by Chris Becker

The energy nexus through the Middle East and the Crimean peninsula is under tremendous tension, with markets wobbling across the world.

First, it looks like Iraq is brewing a civil war, as US contractors start fleeing the violence – from the WP:

The crisis in Iraq has prompted U.S. contractors with personnel there to evacuate them from areas near Baghdad that are increasingly in the line of fire as insurgent fighters capture more territory with the apparent end goal of seizing the Iraqi capital.

The individuals are being “temporarily relocated by their companies due to security concerns in the area,” State Department spokeswoman Jen Psaki said in a statement Thursday evening. The individuals involved include U.S. citizens who are currently working under contract with Iraq’s central government in support of the Pentagon’s foreign weapons sales program.

In Ukraine, “separatists” have started rolling tanks across the border:

separatists drove three tanks across the Russian border into Ukraine, according to Ukrainian officials, and Russia’s top diplomat said the insurgents are ready for a pause in the conflict.

Ukrainian Interior Minister Arsen Avakov said the tanks and several armored personnel carriers entered eastern Ukraine through a checkpoint manned by rebels in the Luhansk region. He said government troops attacked the convoy when it reached the neighboring Donetsk region, destroying part of it. The claim could not be independently verified.

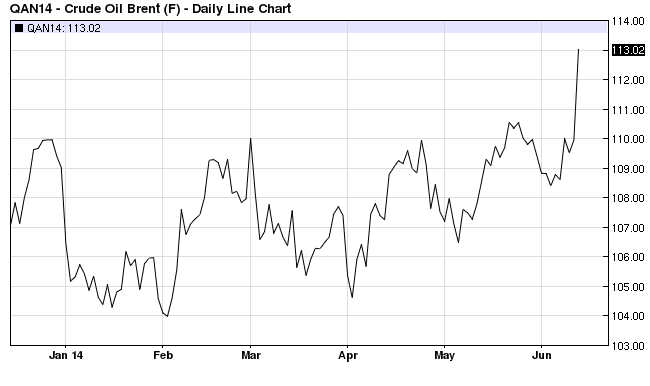

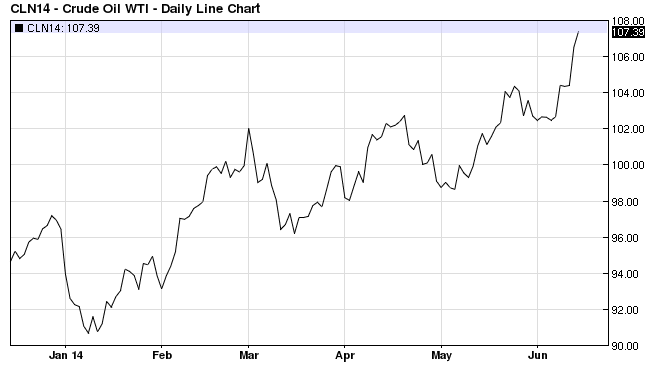

This is sending energy prices reeling across the board:

Its not just these tensions, as a recent note from Marc Chandler at Brown Brothers Harriman (via PragCap):

Declining US inventories appear to be a factor. The EIA reported that inventories at Cushing have fallen to five year lows. This has been a trend since January as the southern tranche of the Keystone XL pipeline has been shipping oil to the Gulf refineries.

Second, reports suggest that China’s demand exceeds what is needed for immediate economic use. China is building a strategic reserve In the January-April period, China appears to have imported about 600k barrels of oil a day. .

Government figures suggest China’s strategic reserves were around 141 mln barrels at the end of last year. In comparison, the US strategic reserves were just below 700 mln barrels in late May. The US strategic reserves are sufficient to cover a little more than a month of consumption (~37 days).

China aims at establishing strategic reserves to cover 100 days of net imports that are something on the magnitude of 600-700 mln barrels. Its coverage of current consumption is estimated to be around three weeks currently.

Third, OPEC decided to maintain the 30 mln barrel a day ceiling for the fifth consecutive meeting this week. There was some thought that it may have chosen to boost output to offset the shortfalls of Libyan and Iranian output. In the middle of May, the IEA called on OPEC significantly increase production.

Libyan output is on the magnitude of 1/10 of its pre-conflict levels. If the Iranians does not reach agreement on its nuclear program by the end of next month, the sanctions that were lifted will be re-applied.

The rising energy prices – along with the run to gold as a safe haven – will go some way in offsetting the falls in iron ore, for BHP at least.

For US consumers (and the rest of us) the pain at the pump has just started. There maybe further pain ahead for younger, poorer US soldiers if war is afoot.