Cross-posted from Doug Noland at Prudent Bear.

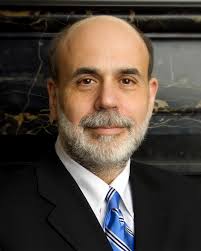

I hope to at some point offer a more complete review of Ben Bernanke’s tenure at the Federal Reserve. I will be fascinated to see how future historians view the Bernanke doctrine. From my perspective, the Bernanke Era has been an abject failure. He was the most outspoken proponent of post-tech Bubble reflation. The noted academic was keen to use the government printing press – not to mention mortgage Credit – to fatefully drive asset inflation and stimulate a particularly unbalanced U.S. economic boom. I will give him less than zero Credit for then inciting an even greater Bubble, again in the name of system reflation, after the 2008 crisis.

Chairman Bernanke has been widely lauded for his “courage”. Firemen entering burning buildings in search of trapped victims are brave. Our troops are courageous. I would see Bernanke and contemporary central bankers much more in terms of “daring.” And it was the Bernanke doctrine of inflationism that basically provided open checkbooks to central bankers (and governments) around the globe. It’s becoming a lot less thrilling now that the bills are starting to come due.

Let’s first take a quick view of some of the notable market changes: For the week versus the dollar, the Hungarian forint declined 3.7%, the Polish zloty 2.7%, the Russian ruble 1.7%, the Czech koruna 1.6%, the Bulgarian lev 1.4%, the Colombian peso 1.1%, the Chilean peso 0.9% and the Brazilian real 0.6%. The yen was little changed this week against the dollar, notably holding last week’s strong advance. Over two weeks versus the yen, the Argentine peso has declined 17.1%, the Russian ruble 6.6%, the Hungarian forint 6.1%, the Chilean peso 5.1%, the Brazilian real 5.0%, the Colombian peso 4.7%, the Polish zloty 4.6%, the South African rand 4.4%, the South Korean won 4.1% and the Indian rupee 3.9%.

Notable yield increases this week included Ukraine 10-year (dollar) yields jumping 55 bps to 9.85%. Russian yields rose 26 bps to 8.35%, Poland yields surged 30 bps to 4.70%, Hungary yields rose 36 bps to 6.0%, and South African yields rose 36 bps to 8.90%. As for equities, India’s Sensex index dropped 2.9%. Stocks in Taiwan were down 1.8%, Thailand 3.1%, Philippines 2.0%, Turkey 4.0%, Russia 3.4% and Chile 4.4%,

We may be witnessing an End of an Era right before our eyes. Chairman Bernanke’s last meeting had the Fed sticking with its tapering plan, in spite of heightened global market instability. Wednesday’s FOMC statement was notable for a generally upbeat tone without even a mention of emerging market stress. And Friday from the Fed’s most outspoken hawk, head of the Dallas Fed Richard Fisher: ‘I was pleased that all members of the committee saw things closer to how I have seen things.”

Thus far, things do seem consistent with the view that the FOMC is both determined to rein in balance sheet expansion and cognizant of the risks associated with so quickly jumping to the market’s defense. Importantly, the “push back” against any “tightening of financial conditions” language from this past summer and fall has been missing in action.

When I broach “End of an Era”, I’m actually not referring to Bernanke’s chairmanship. I’ll suggest instead that we might have reached the initial phase of the visible failure of inflationism. For years now, the Fed has been determined to ensure a rising “price level” to supposedly grow out of debt problems. This led to historic (and erratic) asset inflation in the U.S. that faltered back in 2008/2009. Subsequent massive reflationary measures worked to reflate U.S. asset prices, while inflating prices, markets and economies globally. Virtually all central banks and government joined in.

When I began referring to the “global government finance Bubble” back in April 2009, I had reason to fear that the unfolding Bubble would indeed prove to be the “Granddaddy of all Bubbles.” In particular, unprecedented amounts of “money” were poised to flood into China and the developing economies. The Bernanke doctrine specifically sought dollar devaluation along with the impetus to coerce savers from the safety of their savings out to inflating global risk markets. And, importantly, global policies had once again created a highly conducive backdrop for leveraged securities speculation.

