By Lindsay David , Paul Egan & Philip Soos

Introduction

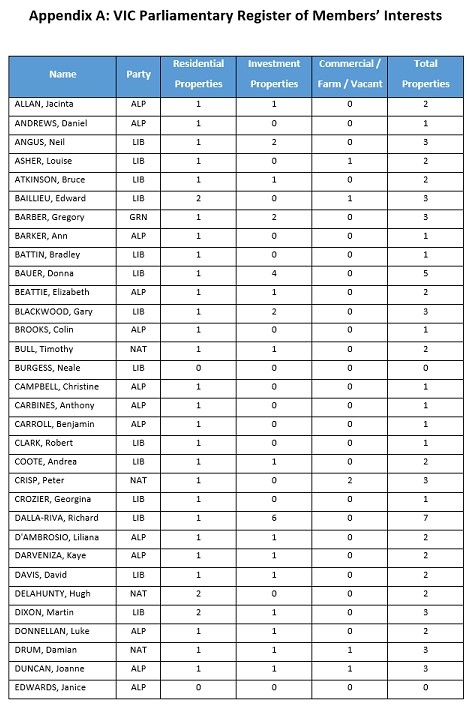

Following our analysis of Commonwealth Parliamentarians’ real estate holdings, our attention now turns to Victoria’s parliament, which is set for an election in November 2014 under its fixed four-year term.

Victorians are entitled to ask: what sort of policies and forward direction will politicians and their parties promise with respect to housing?

Australia, including Victoria, is in the midst of a chronic housing affordability crisis. House price inflation has outstripped both rents and household incomes since 1996, leading to a residential property market that is unaffordable in both historic and international terms.Yet, instead of acting to resolve the crisis, Victoria’s elected representatives are resolutely determined to maintain world-beating prices with poorly designed policies – purposefully maximising prices despite the costs incurred by the community.

The public should critically consider whether the property holdings of state politicians are negatively influencing policy and causing them to ignore impartial evidence. The parliamentary register of members’ interests may assist in this regard, allowing for a summary report of real estate holdings for each Victorian state politician, although assets may be jointly owned with their spouse.

