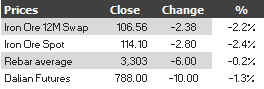

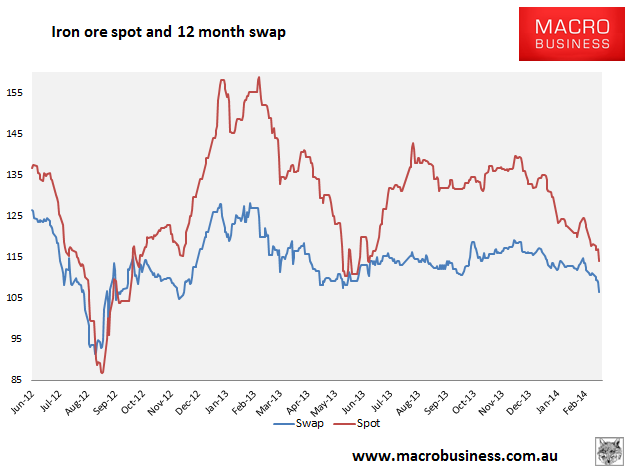

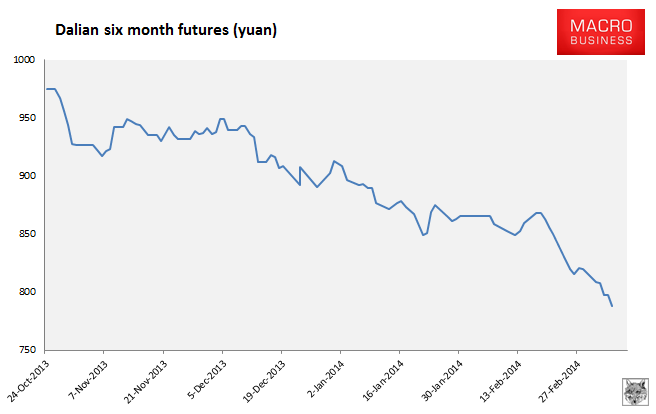

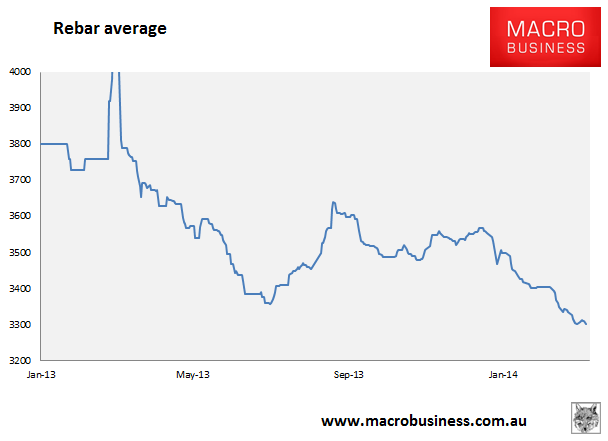

Find below the iron ore charts for March 7, 2014:

In paper markets, 12 month swaps smashed any support level and are in free-fall. Dalian futures opened limit-down before rallying to still sharp losses. Rebar futures did likewise.

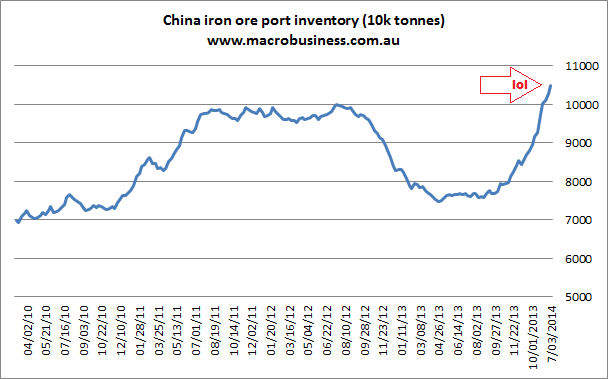

In physical markets, iron ore is eyeing mid-last year’s low of $110.4o and will probably go through it like molten steel through butter. As for port stocks, up another 2.5 million tonnes on the week to 105 million tonnes, I’ve made plain what I think of that on the chart. Steel prices have fallen back to within a whisker of last week’s record lows.