China, with its almost 1.4 billion citizens and already entrenched Bubble dynamics, had the capacity to inflate colossal Credit and economic Bubbles. Chinese officials claimed they’d learned valuable lessons from the Japanese Bubble experience. But I fully expected it to be very difficult for authorities to rein in increasingly powerful and systemic Bubble excesses.

I had hoped that our central bank had learned some lessons from previous reflationary policies and attendant destructive booms and busts. Yet a reading of economic history had me convinced that once aggressive monetary inflation has been commenced it becomes extremely difficult to stop. With the Bernanke doctrine of inflationism on the line, I also doubted the Fed’s capacity to accept the errors of its ways. Mistakes would beckon bigger mistakes. Too predictably, instead of recognizing the damage wrought from “money” printing, the Fed was too quick to double down with the electronic printing press.

As it turned out, my worst fears from back in 2009 came to fruition. Truth be told, the global Bubble surpassed what I even thought possible. The Fed’s balance sheet is on its way to $4.5 Trillion. The Chinese Bubble inflated to historic proportions – and is still rapidly inflating. Scores of EM countries, many with notably checkered pasts when it comes to monetary and economic management, were inundated with cheap global finance like never before. It was destined to be a fiasco from the start. Throughout it all, rarely would local authorities move to rein in overheated domestic Credit systems. Inflationism had enveloped the world like never before. And then Japan took “daring” to a whole new level of recklessness.

As already noted, the bills are beginning to come due. Inflationism’s inevitable consequences have manifested to the point of being highly destabilizing. Late-cycle Credit excess has created enormous amounts of suspect debt and economic maladjustment. Worse yet, these days much of this debt trades in the marketplace. Likely huge quantities of potentially problematic securities are held by leveraged speculators.

On the fundamental side of things, wealth redistribution and inequalities have become more conspicuous and socially unsettling. Global monetary inflation is today having widely divergent effects on prices, currencies and economies. This is apparent today both domestically and internationally. Facebook beats Wall Street earnings estimates and Mark Zuckerberg’s net worth jumps $3.2 billion – on Thursday. This week will see more wealth for scores of Facebook and Google millionaires to further bid up Silicon Valley home prices.

January 28 – Bloomberg (Ari Levy and Dan Levy): “The epicenter of the income inequality debate has shifted 2,600 miles west, from Wall Street to Market Street. Whether it’s protesters targeting Twitter Inc.’s new San Francisco headquarters and Google Inc.’s buses or the criticism against these agitators by former venture capitalist Tom Perkins, the Bay Area’s technology industry is attracting the kind of attention often reserved for New York’s moneyed elite. Concern about the growing gap between the wealthiest and poorest Americans is erupting across San Francisco, where an influx of newly minted dot-com millionaires is boosting rents and property prices, putting affordable housing that much further out of reach. Rage over inequality has spilled into the streets, where demonstrators have blocked buses transporting Google employees, breaking the window in one in Oakland. ‘All booms have their winners and losers,’ said John Elberling, executive vice president of Todco, a San Francisco- based builder of affordable housing. ‘Even if you have a good job, it’s very likely you can’t afford to buy a place in the city.’”

It’s also becoming increasingly apparent that the global “system” has become acutely vulnerable to even a meager reduction in global monetary accommodation. Predictably, markets and economies around the world became highly dependent upon ultra-loose “money”. Now, the inevitable faltering of Bubbles and attendant risk aversion see a problematic tightening of finance for the most susceptible at the “periphery.” Rather quickly, those that have been on the receiving end of years of easy flowing cheap “hot money” now confront the harsh reality that they’ve actually been on the losing end of monetary inflation. And with the Fed at least at this point more determined to reduce its monetary inflation, trouble at the “periphery” is seeping into a little risk aversion (i.e. contagion) at the “core.”

