The AFR’s Robert Carling has posted an article today arguing to reform stamp duties:

…the states’ reliance on this source of revenue [stamp duties] is unhealthy and highlights the need to rethink how states are funded.

The beginnings of the Sydney boom helped push the NSW budget to an unexpected operating surplus in 2012-13.

…The huge increase in the weight of stamp duty on real estate transactions over time is a concern, not only because of the burden it places on buyers and sellers of homes, but also because stamp duty is widely recognised as one of the most distorting taxes. At the margin, it locks people into inappropriate housing and discourages mobility…

For these reasons, various government-initiated tax reviews, including the Henry review, have recommended replacing stamp duty with broader and less distorting taxes, including land tax…

States are right to say they need growing revenue bases, but property stamp duty is one that fails other criteria for sound revenue raising. Stamp duty reform is needed by re-examining how states are funded overall.

Carling’s arguments against stamp duty hit the nail on the head.

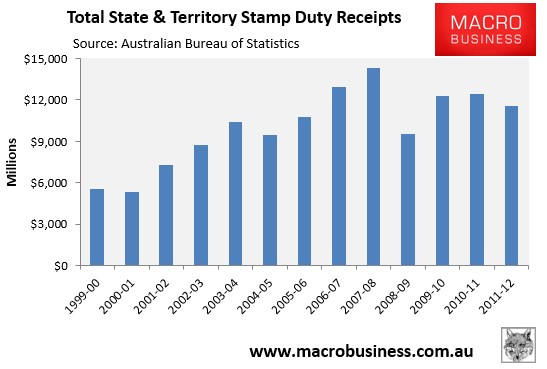

The volatility of stamp duty receipts – which rise and fall with the housing market – can reap havoc on state government finances, making budget forecasting and planning especially difficult (see next chart).

Aside from their inherent volatility, reforming stamp duties also has a lot of merit on efficiency and equity grounds.

Stamp duty is a highly inefficient tax that discourages housing turnover by unnecessarily penalising people that move to homes that better suit their needs. Obvious examples include baby boomers downsizing from large family homes and young growing families upsizing to bigger family-friendly homes. Such disincentives inevitably lead to an inefficient use of the housing stock, such as empty nesters occupying large homes with multiple spare bedrooms. Stamp duties also hinder labour mobility since they discourage workers from relocating closer to employment.

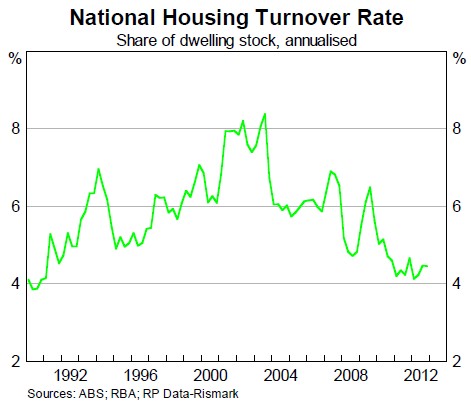

Stamp duties are also highly inequitable. As shown in the next RBA chart, between 4% to 8% of the housing stock is transacted annually. As such, we have a bizarre situation where a small minority of the population are paying taxes that support services for the whole community – all for the privilege of moving to a home that better suits their needs.

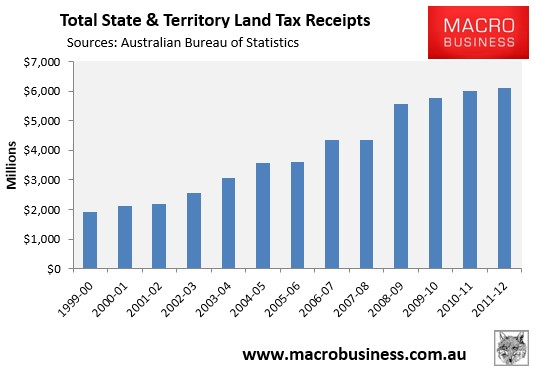

A fairer way of sharing the tax burden would be to abolish stamp duties and extend land taxes currently applied on investment properties to one’s principal place of residence. As shown by the next chart, land tax receipts have proven to be a remarkably stable source of revenue when compared against stamp duties, since they are not affected by transaction volumes.

As argued previously, broad-based land value taxes (LVT) would also assist in the provision of new housing via two channels. First, an LVT would help make infrastructure investments self-funding for governments, since any land value uplift brought about through increased infrastructure investment (e.g. new roads, trains, etc) would be partly captured by the government via increased LVT receipts. Accordingly, governments would be more likely to facilitate development, rather than act to restrict it in a bid to save on infrastructure costs. Second, an LVT would penalise land banking and vagrancy, effectively increasing the supply of land in the process and bringing new homes to market more quickly.

As with any change to the tax system, there are transitional issues that would need to be worked through in shifting from stamp duties to a broad-based LVT.

One concern is that those who recently purchased a property (and paid stamp duty) would be double-taxed via an LVT. A logical solution is to credit all landowners with the amount of stamp duty paid and then deduct the hypothetical land tax they would have paid since the date of purchase.

Another concern is that asset rich, cash poor, retirees could be left with LVT bills they cannot pay, requiring them to sell their homes. A logical solution is to allow these people to accumulate their LVT liability, with the bill payable upon death (via the estate) or once the house is eventually sold (whichever comes first).

Last year, the ACT Government announced the bold (and sensible) plan to transition out of stamp duty over 20 years, replacing it with a broad-based land tax levied via an increase in property rates. Reforming stamp duty was also a recommendation of the Henry Tax Review, which characterised stamp duty as an inefficient tax, and recommended replacing it with broad-based LVT levied on all properties.

The options are there, and it is in the state and territory governments’ financial interest to pursue reform and change the tax mix.

unconventionaleconomist@hotmail.com