corporates.

Lets start with the big picture of Aussie capital flows and what is holding up the currency. Shorting AUD has been about as much fun as being in the octogon with George St Pierre – just when you think you’ve got the terms of trade flow right you get slugged with flight to quality flows and just when you think they are receding with normalization of the volatility regime you find mining majors rushing into the market to build mines and gas plants as fast as they can. Its about as much fun as being hit in the face, then kicked, then thrown on the ground and strangled until you tap stop out. Ie not fun at all. So, where are we now with respect to these key drivers of flows and where are we going?

First, it appears that portfolio flows have slowed down somewhat. There are some tentative signs of a slowing of reserve accumulation ex Japan and Australia has not seen material net inflows for a couple of quarters.

TMM are big believers in normalization of current account balances as being a sign of the world getting better and this does appear to be happening. So, if reserve assets are generally going down and the eurogroup does not do anything insane for a while, perhaps having had their false idol of Reinhardt and Rogoff smashed by a bit of basic spreadsheet math then there should be less net flows and much less flows to Australia. TMM won’t bet the farm on this one but having been blindsided by these flows despite having got the commodities picture largely correct we have stopped whimpering and gotten out of the fetal position on this one.

Second, what about European bank deleveraging? This provided a substantial tailwind to shorts in 2011 but has also tapered off as of late. BIS data seems to indicate that Eurobank exposures to Australia are now low enough that it is unlikely to be a key driver and anecdotal evidence from our trip down here indicates that most eurobanks that are leaving the market are down to their last couple of hundred million dollars of loans. The loan auction-palooza of 2011 appears to be a long way away now.

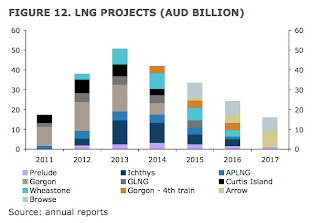

Third – what about all that mining investment? This is a bit more contentious and frankly much more important of a driver of flows in the last year and going forward. Investment continues to be torrid and while the coal sector is desperately looking to cut capacity after an apparent step function change in Chinese thermal power growth and iron ore projects get cancelled the gas sector rolls on. Or does it? Here is ANZ’s pipeline of future projects as of Jan 2013:

Putting that lot together TMM feel that Aus$ is vulnerable to an old fashioned sharp move lower in a “thatshouldnthavehappened” style that is pure “Gold”.