Cross-posted from The Conversation:

Australia faces a fall in living standards unless policy action is taken. This is due to de-industrialisation and loss of economic complexity.

The higher the economic complexity, the stronger the economy’s value-creation prospects. Australia languishes at 79 in global rankings of economic complexity.

Modern industry policy could help correct this but is poorly understood. Hence it is frequently maligned in Australia.

Any intervention should aim to improve business environments or influence a shift in the economy. The goal should be a structure that generates higher economic benefits. That, in turn, provides all the desirable social good.

Australia needs a consistent long-term industry policy to tackle the following challenges.

Increase the nation’s economic complexity

Policy should help broaden and deepen the available industrial commons. This is the shared concentration of knowledge, capabilities and resources within an industrial sector. Some liken it to an ecosystem supporting production.

The industrial commons does not reside in one organisation. It is spread out over many organisations and individuals – normally within a localised area or region.

A broad base of industrial commons with different expertise and dispersed nationally creates high economic complexity. This is related to the useful knowledge embedded in the economy. Economic complexity enables a modern society to amass and effectively use large amounts of productive knowledge distributed among its members.

Countries and regions that achieve high economic complexity develop a basis for competitive advantage as distinct from standard price-based competition. This is evident in high-cost manufacturing economies that succeed regardless of low-cost competition.

This is of vital importance, particularly for high-cost countries like Australia that are in danger of losing significant manufacturing capabilities.

Add value to manufacturing

Greater economic complexity aids the transition to high-value-added manufacturing. This process depends on the interaction of the knowledge of specialists (designers, marketers, finance experts, engineers, technology experts from various disciplines, human resource managers, legal experts, environmental scientists, social scientists etc). Where economic complexity is lower, it is not possible to make products of the same high added value.

The more the interdependencies required to make high-value-added products can be located within a nation or region, the more the benefits of locally based, complex value chains can be captured.

To achieve high complexity, an economy needs a high presence of product groups (or communities) requiring or generating complexity. These are found in high-value-added manufacturing like machinery, chemicals, medical devices, electronics etc.

As can be seen in other countries, most high-value services are closely interlinked with manufacturing. A service economy without high-value manufacturing is not a viable economy (as the UK discovered).

A highly complex economy is more likely to benefit from a random entrepreneurial event. In a less complex economy, the entrepreneurial start-up will engage lead customers and access specialist suppliers in places with high economic complexity. Over time, this leads to the start-up firm migrating to economies with higher complexity and greater scale.

This has all too often been Australia’s fate. The loss of several industrial commons as well as the decline of firms and industries with high complexity is reducing economic complexity.

Follow clear rules for restructuring

The stronger the international competition, the lower the prices that national firms can charge for their products. The result is lower-value returns to owners and employees. They then have less money available for consumer spending.

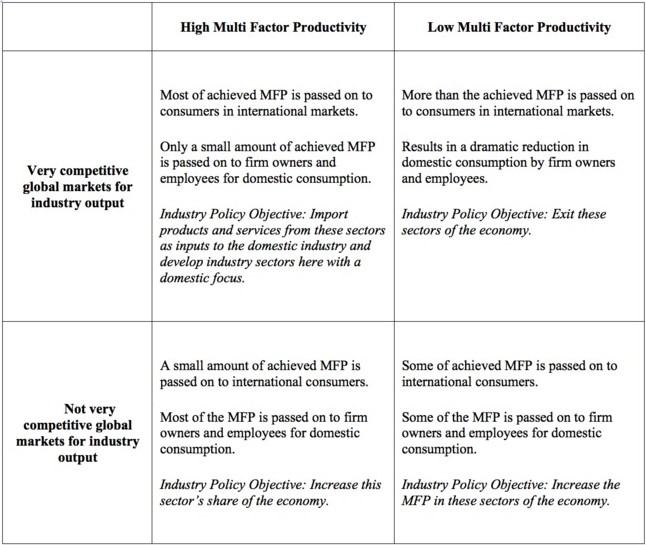

It is critically important that Australia sells its products and services for as high price as possible while buying imported goods and services as cheaply as possible. The relationship between multi-factor productivity (MFP) in an industry and competitiveness in global markets for its products determines the share of achieved MFP that becomes available for domestic consumption.

The outcomes can be seen in the table below:

In addition, the industry’s MFP increase and relative bargaining power should be higher than that of suppliers and customers.

The policy objective is to continuously restructure industrial activities around domains with high multifactor productivity and high MFP growth that serve global markets with low competition and a relatively strong bargaining position for Australian firms.

Presently, Australia’s industry is primarily in domains with very competitive global markets for outputs like agriculture and mining. The Australian producer has low bargaining power (i.e. is a price taker). MFP and its growth are also relatively low compared to manufacturing in high-cost countries.

Identify manufacturing sweet spots

Australia has around 35,000 manufacturing firms with more than one employee. Only a minority, about 2500, are high-performing, globally competitive firms.

Most of these produce goods with these characteristics:

- low volume (meaning limited benefits from economies of scale and clear benefits from economies of scope);

- high variability (e.g. through short product life cycles or high levels of customisation);

- high complexity (of products, services or a combination of these, a complex production process, or complex production systems);

- high value added (which could mean offering luxury products where price and costs are disassociated, through control of brand, relationships etc enabling monopoly or scarcity rents, through extremely high customer relevance, to highly effective business models allowing the appropriation of most value created for the customer etc).

Industry policy should focus on creating an environment in which such firms can emerge. If policy encourages these firms to operate in or link to domains where Australia has a comparative advantage, firm-based competitive advantages can be developed.

Examples of sustainable high-value industries that could be established include:

- Luxury and functional food goods for Asia;

- Customised cross-laminated timber construction elements;

- High-value chemicals extracted from sustainable cellulose raw materials as petroleum substitutes;

- Inorganic nanoparticles for additive manufacturing equipment (which would increase the price from a few cents for a kilogram-equivalent of ore to about $300 per kilogram of nano particles);

- Highly efficient solar cells that broaden absorption into infrared and ultraviolet using properties inherent in specific local minerals;

- Assisted living for improving quality of life and cutting health costs;

- Medical devices to replace drug treatment, thereby increasing quality of life and reducing health costs;

- Unconventional gas product-service systems specifically adapted to the Australian geological and geographic environment;

- Produce components, sub-systems and sub-assemblies for the global automotive industry in the domain of CO2-based drive trains using catalytic technology based on mineral properties.

These are just a few of the manufacturing possibilities.

Tactical and strategic objectives

The mostly tactical policy objective is to ensure a value-creating industrial base able to maintain Australia’s standard of living.

The mostly strategic objective is to ensure a broad and deep industrial commons that increases economic complexity. This enables the country to benefit from entrepreneurial activities so growing firms replace declining uncompetitive ones.

These and other opportunities are not being pursued. The result is continuously reduced value creation and value appropriation in Australian industry.

We can see the warning signs. Federal and state budget deficits are growing. Goods made in Australia comprise a declining share (about 7%) of the economy.

The consequence is that Australia will suffer a reduced standard of living.

Article by Goran Roos, Professor of Business and Strategic Design at Swinburne University of Technology