Updated forecasts from Treasury in the federal budget papers show the capital gains tax exemption on the family home, the 50 per cent CGT discount and superannuation concessions remain the biggest costs to the budget...

Since most household saving is concentrated in property and superannuation, the cost to federal revenue could grow as a percentage of GDP if no action is taken to tackle the budget sacred cows…

Treasury predicts superannuation tax breaks will cost $36.25 billion in 2014-15. The super concessions will in total cost $171 billion over the three years. The other big costs is the capital gains tax exemption on the family home (estimated to grow to $57 billion over the three years to 2017-18) the 50 per cent discount on capital gains (which could hit $70.5 billion over the same period) and the cost of CGT discounts for individuals and trusts (estimated at $28.3 billion).

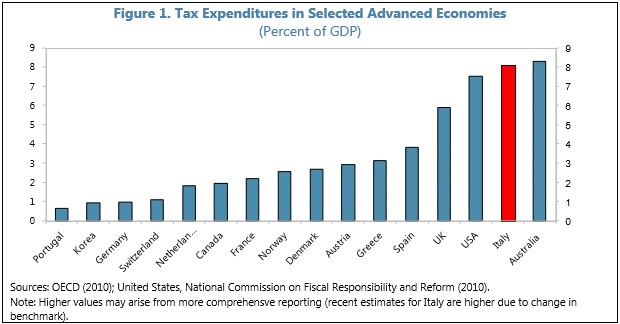

Certainly, Australia’s tax lurks are world-beating. A report released earlier this year by the International Monetary Fund (IMF) estimated that Australia has the highest tax expenditures in the OECD when measured against GDP (see next chart).

According to the report, tax expenditures are:

…government revenues foregone as a result of differential, or preferential, treatment of specific sectors, activities, regions, or agents. They can take many forms, including allowances (deductions from the base), exemptions (exclusions from the base), rate relief (lower rates), credits (reductions in liability) and tax deferrals (postponing payments).

The IMF also believes that tax expenditures should be reformed since they:

…can have major consequences for the fairness, complexity, efficiency, and effectiveness of not only the tax system itself but, since they often serve purposes that might be (or are also) pursued through public spending, of the wider fiscal system.

Nevertheless, the claimed $300 billion cost to the Budget is likely exaggerated, since it does not account for changes in behaviour that would likely occur in the event that these tax concessions were closed. A classic example is the expected increase in negatively geared investment in the event that superannuation concessions alone were closed. It’s a complex area, making estimating likely revenue losses difficult.

Further, not all tax concessions should be closed, anyway. Take, for example, the capital gains tax exemption on one’s owner-occupied dwelling, which is said to cost the Budget $57 billion over the next three years. Removing it would have the same deleterious impacts as stamp duty. It would discourage housing turnover and unnecessarily penalise people that move to homes that better suit their needs. Obvious examples include baby boomers downsizing from large family homes and young growing families upsizing to bigger family-friendly homes. In turn, such disincentives would encourage a less efficient use of the housing stock, such as empty nesters occupying large homes with multiple spare bedrooms. Applying a capital gains tax on one’s home would also hinder labour mobility, since it would discourage workers from relocating closer to employment.

Rather than closing the capital gains tax exemption, it would make far more sense to apply a broad-based land tax (preferably in place of stamp duties). Such a reform would encourage a more efficient use of the housing stock and improve labour mobility, penalise land banking and vagrancy (increasing effective land supply in the process), and help to make infrastructure investments self-funding for governments (since any land value uplift brought about through increased infrastructure investment would be partly captured by the government via increased land tax receipts).

That said, there is a strong case to limit superannuation concessions, which have increasingly become a mechanism for richer older people to avoid paying tax, rather than a genuine means for Australians to pay for their own retirement and avoid drawing on the Aged Pension. There are very good reasons to quarantine negative gearing losses, so that they can only be applied against income from the same asset, as well as removing the capital gains tax concession on investments (why should they be taxed at a lower rate than income?).

These concessions do cost the Budget many billions of dollars (although the exact cost is uncertain), and they are skewed towards the wealthy and high income earners, undermining the progressiveness of the tax system.

Any genuine attack on entitlements must tackle these lurks head-on.