January 30 – Financial Times (John Aglionby and Delphine Strauss): “India’s central bank governor has lashed out at policy makers in the US and other industrialised countries for their uncoordinated approach to economic policy as they recover from the financial crisis. Speaking a day after the US Federal Reserve took the latest step in reducing its programme of quantitative easing, Raghuram Rajan said emerging markets helped pull the world out of the 2008 financial crisis by supporting global growth and should not have to suffer now developed countries are starting to recover. India, Turkey and South Africa have all raised interest rates this week to counter sharp falls in their currencies as investors switch funds from emerging markets into recovering developed countries such as the US and UK. ‘International monetary co-operation has broken down,’ Mr Rajan, a former chief economist at the International Monetary Fund, said in a Bloomberg India TV interview, two days after the Reserve Bank of India raised its main interest rate by 25 bps to 8%. ‘Industrial countries have to play a part in restoring that [co-operation], and they can’t at this point wash their hands off and say, we’ll do what we need to and you do the adjustment.’ … Mr Rajan’s words will carry force: he has taken radical action since his appointment last September to restore investors’ confidence in India. His comments underline the bitterness felt in many emerging markets that have struggled to manage both the inflows of hot money, while the Fed was ramping up its stimulus programme, and the prospect of their withdrawal.”

Reporting on the same issue, a Friday Bloomberg article (Kartik Goyal) added this comment:

“‘The U.S. should worry about the effects of its polices on the rest of the world,’ Rajan told a group of students… ‘We would like to live in a world where countries take into account the effect of their policies on other countries and do what is right, broadly, rather than what is just right given the circumstances of that country.’”

For decades now, the U.S. has inundated the world with dollar balances. Our central bank was never held accountable. I fully expect acrimony to now play catch-up. To be sure, policy measures since the 2008 crisis only pushed this entrenched Dollar Bubble to “parabolic” extremes. The conventional view holds that EM is significantly less vulnerable today compared to back in 1997. From my perspective, excesses over recent years absolutely dwarf those that preceded the ’97/98 crisis. The numbers below from Reuters help put things into clearer perspective.

January 28 – Reuters (Sujata Rao, Daniel Bases and Vidya Ranganathan): “Emerging markets have attracted about $7 trillion since 2005 through a mix of direct investment in manufacturing and services, mergers and acquisitions, and investment in stocks and bonds, the Institute for International Finance estimates. JPMorgan estimates outstanding emerging market bonds at $10 trillion compared with just $422 billion in 1993. Assets of funds benchmarked to emerging debt indices stand at $603 billion, more than double 2007 levels, it said, and over $1.3 trillion now follows MSCI’s main emerging equity index. Mutual fund data from Lipper… shows that in the past 10 years net inflows into debt and equity markets was in the region of $412 billion.”

It’s also worth noting that the global hedge fund community is today about 10 times larger than back in 1997. I believe the growth in sovereign wealth funds has been at least as dramatic. Exchange-traded funds (ETFs) weren’t even a factor back in 1997. China hardly mattered to the global economy.

January 30 – Bloomberg (William Pesek): “Among the many reasons to dismiss President Xi Jinping’s pledges to transform China’s growth model, Gan Li may offer the best: an epic housing bubble that can’t be allowed to pop. Gan, a professor at Southwestern University of Finance and Economics in Chengdu, Sichuan… recently crunched some disturbing numbers on the level and distribution of household income and wealth. After examining survey results from 28,000 households and 100,000 individuals, Gan believes that roughly 65% of China’s household wealth is sitting in real estate. An astounding 90% of households in nation of more than 1.3 billion people already owns homes. In the first half 2012, he found, about 42% of demand for properties came from buyers who already owned at least one. Many of these homes and apartments… were bought in the midst of one of history’s biggest real estate booms and bubbles. ‘The Chinese housing market is clearly oversupplied,’ Gan told Tom Orlik… ‘Existing housing stock is sufficient for every household to own one home, and we are supplying about 15 million new units a year. The housing bubble has to burst. No one knows when.’ When it does, the damage to household wealth will reverberate across the second-biggest economy, devastate consumption and increase risks of social unrest. In other words, it’s something the Communist Party can’t allow to happen.”

China remains a major wildcard. “The housing bubble has to burst.” “…It’s something the Communist Party can’t allow to happen.” Well, Bubbles do indeed always burst. And when it reaches the scope that a government can’t allow it to happen, one should best be prepared for an eventual bust of devastating proportions.

Here at home, Bernanke is leaving Yellen and the FOMC in a very tough spot. The course of Federal Reserve policymaking is in a state of high uncertainty; U.S. markets are unsound; and global financial and economic systems are highly unstable. Of course, Bernanke is not fully to blame. Yet he has been the leading proponent – the intellectual mastermind – of contemporary inflationism that is today seemingly at a critical crossroads.