Analysis

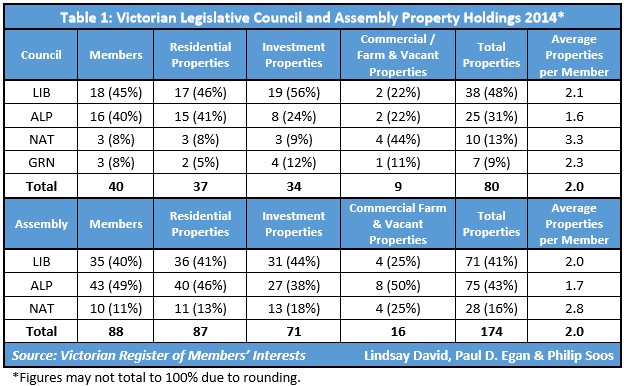

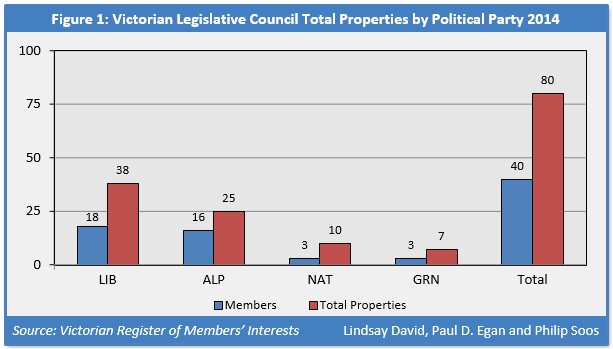

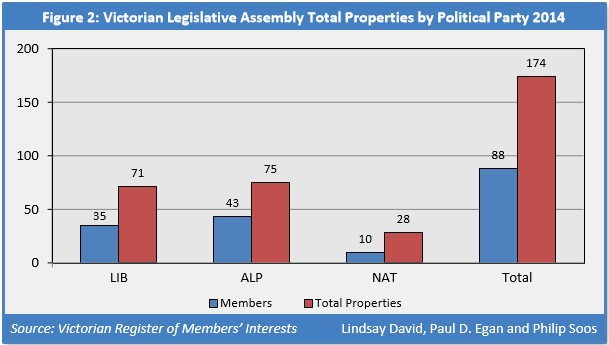

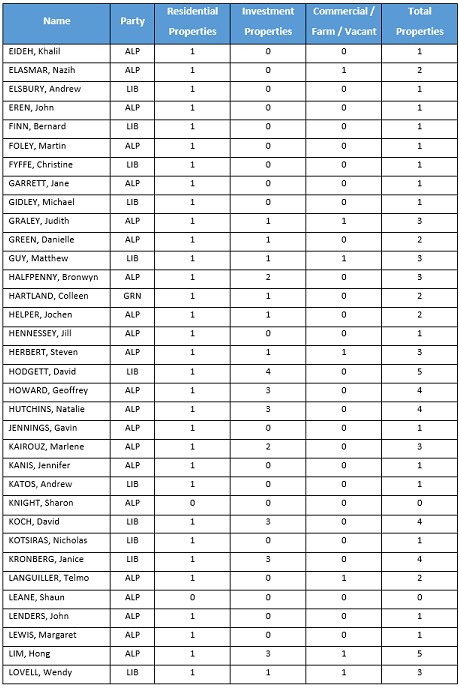

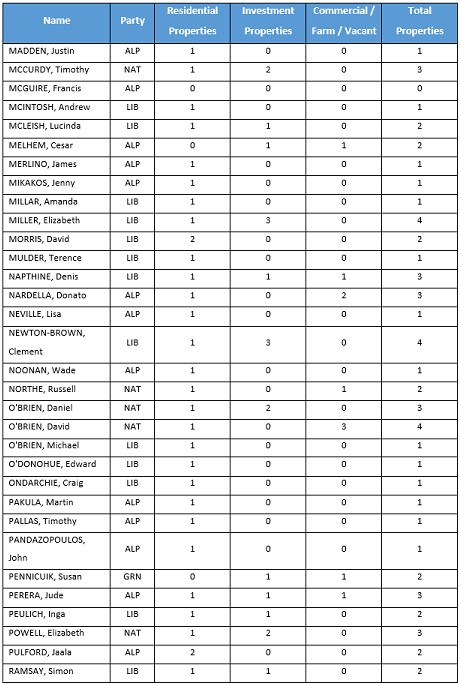

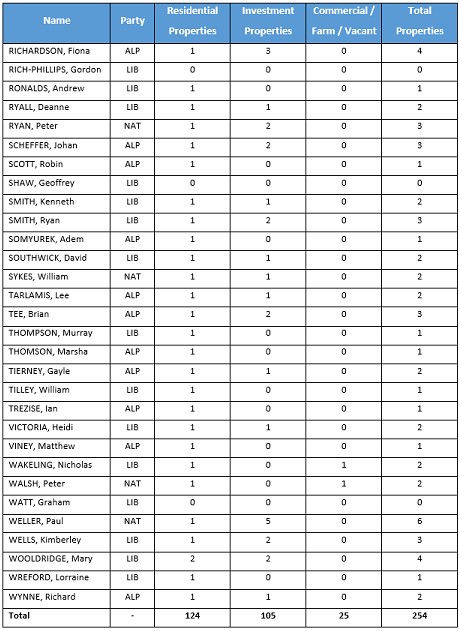

It is evident that parliamentarians are heavily invested in the property game. The 128 members in both houses of the Victorian parliament have an ownership stake in a total of 254 properties – an average of 2.0 properties per member, conservatively estimated at around $136 million. This is calculated by multiplying the Melbourne median dwelling price of $535,000 by 254 properties, as of September 2014.

The real total is probably considerably higher, with well-off politicians more likely to purchase real estate in prime suburban and coastal areas above the median. Furthermore, non-residential property holdings – farmland, commercial and vacant properties – comprise around 10 per cent of the total and may be worth millions of dollars in some instances. Property investment is popular right across the political spectrum and is a common thread binding the normally divided and bickering politicians together.

Victoria’s political class possess a substantial property portfolio, with only 8 of the 128 members (6 per cent) not owning any real estate, though holdings appear incomplete or mistakenly undeclared in some register entries. In the Council, 40 members own a total of 80 properties – an average of 2.0 properties per politician – estimated to be worth around $43 million. In the Assembly, 88 members own a total of 174 properties, with the same average of 2.0, at an estimated worth of $93 million.

The data suggests the majority of Victorian politicians have a vested interest in maintaining high housing and land prices, particularly if they have mortgages over their own investments. Unfortunately, mortgage interests are undeclared, unlike their federal counterparts. Nonetheless, politicians have a strong incentive to consider their self-interest ahead of the common good, given a large fall in real estate prices would reduce the value of their asset base and cause many investments to fall into negative equity. Thus, Victorians should cynically view any legislation or regulations which, when enacted, further inflate real estate prices and enrich a multitude of land owners in the process.

