The Abbott Government receives some support today from quarters arguing that although it has its problems it at least addresses Australia’s real issues. From Rob Burgess at Business Spectator:

At other points in Australian history it might have been quite enjoyable to watch the lambasting Prime Minister Tony Abbott and his team are copping from the larger part of the commentariat over the May 13 budget.

…That is not to say the government hasn’t offended — Abbott set the bar for honesty as high as possible and then presented Australia with a ‘farrago’ of broken promises, as one Labor speech-writer put it.

…The glee commentators are deriving from Abbott-baiting threatens to punish the whole nation rather than the PM as the great cash-cow that has sustained the nation for a decade, the resources price boom, is ending.

What’s needed, if we are to stop the wheels falling off the economy, is more of the ‘look-through’ principle.

There are obviously many flaws in that budget — particularly the needless persecution of the genuinely unemployed or disadvantaged — but emerging from the political wreckage of that process is something like an economic plan.

Well, yes, sort of. Leith and I support the Budget to the extent that it has begun the wind back of entitlement and unaffordable promises, especially for older and wealthy Australians. But it’s a big stretch to say the Budget constituted a new economic plan. It’s structural reforms were very limited and although there was a big push to cut recurrent spending and replace it with productivity-directed investment, the dividend on that front is highly questionable. Alan Mitchell explains why at the AFR:

The Abbott government boasts that the budget’s $11.6 billion “growth package” will catalyse $58 billion in new infrastructure construction.

Most of the spending will be on roads, but the promised cost-benefit analyses are not happening and, as the Productivity Commission warns, it is hard to know what new infrastructure we need if we are not using the existing infrastructure efficiently.

All we can say with certainty is that our urban roads, in particular, are being used inefficiently, and that the new road investment will come at a cost to the economy. The money sunk in the politicians’ favourite road projects can’t be invested elsewhere, including in projects that might have brought greater benefits to the economy. And among these projects might be less flashy (and, for the more politically influential members of the construction industry, less profitable) road improvements.

He goes on to argue that we need broad congestion charging to insure against the risk that we end up with new toll roads:

…that are overpriced and under-used, while the surrounding public road networks will remain underpriced and congested.

Too right and fat chance as the finance and road oligopolies must be fed their rents.

But it doesn’t end there. Ross Gittins looks at a range of wider Budget proposal and their impact on productivity:

It makes the federal government smaller, but not better. It’s a giant exercise in cost-shifting: to people on pensions, to the young jobless, to university students, to the sick and, to the tune of $80 billion, to the states.

…Next exhibit on the micro-reform list would be the deregulation of university fees. The claim that this will unleash competition and so make the tertiary education ”industry” a lot more efficient is so debatable…the Gonski reforms which would have put federal grants to schools on a needs basis. He’s left grants to private schools unreformed and unmeans-tested…this is a micro-reform negative. Adjusting grants to reflect students’ disabilities would have done much to increase the skills, employability and workforce participation…

…Medical services account for 9.5 per cent of gross domestic product….There is plenty of room for the reform of excessive schedule fees for certain procedures, perverse incentives and overservicing, particularly by the corporate sausage-machines that have been permitted to take over so much of general practice.

…Finally, ”corporate welfare”. The foreshadowed toughness didn’t materialise…

These are all very sound micro-economic economic arguments. But, to my mind, what was most glaringly absent from the Budget vis-a-vis structural reform was any effort to make Australia more competitive. There was no effort to bring down the dollar (beyond an inadvertent demoltion of consumer confidence) and the basic macro-economic assumption of the Budget is that Australia can continue to run it’s old current account deficit economic model of public saving and private leveraging even though it kills productivity.

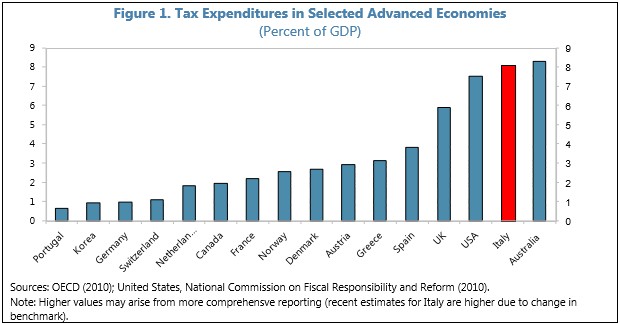

The model is directly supported by the regime of extraordinary and world-beating tax expenditures identified by the IMF:

Negative gearing, capital gains tax, superannuation concessions all hugely mis-allocate of capital across the economy into unused land-banking and price speculation.

Budget detractors have not so confronted this realty yet, either, but that does not excuse the Abbott government. The core of the structural adjustment confronting Australia has not yet even been mentioned.