It seems all opposition parties are intent to follow Tony Abbott’s “Dr No” example in opposition and oppose nearly all attempts at reform.

In last week’s Budget reply speech, Federal Labor leader, Bill Shorten, declared that Labor would oppose nearly all significant measures, including changes to university fees, the Medicare co-payment, fuel tax re-indexation, changes to indexation arrangements for pensions, and tougher Newstart requirements for under 30s.

The Greens have taken a similar stance, although they will allow through fuel excise re-indexation, but block the 3-year deficit levy on high income earners because it is not permanent.

And then there is the Palmer United Party (PUP), which seems intent to be everything to everyone. It has brushed-off claims of an impending Budget crisis and vowed to oppose virtually every significant measure in the Budget, including “the imposition of a debt tax, huge cuts to public sector jobs, increased health and education costs, [and] ripping the rug from underneath our most vulnerable with reduced welfare spending and increasing the pension age… There is no debt crisis and therefore the excuse to impose a two per cent debt tax and introduce other harsh budgetary measures”.

PUP has also argued that there should be no HECS or HELP fees for Australian university students. And who can forget its policies in the lead-up to last year’s election, including lowering income tax rates by 15%, increasing the Aged Pension by 20%, and injecting $80 billion into the health system.

Killing the Budget’s key measures would likely blow a combined hole of at least $15 billion over the four year forward estimates, and much more thereafter.

While some measures in isolation are undoubtedly highly questionable, such as tougher requirements on young unemployed, changes to university fees and funding, and of course Abbott’s flawed paid parental leave scheme, the Budget at least acknowledges that the nation’s finances are unsustainable in their current form and need fixing.

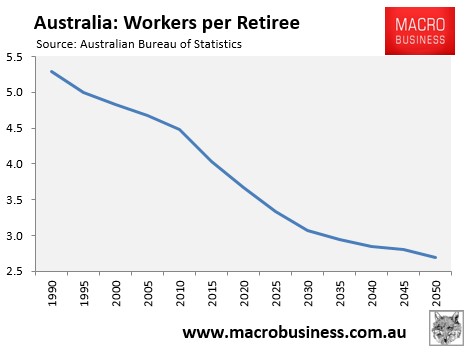

In particular, the ageing of Australia’s population and the large scale retirement of the baby boomer generation means that there will be a shrinking pool of workers supporting a growing army of retired and aged people, causing the tax take to shrink just as aged-related spending is rising.

Viewed in this light, the widespread opposition to the Coalition’s Aged Pension reforms – including changing indexation to the CPI rather than male earnings and tighter means testing of the Seniors Health Card – are curious. How can anyone credibly justify increasing the real value of pensions for the bulging cohort of retiring baby boomers, when there will be relatively fewer taxpaying workers to support them?

Opposition to fuel excise re-indexation is equally odd and politically opportunistic. Freezing fuel excise indexation in 2001 was one of the biggest blunders of the Howard Government, and now costs the Budget some $5 billion per year in lost revenue, with this figure growing over time with inflation. It has also narrowed the tax base and increased the tax burden on less efficient income taxes – precisely what you don’t want with an ageing population and a shrinking worker share.

Labor’s opposition to raising fuel excise, in particular, is curious in light of its previous support for emissions trading and/or a carbon tax. Fuel excise is a defacto pollution tax. Opposing an increase in fuel excise, whilst lamenting climate change, is incoherent.

The point is, it’s fine to oppose Budget savings if you can provide an alternative plan to cut expenditure and/or raise taxes. But simply opposing measures without providing alternatives, as has been done by the opposition parties, ignores the very real structural pressures facing the Budget from falling commodity prices and an ageing population.

As noted by Houses & Holes this morning, these budgetary pressures are now coming home to roost, with ratings agency, Standard & Poors, warning that the Budget needs to be brought back to surplus if Australia is to maintain its AAA credit rating, which in turn is required to support Australian banks’ huge offshore liabilities.

Some low hanging fruit that could be targeted by the opposition parties as alternatives to budgetary reform could include closing Australia’s more egregious tax expenditures – including overly generous superannuation concessions (which mostly benefit the wealthy), quarantining negative gearing so that losses from an asset can only be claimed against income from that same asset, removing the capital gains discount on investments, and removing tax concessions on company cars – as well as abolishing Abbott’s paid parental leave scheme.

Reforms to these areas alone would save many billions of dollars and improve equity in the process.

If the opposition parties were credible, they would also be championing broad-based tax reform, with a focus on both broadening the tax base and shifting it towards more efficient sources – namely away from productive enterprise and onto consumption, land and resources.

Being in opposition is about developing an alternative plan for the nation, not just saying “no” to each and every major reform.