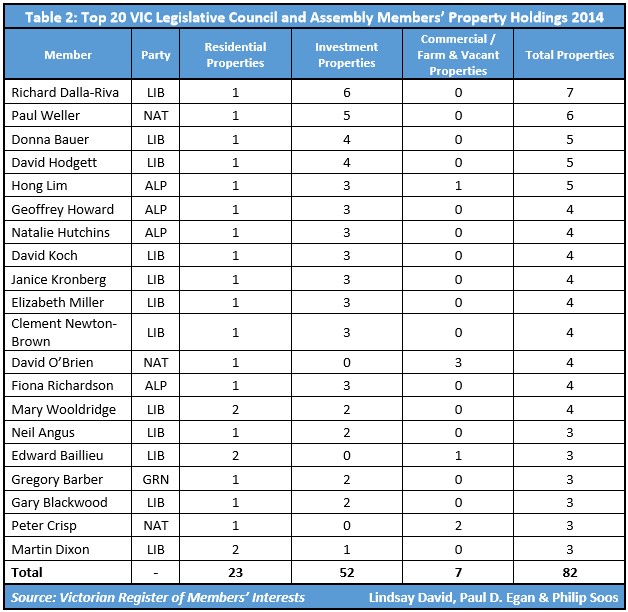

When only twenty members of the Victorian parliament can lay claim to a total of 82 properties, it is wishful thinking to expect politicians to address the real causes of housing unaffordability. Contrary to reason, parliamentarians assume that signs of a new market normal include both heavy debt burdens and the faint pulse of record-low first home buyers. The urgent entreaties from the Victorian Treasury to reform the state’s broken tax system have gone unheard, even though economic efficiencies and greater competitiveness would arise from a shift of the taxation base onto those appropriating geo-rent (economic rent associated with land) and off individuals and productive businesses.2 The dearth of high-quality schools, transport and other civic services once enjoyed by the public is therefore directly linked to political inaction.

The property-rich Victorian Parliament cannot be trusted to act in good faith on matters concerning real estate. Aversion to evidence-based housing policy has a long and tortured history, notably due to politicians’ interest in maintaining the value of their collective real estate holdings. A voter backlash is also feared following any substantive reforms that reduces prices. The corrosive lobbying of the FIRE (finance, insurance and real estate) sector also ensures politicians do not pass legislation or regulations amenable to the cause of housing affordability.

State and federal parliamentarians have a considerable blind-spot for effective policies that improve affordability, having consistently ignored empirical data and sound research in preference to flawed reforms that actually increase prices. This negligence and studied indifference suggests the direction of housing policy must be freed from the vested interests of an unrepresentative parliament, for the negative impact upon social justice and economic efficiency has been profound.

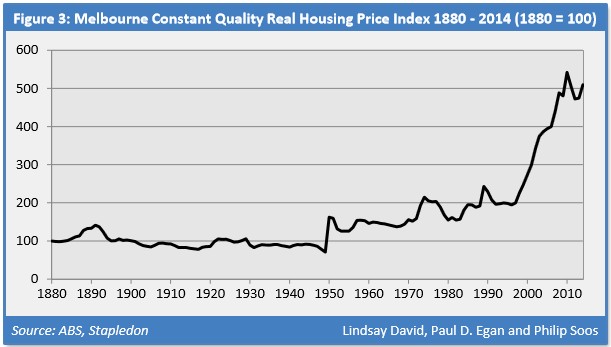

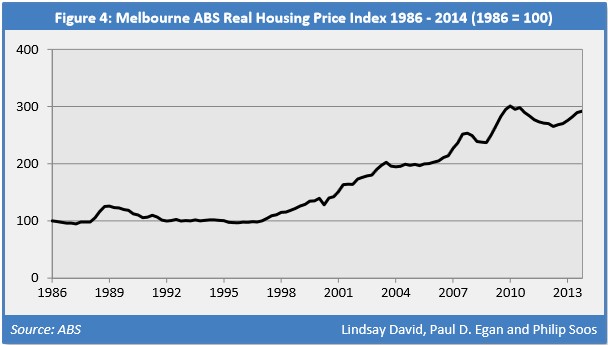

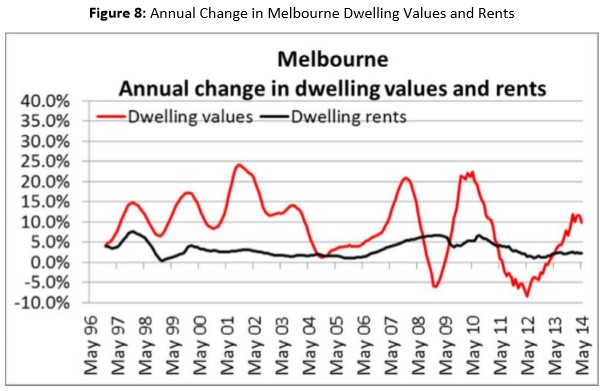

Melbourne’s housing prices surged by 178 per cent between the trough in 1996 and apparent peak in 2010. This represents the largest and most persistent rise in Melbourne housing prices since data was first recorded in 1880. Prices softened between 2010 and 2012, but have since risen. As of 2014, prices are 6 per cent below the peak set in 2010.

