From Nomura via FTAlphaville today comes a very important chart:

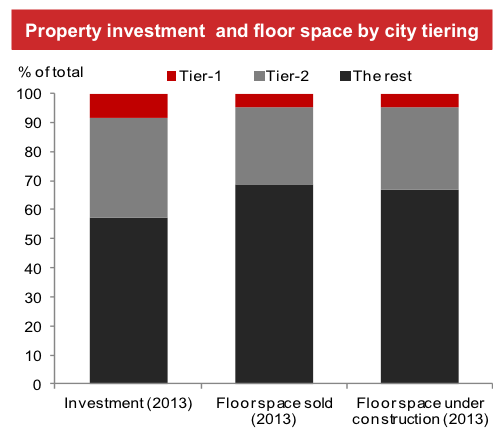

China’s over-building and excess real estate supply is widely regarded to be concentrated in lower tier cities, especially tiers 3 and 4, where nearly three quarters of construction is currently taking place. Is it any wonder that Soc Gen’s sees it this way:

In summary, we think that real estate investment growth will continue to trend lower, likely to the level of 5% yoy (from 12.5% in June), a level last seen during the 2009 downturn. The IMF once estimated that a 1% decline in China’s real estate investment would shave about 0.1% off China’s real GDP within the first year. And so a 7.5ppt deceleration in real estate investment growth would drag down GDP growth by about 0.75ppt. Hence, we maintain our view that the downward pressure from the housing sector will be immense and the downside risk will be non-negligible.

Therefore, policy easing will most likely continue, but the scope is increasingly limited. More local governments will relax purchase restrictions and cut the property transaction tax, but that is unlikely to help much. At the central government level, the decision, at the end of the day, is about to what extent the top leadership is willing to stretch the economy’s debt-absorbing capacity. If it continues with selective easing and only targets infrastructure, in order to offset the kind of property investment slowdown projected above, infrastructure investment growth may have to surge further to over 30%. And this will need to be achieved while land sales are in deep contraction. In June, land sales contracted 6.3% yoy, compared with 1% growth in May.

If the authority chooses to deploy broad-based credit easing, then the obvious question is whether it is really a good idea for China’s long-run prospects. The answer seems to be equally obvious. Hence, the most likely scenario in our view is still selective easing and short- lived growth reacceleration.

That remains the MB base case.