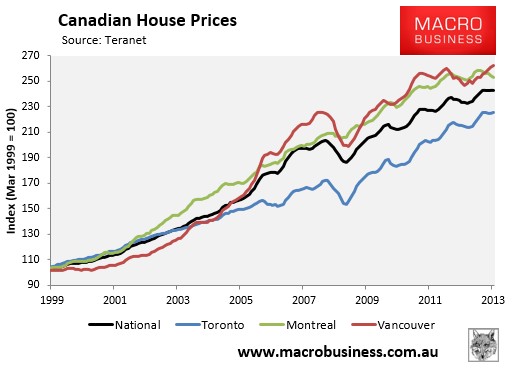

December’s house price results, released yesterday by Teranet, revealed that Canadian house values rose marginally over the month (+0.1%) to a new record high, with prices also up 3.8% over the year and 30% above their April 2009 trough:

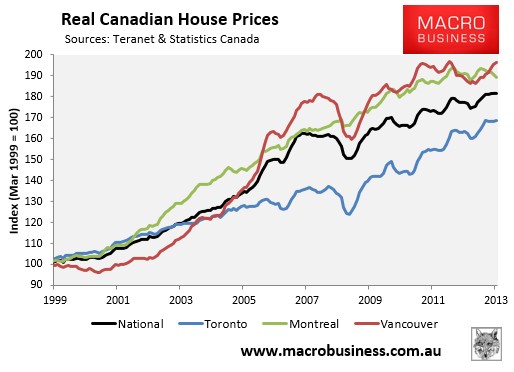

In real terms, Canadian house prices also hit a new peak, with prices 21% above their April 2009 trough:

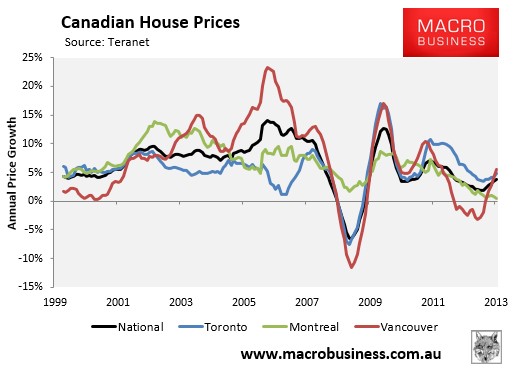

Price performance across the major markets was mixed, however, with solid growth recorded in Vancouver (+0.6%) and Toronto (+0.4%), whereas values in Montreal fell by 0.6%. Price momentum is also strong in Vancouver, whereas Montreal is weakening (see next chart).

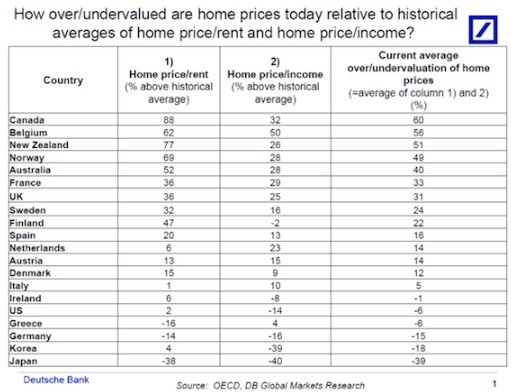

For a number of years now, Canada’s housing market has been the strongest performing developed market, which has also made it the world’s most overvalued according to the Economist, the OECD, and Deusche Bank (see below table).

Household debt in Canada also continues to rise, recently hitting an all-time high of 164% of disposable incomes, which raises the risk of a disorderly unwind. Meanwhile, unemployment has also worsened, increasing by 0.3% to stand at 7.2% as at December (see next chart).

With risks clearly building, hedge funds are now circling the Canadian housing market. But the market has looked dangerously overvalued for years and there’s no telling when the market will follow its southern neighbour into decline, if at all.

unconventionaleconomist@hotmail.com