It’s official, Australia’s car assembly industry is dead, with Toyota last night announcing that it will cease local operations in 2017, citing high costs, the elevated Australian dollar, and increasing competition from free trade agreements.

With the announced closure there will be 2,500 job losses from Toyota’s assembly plant, which comes alongside the 1,200 job losses at Ford and 2,900 job losses at Holden by 2017. Total job losses across the economy will be much greater, however, with tens-of-thousands of job losses likely across component makers, let alone those indirectly reliant on the industry. Some estimate as many as 200,000 jobs are now in jeopardy.

There are three questions to answer today. Why has this happened? Does it matter? What does it mean for the future?

On the first, there is no need to look beyond the obvious of what all three manufacturers have told us: they can’t compete from Australia. Business is about efficiency and it’s cheaper and more profitable to make cars elsewhere and ship them to Australia. It’s wages. It’s the currency. It’s many other input costs including, I’m sure, land costs.

Why is it so expensive to manufacture here? It’s not because of some natural order of things. Nor is it because of the rise of cheaper emerging markets. It’s a choice we’ve made for a dozen years and more to prioritise certain forms of growth. Across the millennium we chose to invest heavily in houses and consumption, we chose a tax regime that supported it and established a higher inflation target band for the Reserve Bank than other countries. The result was predictable in a debt borrowing surge, consumption led growth via wealth effects and high wages growth in non-tradable sectors.

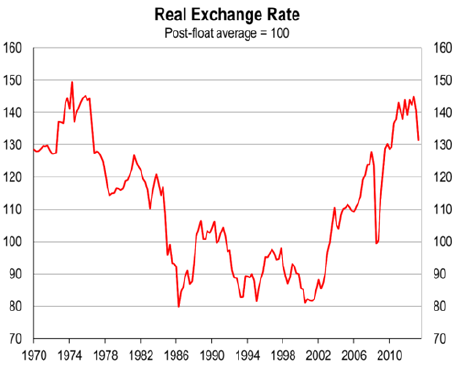

For a while we were protected by a low currency as the world fixated on other things. But when luck turned our way, and the commodities boom arrived as our consumption boom departed in 2003, the inflationist path we had chosen began to bite with a higher currency. Our real effective exchange rate (REER), that which summarises all of a country’s costs versus others, began to climb:

Competitiveness in all tradable goods sectors began to feel the pinch. But until 2008, our existing settings of inflating asset prices and consumption were boosted by our next choice, which was to recycle the benefit of the commodities boom into the local economy for immediate gratification. Rather than correct, we boomed!

Then came the global financial crisis, which pulled down all other Western economies with similar business models to our own, as the debt which underpinned growth became too expensive to service. Our luck held, however, and the commodities boom returned in an even bigger form, driven by emerging countries like China which stimulated building in their own desperate attempt to ward off the GFC.

All but one Australian institution chose again to devour the raw proceeds of the boom. Any attempt to save some of the commodity revenues for the future or to slow it down were smashed by a self-satisfied political economy. The one exception was the Reserve Bank which chose to inflate our already high interest rate structure and currency to prevent inflation getting completely out of hand.

The result was a second leg up in the REER. And now any tradable business not bolted down by extreme competitive advantage was swept offshore, including today car manufacturing, as well as an increasing number of other famous Australian manufacturing brands. So much for where we came from. Does it matter?

There are prior examples of similar episodes in other countries. The most infamous being The Netherlands and what is described as “Dutch Disease”.

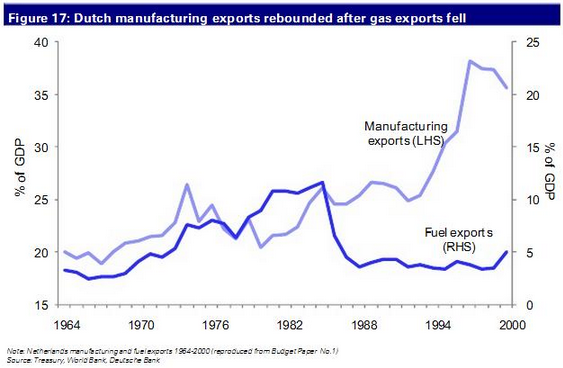

In the 1970s, The Netherlands enjoyed a North Sea gas boom. But the resulting macroeconomic impact of a rising real exchange rate meant that it also suffered a material decline in manufacturing output. At the time, The Economist magazine described this phenomenon as Dutch disease. It has since been described in various forms as the “resource curse” or in Australia as the “Gregory effect” after economist Bob Gregory.

