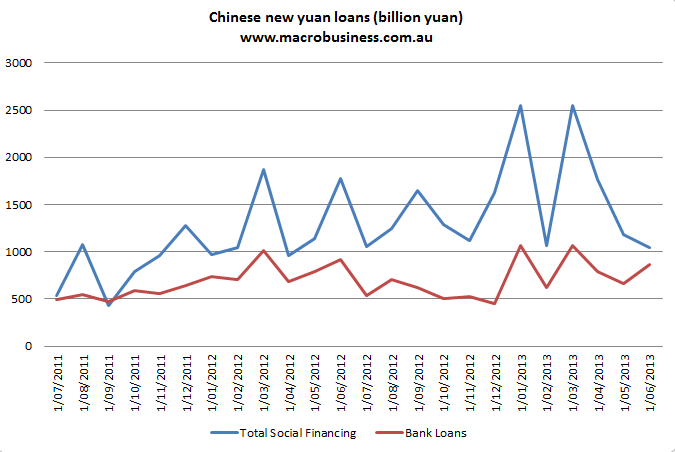

China’s June bank lending figures were out on the weekend and do not disappoint those looking for evidence that last month’s tight interbank rates have hit lending. Bank loans held up well at $860.5 billion yuan, actually beating consensus of $800 billion. But Total Social Financing, which adds in the shadow baking system was hammered at $1040 billion yuan versus $1275 expected. Here’s the chart:

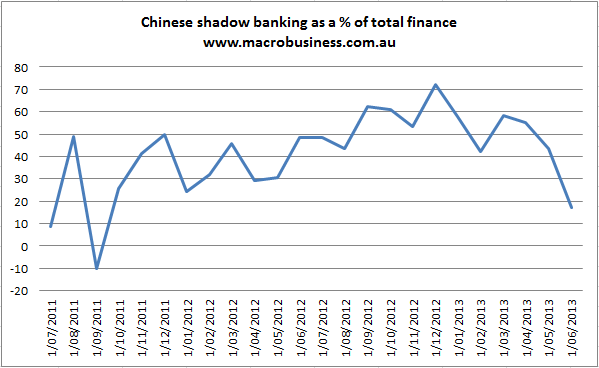

The spread between bank and non-bank financing collapsed with shadow banks accounting for the lowest proportion of finance in two years:

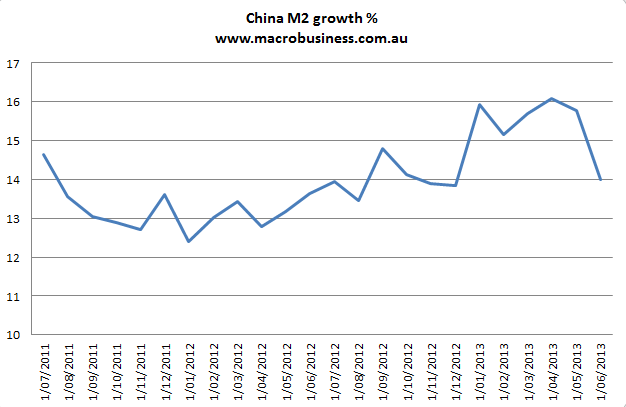

As a result, money supply missed consensus on all three measures. M0 came in at 9.9% versus 10.5% expected, M1 came in at 9.1 versus 10.7% and M2 came in at 14% versus 15.2% expected:

It looks like China quite successfully reigned in its shown banking activities in June. It also seems to have successfully quarantined traditional banks from the crunch.

M2 is still around its target and Total Social Financing is still at reasonable levels versus last year. The question is what does it mean to have no access to the huge ramp up in shadow banking activities in evidence over the past six months? If it was a kind of Minsky moment in which new loans were simply being originated to repay old, and hence contributed nothing to growth, then we might expect slowing growth as ponzi businesses go bust and bad debts pile up in the second half.