The Housing Industry Association (HIA) has today released a research report, entitled First Home Buyers: The Big Picture, which appears to be yet another thinly veiled attempt to thwart reforms to negative gearing:

Concerns about First Home Buyer (FHB) participation in the home purchase market have surfaced repeatedly in the media over the past year…

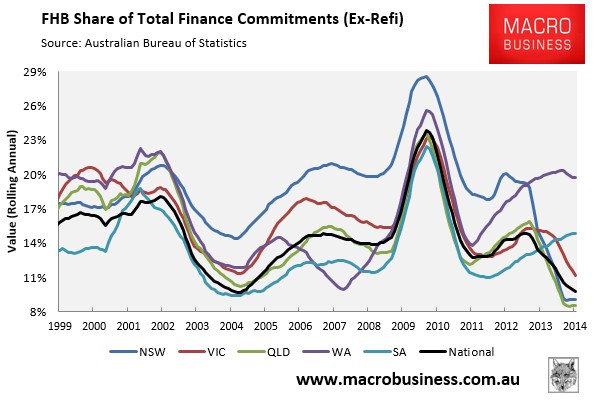

Commentary around the low FHB share has typically invoked the narrative that younger buyers are being ‘squeezed out’ of the market by investors with deeper pockets…

Low FHB shares have also been attributed to changes in FHB grant regimes in many states…

In a recovering market, more seasoned buyers like investors and non-FHBs are likely to be the fastest to respond to the improved conditions. FHBs are a little more risk averse, and will be less comfortable about entering the market at first. This means that their share of the market will temporarily flag as the market negotiates its turning point. Over time, we can expect FHB activity to gradually increase as the market recovery becomes more established…

The low share of the owner occupier mortgage market accounted for by FHBs is a temporary phenomenon, and reflects a unique mix of factors. These include: A substantial amount of FHB demand was dragged forward due to improved grant incentives and concessions during and following the GFC:

- The proportion of Australia’s population in the key FHB age group was in long term decline up until quite recently;

- Labour market conditions are currently having a disproportionately detrimental effect on FHB participation in the market;

- Increasing numbers of first homes are purchased as investment properties, and do not show up as FHB purchases;

- More significant parental support and increased numbers of inheritances are facilitating mortgage-free FHB purchases;

FHBs are much slower to enter the improving market than non-FHBs and investors – their market share has temporarily dipped as a result.

Over time, we expect FHB activity in the market to increase. This is for the following reasons:

- The share of population in the 25 to 35 year age group is starting to increase again;

- FHB confidence will grow as the housing market recovery becomes more consolidated;

- The eventual improvement in labour market conditions will facilitate greater FHB market participation; and

- Strong price growth will lead to the accumulation of home equity – allowing increased parental support for home purchase by FHBs.

The public commentary around FHB market participation has frequently focused on introducing policy measures to dissuade investor activity in the market. Such measures distract from the fact that the housing supply response to strong population growth over the past decade has been insufficient. The most likely impact of imposing penalties on investors is that fewer homes will be built. Fewer investors in the market will force the rental market to tighten and hurt the disposable incomes of households in that area of the market.

Accordingly, the real challenge will be for policymakers to ensure that the recovery of FHB activity over the coming years will be met with a strong supply of affordable housing. Australia has the fastest growing population of any major developed economy and it is vital that policy allows for the provision of an adequate dwelling stock for a population undergoing such strong increase. Policy measures with respect to FHBs, however well intentioned, must ultimately be judged on their ability to support stronger flows of new dwelling supply and their effectiveness in promoting improved housing affordability for ordinary households.

While I wholeheartedly agree with the HIA’s argument on supply, which is a no-brainer, its claims on property investment do not pass the laugh test.