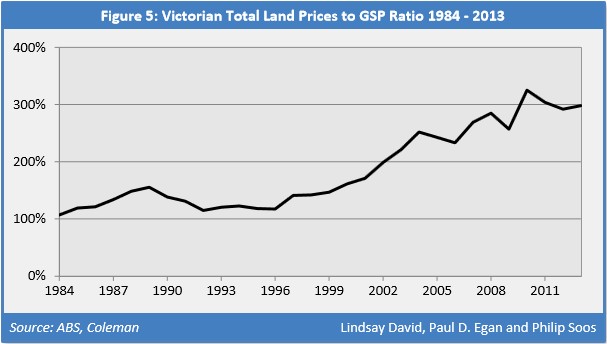

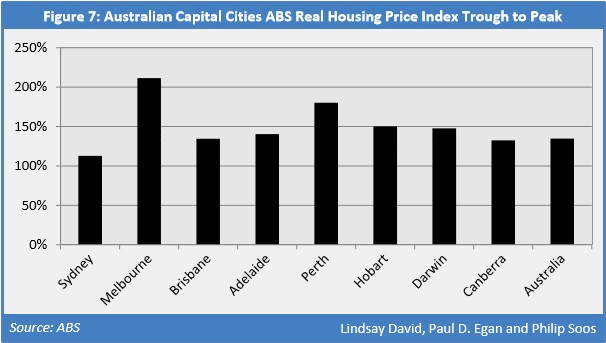

Total Victorian land prices have similarly ballooned, with the prices to Gross State Product (GSP) ratio climbing from 117 to 325 per cent between 1996 and 2010, a relative increase of 178 per cent. As of 2013, Victoria is notorious for having the most inflated land prices nationwide, with the ratio having only fallen marginally to 298 per cent of GSP. This outcome is primarily due to the sharp rise in residential land prices, rather than commercial, rural or other categories of land. Real housing prices have risen substantially in every Australian capital, though Melbourne has shown the greatest increase from the trough in

1996 to the apparent peak in 2010.

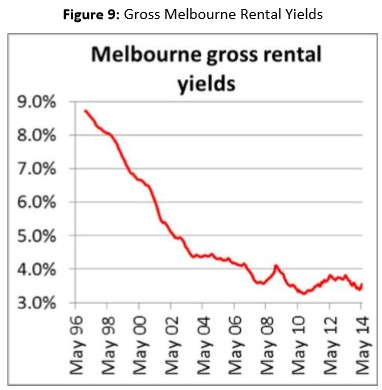

Debt-financed speculation has precipitated skyrocketing land prices that are completely divorced from technical fundamentals, such as rents or household incomes. As a result, gross yields have plummeted from around 9 per cent in 1996 to a tiny 3.5 per cent in 2014.

Net yields are around half that of gross yields, hovering below 2 per cent, reinforcing claims that the Melbourne property investment model is strongly predicated on potential future capital gains instead of sound cash flows.

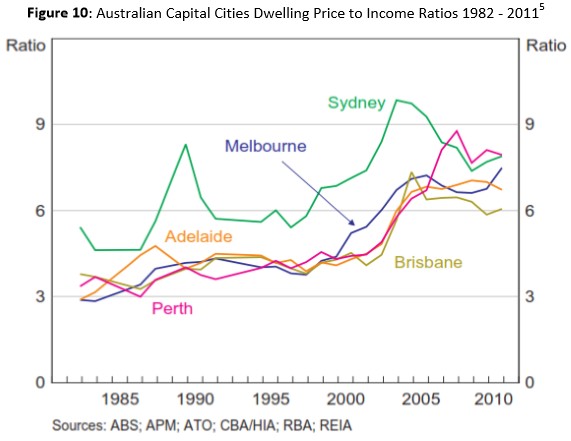

The long-term trend in the dwelling price to income ratio demonstrates a median-priced Melbournian dwelling could be purchased for around four times household income in the mid-1990s, but this has since doubled to around seven to eight times in 2011. In Melbourne’s inner ring, the ratio rises to around eleven to twelve times household income.

