Cross-posted from David Collyer at Prosper Australia

The Queensland Supreme Court has struck out the differential rate some Queensland councils charge investors over and above residents on similar properties. Councils may be forced to pay it all back. $300 million a year is in doubt.

This landmark decision exposes the folly at least 19 Queensland councils have indulged in. They are clueless on the economic cost willfully imposed on ratepayers.

The Local Government Association of Queensland is working on an appeal. Some councils have had this cross-subsidy in place for 20 years, so unwinding it will be, ahem, expensive.

According to Madonna King in the Brisbane Times:

The case was taken to the Supreme Court by a group of Mackay investment home owners who were being charged an extra $200 a year above the normal rates. The court declared that investors should not have to pay higher rates and that the rating system amounted to an “improper exercise of power’’ under the Local Government Act.

Councils have believed differential investor/home owner rates were covered under State Government regulations – something now thrown into doubt.

Differential rate proponents can emerge in the strangest places. A Green on the Hobart City Council wants a higher differential rate on vacant land to drive it into use. Alderman Leo Foley says switching Hobart’s rating base from Net Annual Value to Site Rating would do the task without discrimination, without the posturing. Quite right.

I was in Maryborough and Hervey Bay last week, speaking at the Fraser Coast Rates Summit.

In principle, Queensland has an excellent council rate system. Site value is mandated. But wealthy landowners cannot resist a cost-shifting opportunity and Fraser Coast Regional Council introduced a Minimum General Rate.

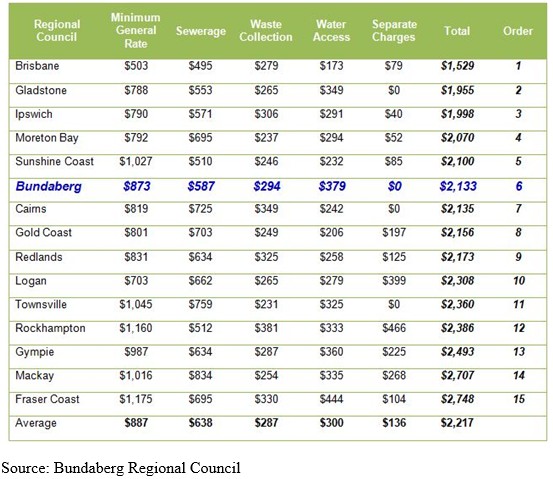

An MGR may sound innocent. It can be defended to meet the cost of valuation and sending a rates bill on low value sites – say, $150. But Fraser Coast’s MGR is $1175 in built up areas and $1098 elsewhere.

Eighty per cent of ratepayers are on the MGR. The remaining twenty per cent on the most valuable sites are thus subsidised and pay a mere 0.8 cents in the dollar.

Nice work! This MGR behaves exactly like a poll tax. Margaret Thatcher would be thrilled.

The lowest value rateable site in Fraser Coast is $9,900 and fully liable for the $1098 minimum – 11.1 per cent of the lot’s value.

I talked with a man who owns eight low-value lots subject to flooding that can’t be built on and he can’t sell. Combined, they make a nice horse paddock – but the MGR is due on each and every one with a $8784 annual rate cost. (I didn’t ask how or why he acquired the lots).

Fraser Coast is a low income, low land price area with high unemployment – a haven for pensioners and retirees. Yet it has the highest MGR in Queensland, which Bundaberg points out in defending its own repugnant MGR:

Council rates may seem a simple way to meet the cost of rubbish, roads and kindergartens. But MGR demonstrates the damaging actions politicians undertake to shift obligations from favored groups onto the unwary – those foolish enough to trust in government to ‘do the right thing’. The unceasing political attacks on sound taxes and good practice occur at local, state and federal levels.