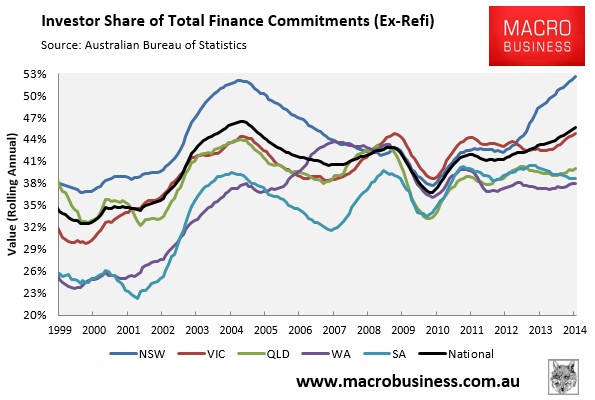

ABS housing finance data shows clearly that FHBs are being crowded-out by investors, particularly in Sydney and to a lesser extent Melbourne, where the investor share of total mortgages (excluding refinancings) has hit record highs (see below charts).

While there are question marks over the veracity of the ABS’ FHB data, which shows mortgage demand near all time lows, the rising investor shares are beyond doubt.

Moreover, the HIA’s claim that “fewer investors in the market will force the rental market to tighten and hurt the disposable incomes of households in that area of the market” is propaganda aimed at preventing changes to negative gearing rules.

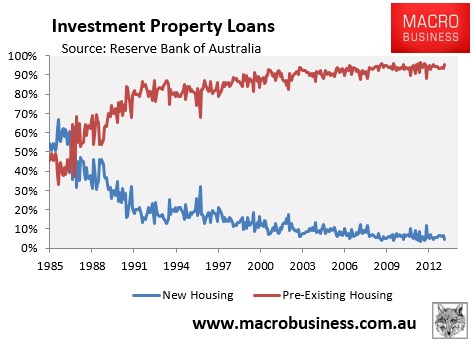

As already explained this morning, Reserve Bank of Australia (RBA) data clearly shows that the overwhelming majority of investors – almost 95% – buy pre-existing dwellings, not newly built dwellings, and that the proportion of investors buying new dwellings has fallen spectacularly since negative gearing was re-introduced in September 1987 (see next chart).

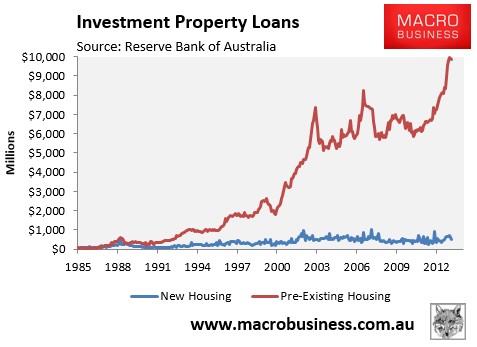

Moreover, the amount of investor funds going into new housing has barely shifted in 25 years, whereas investment in pre-existing dwellings has skyrocketed:

Since investors primarily purchase pre-existing dwellings, negative gearing in its current form simply substitutes homes for sale into homes for let. Accordingly, the policy has done little to boost the overall supply of housing or improve rental supply or rental affordability.

In the event that negative gearing was wound-back and a proportion of investment properties were sold, who does the HIA think they would be sold to? That’s right, renters (or other investors that would rent them out). In turn, those renters would be turned into owner-occupiers, reducing the demand for rental properties and leaving the rental supply-demand balance unchanged.

As for the HIA’s suggestion that rents will rise, hurting the disposable incomes of renters, the below chart plots the Australian Bureau of Statistics (ABS) rental series from 1972, with the period where negative gearing losses were last quarantined (i.e between June 1985 and September 1987) shown in red. As you can see, there was nothing spectacular about this period, with much higher rental growth recorded in earlier periods when negative gearing was in place:

Similarly, if we deflate the above series by CPI, in order to remove the effects of inflation, we again see that rental growth over the period when negative gearing was last quarantined was nothing special, with periods of higher rental growth recorded both prior to and subsequently:

It sure is getting tiresome continually debunking the HIA on negative gearing (also here, here, and here). But as long as the HIA continues to spout the same falsehoods, I will continue to pull out the same rebuttals (and charts), no matter how repetitive it becomes.

What is particularly odd in all this is why the HIA doesn’t support targeting negative gearing at new builds? After all, such a policy would stimulate construction and benefit its homebuilder members. I can only speculate that the HIA cares more about protecting the value of its member’s land banks, rather than actually boosting construction.

unconventionaleconomist@hotmail.com