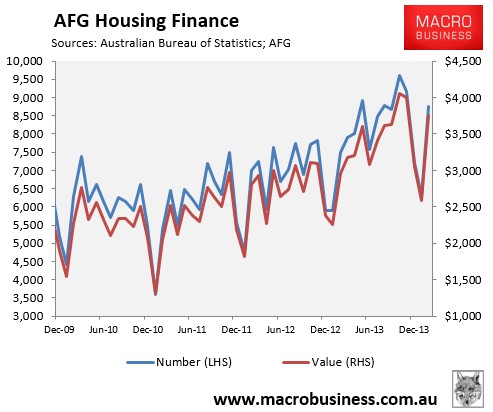

Australian Finance Group (AFG) has released its housing finance data for the month of February, which registered a seasonal 39% jump in mortgage applications over the month, but more importantly (since the series isn’t seasonally-adjusted) a 17% increase in the number of applications over the year. It was also the Group’s strongest February on record, with 8,740 mortgage applications (valued at $3,759 million) processed over the month (see next chart).

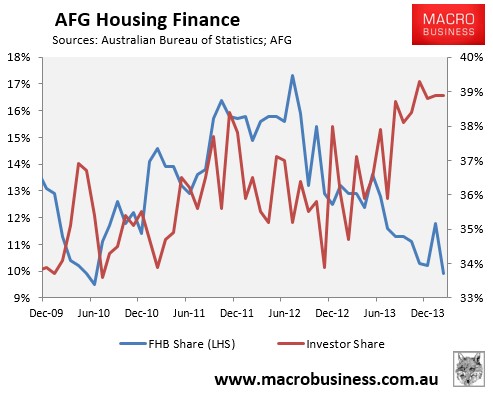

AFG also reported a sharp decline in first home buyer (FHB) mortgage share in February – from 11.8% to 9.9% – driven by a large decline in FHBs in Western Australia. Here’s how FHB mortgage demand has changed over the year:

- National: 9.9%, down from 12.9% in February 2013;

- New South Wales: 3.4%, down from 4.5% in February 2013;

- Victoria: 10.3%, down from 17.1% in February 2013;

- Queensland: 6.9%, up from 6.4% in February 2013;

- Western Australia: 19.5%, down from 24.5% in February 2013; and

- South Australia: 13.1%, up from 12.9% in February 2013.

However, investors are still driving new mortgage demand, with their share of mortgages at 38.9% in February, according to AFG (see next chart).

Below are the investor shares by major market, as well as the changes over the year:

- National: 38.9%, up from 34.7% in February 2013;

- New South Wales: 47.5%, up from 43.4% in February 2013;

- Victoria: 38.4%, up from 34.0% in February 2013;

- Queensland: 32.3%, down from 34.2% in February 2013;

- Western Australia: 32.7%, up from 26.4% in February 2013; and

- South Australia: 33.7%, down from 34.6% in February 2013.

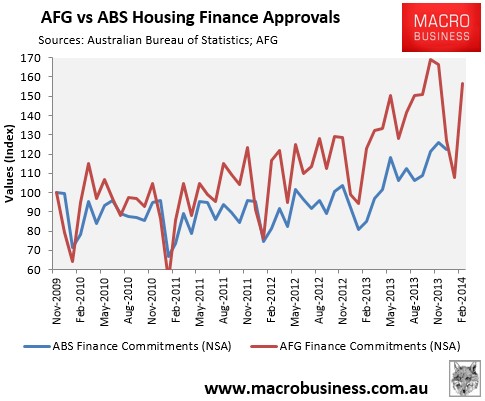

As noted previously, some caution should be exercised in interpreting AFG’s figures and extrapolating its results to the overall mortgage market, as measured by the Australian Bureau of Statistics (ABS).

AFG’s data measures mortgage applications, whereas the ABS measures actual mortgage commitments. According to AFG’s General Manager of Sales & Operations, Mark Hewitt, just over three quarters of applications on average become mortgage commitments, although this figure can obviously fluctuate month-to-month. AFG’s market share has also been rising in recent years.

Therefore, while AFG is a useful guide as to the strength of mortgage demand, its results do not necessarily translate to the overall mortgage market as captured later by the ABS.

To illustrate, consider the below chart showing how the growth of AFG mortgage applications has diverged significantly from ABS mortgage commitments since November 2009:

Nevertheless, the AFG data supports the ABS housing finance release for December (the latest available), which revealed a continued dominance of investors in the mortgage market.

unconventionaleconomist@hotmail.com