Hardly a happy picture and it’s not expected to improve much either. We have the weekend’s shocking trade figures to digest yet, and from CISA on Friday:

China’s iron ore import prices are likely to come under pressure in March, as the expected increase in domestic steel output is unlikely to offset the impact of persistent iron ore oversupply in China, the China Iron & Steel Association said in its February iron ore market report released Thursday.

Warmer weather in China will result in a recovery in domestic steel demand to some extent and this will cause a moderate increase in steel output in March as well as the second quarter of this year, but iron ore prices will probably soften further because of oversupply, CISA said in its monthly report.

The association estimated that China’s daily crude steel output was 1.993 million mt over January 1-February 20 this year, down 6.3% from the daily average over January-February 2013.

CISA said the widening losses among Chinese steel mills since January this year — due to falling domestic steel prices — will also pressure imported iron ore prices in March, similar to the situation in January….Wang Yingsheng, a senior CISA official, said at an iron ore conference in East China’s Jiangsu province last week that 43% of its member mills reported losses in January, compared with over 30% in the whole of 2013.

I’ve noted before that CISA high-frequency data can under-estimate daily steel run rates but given the comprehensive data pointing at underlying weakness, I would not bet on it right now. The run rates will not improve sustainably until steel prices rise.

It appears that, along with copper, Chinese reform is reaching a tipping point for the grossly over-supplied steel sector. I would not rule out the steel shakeout turning disorderly though I do still expect further stimulus when the pain gets severe enough.

As the steel mills continue to rationalise, there is room for further destocking of iron ore at steel mills but the greater concern for short term prices is from those that have built colossal port stocks via financing schemes. A margin squeeze in iron ore supply is now a distinct possibility and downside price-gapping a clear risk in the spot market.

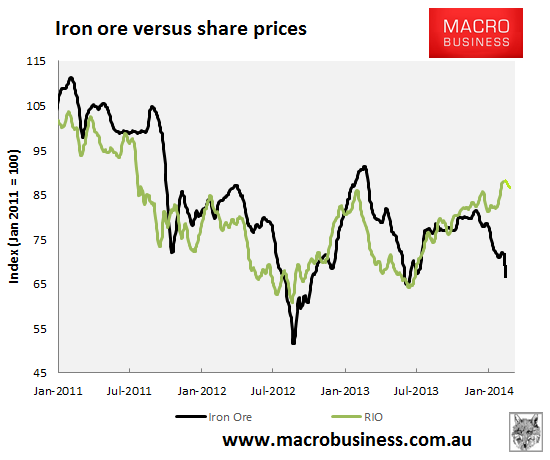

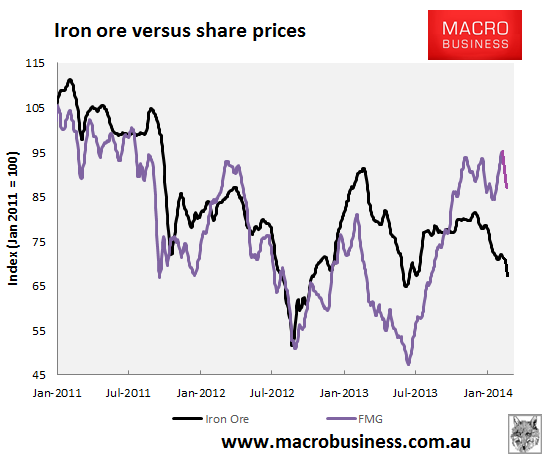

For those interested in iron ore equities, here are the updated charts of the majors versus the iron ore price:

The gap between equity prices and the underlying price of ore has rarely been so wide because the majority of the profits growth in the recent Australian corporate earnings season was driven by miners. That is now a figment of history and to make matters worse for the miners the RBA’s housing reflation policy has put a fire back under the Australian dollar, at least for now.

Australian mining equities, corporate profits, Budget receipts and national income flows have planted their collective foots in an iron ore bull trap.