What I call Australian disease has two key differences to the Dutch experience. The first is that even during its episode of tradable pressures, Dutch manufacturing never fell below 20% of GDP in output terms and when the boom ended manufacturing output rose to new highs:

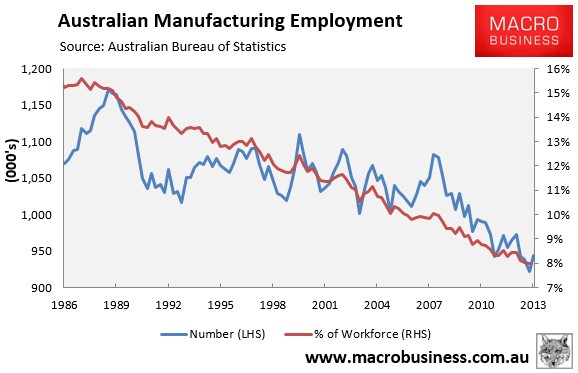

In Australia’s case, manufacturing output is already down to 7% of GDP, the lowest in the OECD and equal with Luxembourg. With cars gone that will shrink towards 5% very quickly. So when one asks if it matters that we won’t be making cars any longer, it’s not an easy question to answer because no developed economy has ever tried to thrive without an industrial base. In relative terms, that’s where we’re headed. The falls in the total number of people employed in manufacturing and the sector’s employment share are going to accelerate.

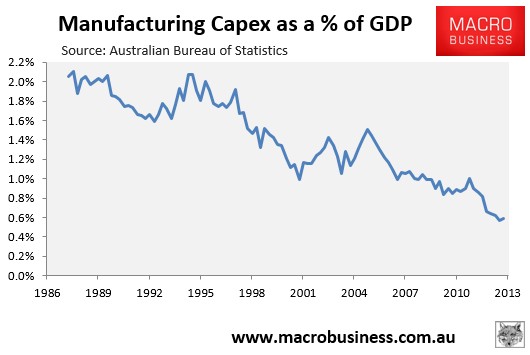

And manufacturing capital expenditures (capex) will go the same way:

That brings us to the future and the second difference to the Dutch experience. Our commodities boom is thought to be more permanent. The gas, coal and iron ore deposits that underpin it have longer duration reserves and it is likely that global population pressures will keep commodity prices higher than before the rise of China. This is the deliberate gamble taken by Australian authorities in their management of this process. They reckon we’ll be all right on the mining truck’s back.

They may be right long term but not the in the short and medium term. One immediate impact of the closure of car manufacturing is that it is colliding with the end of the commodities boom. Australian business investment is headed off an historic cliff for the next three years as the boom winds down. The labour market will be under pressure for much of that period despite the steady rise in exports as projects move from construction to production because they need MANY fewer people to operate the plants than it took to build them.

Another hit to business investment and the labour market is the last thing the economy needs in the next three years and Ford has already said if sales don’t improve it will be leaving earlier than planned, meaning all three may follow in the heat of the worst of the mining capex cliff. That is an unhappy prospect.

Longer term, Australian authorities may be right but it’s a punt without historic precedent and comes with a number of risks:

- the huge supply response in commodities that Australia is a part of may be more effective than we bargain for. In the history of capitalism it usually has been. Alternatively, demand for our commodities may be lower than we bargain on. China is already slowing more than Australian authorities reckoned and there are very strong arguments that it will have to slow much further and become far less resource intensive to become sustainable. If either of these are true then that will mean commodity prices fall much further than we hope, exposing our lack of alternatives for export growth;

- second, manufacturing is the key sector that generates productivity gains in an economy. Without it, an economy may face peak productivity and that means decline;

- third, a total reliance upon commodity exports, especially those that come from a very limited number of multi-national firms, risks unbalancing the political economy of the nation in favour of those firms. That is, it can undermine democracy and the economy as rent-seeking supersedes the commons. It also means you are implicitly eating you nation’s future for those come after;

- fourth, and more speculatively, if the world turns nasty, as it does occasionally, you are left without the people or intellectual property to defend yourself militarily.

These four are the symptoms of Australian disease. An economy struggling to grow at potential and unable to increase its efficiency. A political economy where miners rule the roost at the expense of everyone else and future generations are ignored. An overly dependent ally that can’t carry its own weight strategically.

Can anyone really say with a straight face that they see none of these symptoms in Australia’s shaken frame?