Cross-posted from The Conversation:

There was nothing in the Commission of Audit’s terms of reference inviting it to make recommendations on the minimum wage. The Commission was asked to produce a report on “government expenditure”.

Yet the commission has recommended fundamental changes to the fixing of the minimum wage including, over time, cuts averaging 21% across the workforce, and up to 31% for South Australian workers and 33% for Tasmanians. (Minimum wages should fall, it recommends, from 56% to 44% of average weekly earnings, and vary between states.)

It also recommends (but in an Appendix, not the main volume of recommendations on which journalists focus) that the responsibility for fixing minimum wages be removed from the independent tribunal, the Fair Work Commission, and be made “administrative”; that is, put in the hands of government.

With minimum wage fixing transformed in this way, the setting of award wages for all workers on classifications above the minimum wage would also be affected, as award wage relativities are integrally related to minimum wages.

Indeed, it is difficult to see an independent industrial relations tribunal surviving such change. Other aspects of pay, such as penalty rates, overtime and allowances – previously the target of the WorkChoices legislation – would eventually be in the hands of government wage setters. The tribunal might end up just handling unfair dismissals and other disputes, as permitted by statute.

The recommendation is all the more peculiar because, other things being equal, a cut in minimum wages will lead to an increase in Commonwealth expenditures. At any given level of benefits, spending on benefits or pensions is higher when minimum wages are lower. This is because people on a lower minimum hourly wage, especially those working only part-time hours, would likely be eligible for higher partial pensions or benefits.

This would increase, not reduce, the deficit – counter to the stated purpose of the Commission.

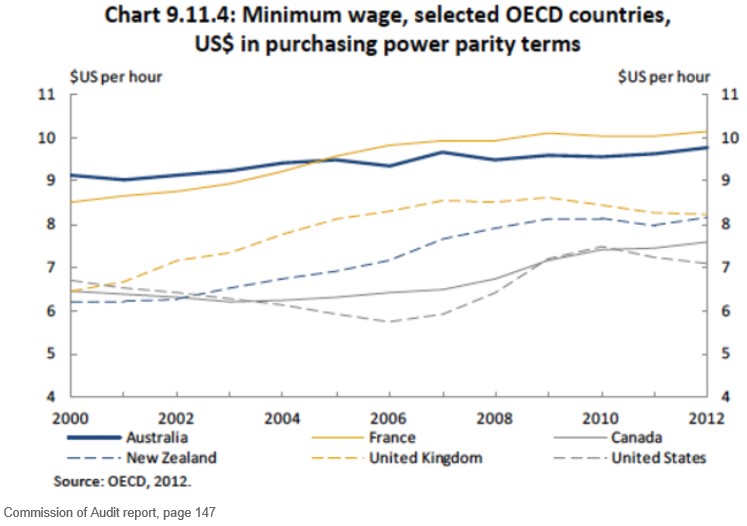

The Commission cites one reason for abandoning independent minimum wage fixing – that cutting minimum wages would reduce unemployment. It cites one piece of evidence in support of this claim – that minimum wages are higher in Australia than in most other countries. It demonstrates this with a chart (below) depicting 2012 minimum wages in US dollar purchasing power parities in six countries chosen by the Commission.

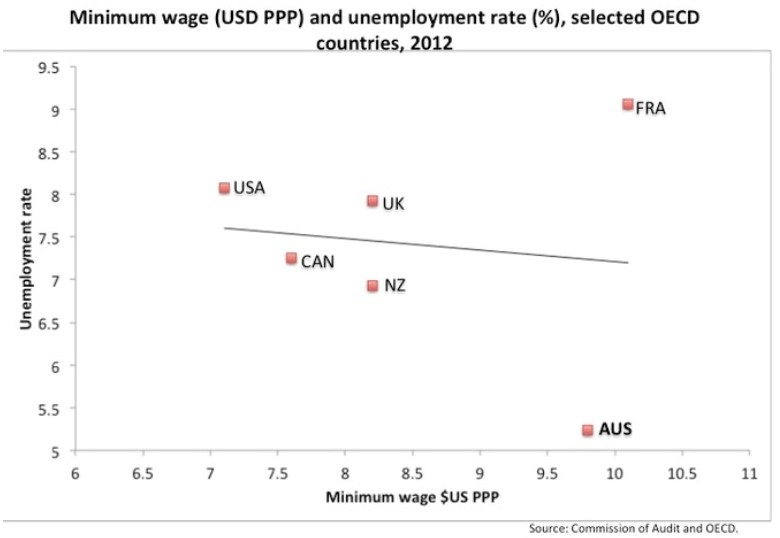

Yet Australia has one of the lowest unemployment rates amongst developed countries – and the lowest amongst the six countries in the Commission’s selected comparison group, as shown below. Australia’s youth unemployment rate is also the lowest of the six.

The USA, with the lowest minimum wage, had the second highest unemployment rate among the six. There, over 600 economists, including seven Nobel laureates, petitioned for an increase in minimum wages. The chart suggests no significant relationship between unemployment and minimum wages in the countries chosen by the Commission.

So the Commission comes up with an idea that is outside its formal mandate, without supporting evidence and with deficit-increasing effects contrary to its stated objectives. How does it deal with the budgetary consequence?

By recommending a tightening of the withdrawal rate for pensions and benefits.

That is, if you are on a pension or benefit and working part-time, the Commission proposes that the government claw back 75% of each extra dollar you earn (rather than the present 50%). It would mean pensioners and beneficiaries pay much higher “effective marginal tax rates” than even millionaires.

The situation where you lose most of the additional income you earn is often referred to as a “poverty trap” and seen as a barrier to labour force participation.

After all, why would you work an extra five hours a week if, after the government clawed back its take, you only got to keep $3 per hour? It wouldn’t cover transport costs, let alone child care.

The Commission claims that these increased barriers to working will “improve incentives to work”. Yet earlier in its report it recognises that withdrawing family tax benefits as you earn more, along similar lines, “reduces the incentive to work”. Such self-contradiction is breathtaking.

This is just one of several aspects of the Commission report which would tend to increase poverty, including amongst the low paid. Others include the Medicare co-payment, charging for access to public hospitals, increased co-payments for pharmaceuticals, raising the pension age, cutting wage subsidies for the long-term unemployed, cutting unemployment, sickness and widows benefits for those aged over 60, abolishing vocational education programs and reducing funding for affordable housing and homelessness.

When the Commission makes recommendations well outside its terms of reference, with outcomes contrary to its objectives, it tells you that the driving motivation is not really public finance. It is much more about ideology.

That should not surprise. The review was headed by the then president of the Business Council of Australia (BCA). Its secretariat was also headed by a BCA secondee.

The BCA has long railed against minimum wages and was an enthusiastic supporter of WorkChoices.

The Coalition had to offer a minimalist target on industrial relations before the election, but needed an “independent” justification for major action after it.

The mutual interest in having a BCA-led “Audit” Commission after the election deal with such issues was inescapable. But it was certainly not in the interests of low paid workers, for whom the Commission shows no understanding.

Article by David Peetz, Professor of Employment Relations at Griffith University