As summarised by Houses & Holes earlier, the Australian Bureau of Statistics (ABS) today released the national accounts for the December quarter, which registered a 0.8% increase in real GDP over the quarter and a 2.8% rise over the year. The result beat market expectations for 0.7% growth over the quarter and 2.5% growth over the year.

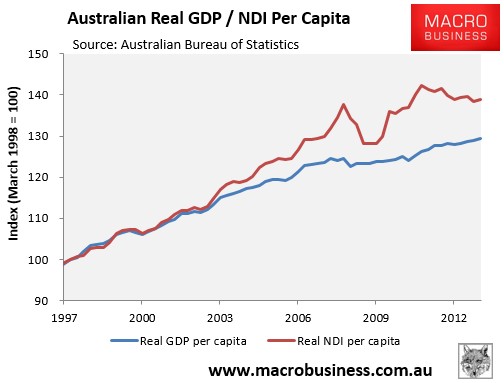

On a per capita basis, however, real GDP increased by 0.4% and by 1.0% over the year. Further, real national disposable income per capital rose by only 0.2% over the quarter and was flat over the year.

According to the ABS, seasonally adjusted growth for the quarter was driven by:

- a 0.6% contribution from net exports;

- a 0.5% contribution from final consumption expenditure;

- a 0.2% contribution from Public gross fixed capital formation; and

- a 0.2% contribution from changes in inventories; partly offset by

- a -0.5% contribution from Private gross fixed capital formation.

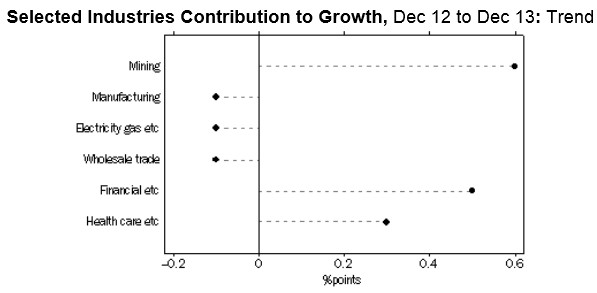

Over the year, Mining (0.6 percentage points) and Financial and insurance services (0.5 percentage points) were the largest contributors to growth, whereas Manufacturing, Electricity, gas, water and waste services, Wholesale trade and Accommodation and food services each detracted 0.1 percentage points in trend terms (see next chart).

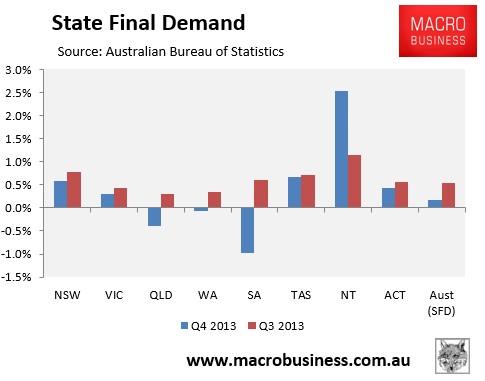

Results were mixed at the state and territory level, with final demand growing strongly in the Northern Territory (+2.5%), and solidly in NSW (+0.6%), Tasmania (+0.7%), the ACT (+0.4%), and Victoria (+0.3%), but contracting in South Australia (-1.0%), Queensland (-0.4%) and Western Australia (-0.1%) [Note: state final demand is different to GDP]:

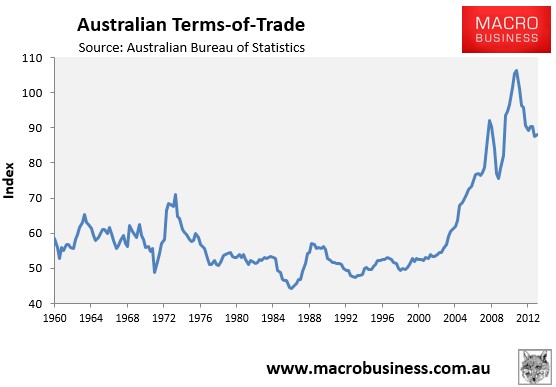

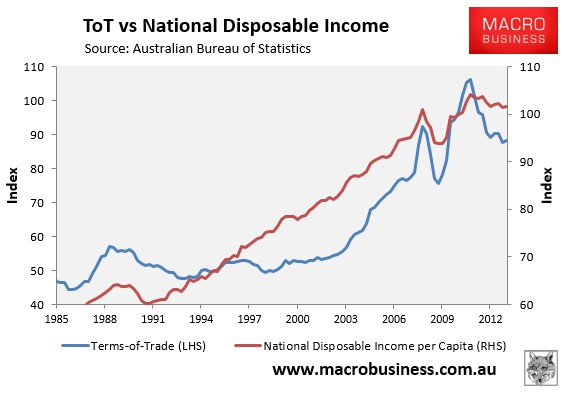

The terms-of-trade rebounded over the quarter, rising by 0.7%:

And the rising the terms-of-trade boosted income growth, with real per capital national disposable income (NDI) rising by 0.2% over the quarter to be flat over the year. Given the large falls in commodity prices (particularly iron ore) since the beginning of the year, income growth is likely to turn negative in the March quarter and will continue to be weak as long as the terms-of-trade unwinds from its current very high level (see below charts).

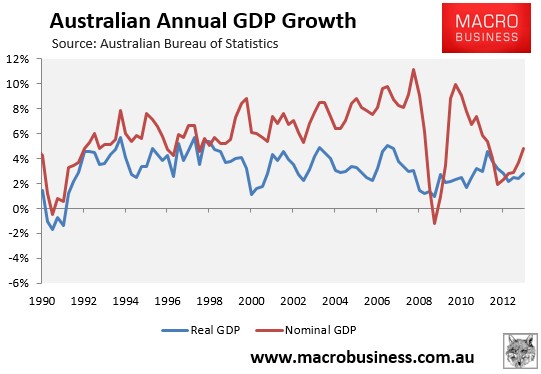

The rise in the terms-of-trade helped nominal GDP to rise further above real GDP, which is a positive for government finances:

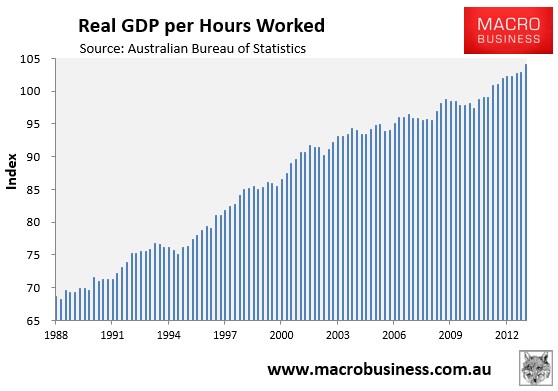

Real GDP per hour worked jumped 1.3% over the December quarter and was up 1.9% over the year, suggesting improved labour productivity as the structural adjustment under way continues to create greater efficiencies in the weaker sectors:

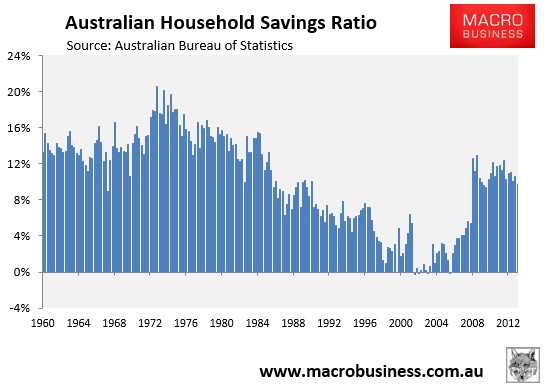

Finally, the household savings ratio fell sharply over the quarter to 9.7% from 10.6% – the lowest level since June 2010. This suggests that households are loosening their purse strings which, if continued, should help the economy to grow as it ventures over the mining investment cliff (albeit potentially worsening structural imbalances by raising debt levels and the CAD):

Overall this is a reasonable result, with headline GDP recording a pick-up in growth (albeit still below trend), and real per capita GDP growth improving.

The real test is ahead, however, with recent sharp falls in commodity prices (particularly iron ore) likely to drag down per capita national disposable income in the March quarter – a trend that is likely to continue as the terms-of-trade retraces back towards its long-run average.

Moreover, the upcoming sharp falls in mining capital expenditures will provide stiff headwinds to growth over coming years, likely keeping headline GDP below its longer-term trend, and at an insufficient level to prevent unemployment from rising, despite rising net exports and a potential boost to consumption in the event that the household savings rate continues to fall.