Recommendations

A range of policies influencing housing affordability are outside the remit of Victorian parliamentarians and are largely a federal responsibility, for instance, population growth, broad economic settings and the provision of finance. Nevertheless, state and territory governments are not powerless, wielding control over an array of policy areas that can help prevent rapid price inflation and reduce prices.

What practical measures can Victorian politicians take to improve housing affordability?

Recommendation #1: More efficient use of the state land tax (SLT).

The SLT provides an ideal tool to moderate land market bubbles and their subsequent devastating busts, with the benefit of immediate availability to state and territory governments. Unfortunately, this tax has been thoroughly anaesthetised by a host of exemptions and concessional treatments, thus rendering it comatose in applying a brake to escalating land prices. The SLT requires broadening to include owner-occupied housing and agricultural land, calculated on a per-square-metre value basis. The narrow existing base and progressivity of the SLT incurs only a small deadweight loss; the complete removal of

exemptions and concessions would reduce this deadweight loss to zero. The SLT should apply per land holding, but not on an entity’s total holdings to encourage development.

Recommendation #2: Changes to municipal rates calculations.

Municipal rates should be levied using site value (SV) rating, taxing the underlying land only. Under the capital improved value (CIV) or net annual value (NAV) system, construction is taxed, suppressing building activity and imposing widespread deadweight losses.

Recommendation #3: Abolition of stamp duty tax.

Conveyencing stamp duties should be removed, with an improved SLT helping to meet any revenue shortfall and increasing the scope for necessary public expenditure.

Recommendation #4: Removal of the first home owners grant and boost.

All housing grants act as a demand-side stimulus that further erodes affordability. When combined with highly-leveraged mortgage loans, the result is rapid price inflation that substantially outstrips the size of the grant.

Recommendation #5: Greater investment in public housing.

A substantial increase in funding for public housing would assist long-term, low-income individuals and families reliant on social welfare to exit the private rental market, ameliorating their financial stress.

Recommendation #6: Tenancy law reform.

Australian tenancy laws should adopt the higher standards enjoyed by other Western nations. Victorian tenants’ limited rights include less stability and security in tenure due to shorter lease terms (6 to 12 months on average), lower rental vacancy rates favouring landlords during contractual negotiations, termination of leases for no reason, and requisite landlord permission for minor alterations and pet ownership.

Recommendation #7: The adoption of ‘right to build’ laws.

This policy encourages timely development of residential and commercial property. Planning delays and uncertainties may raise land costs, thus, this effect is negated by a right (positive presumption) for developers and home builders to undertake activity, within specified local and state government guidelines. If a development is opposed, then the onus is upon the aggrieved party to take the developer to the civil tribunal to prevent construction.

Recommendation #8: Elimination of state/local government infrastructure charges and levies.

Government should reverse their preference for imposing direct charges on developers to finance local infrastructure, resulting in lower land costs. Governments can either adopt the Texan Municipal Utility District (MUD) model or return to the original system of issuing municipal bonds to finance local infrastructure and paying down debts through council rates.

Recommendation #9: Streamlining of zoning processes.

Extensive delays in land subdivision projects and zoning vacant land for residential use in capital cities can take well over a decade, generating considerable costs, uncertainty and reducing developer competition. Comprehensive betterment taxes should be applied to agricultural land that is rezoned for commercial and residential purposes.

Recommendation #10: Removal of most urban growth boundaries (UGBs).

Except for ecologically or culturally sensitive regions of land, there is no sound rationale for UGBs, as only a tiny fraction of Victoria’s land mass is urbanised. Building further out on the fringe may lower housing costs, but this may be more than offset by the rise in transport costs.

Recommendation #11: Greater transparency in the parliamentary register of members’ interests.

The register of interests is opaque and should be improved to allow for a more detailed and accurate listing of politicians’ real estate holdings. Property investments should be clearly separated into the following categories: owner-occupier, residential investment, commercial/industrial investment, and rural/farm/other. Co-owned investments should require the exact percentage holding of the sitting member, and all mortgages and/or commercial loans held against properties should be listed. In the event a politician does not own any property and instead rents, this should be explicitly noted. It is imprudent for the addresses of politician’s property holdings to be listed in the register due to safety and privacy concerns; listing the suburb is more than adequate.

Conclusions

A wide range of practical policies are available to Victorian parliamentarians to lower housing and land costs, improving the lives of all Victorians. Sadly, the aforementioned recommendations are not in the financial interests of the political class and their ultimate constituents: concentrations of capital, especially the FIRE sector. The 30 per cent of Victorians living as public and private tenants are considered a scourge and treated with contempt.

State governments have squandered the opportunity to independently pursue constructive, competitive federalism by simultaneously increasing land value taxes and reducing inefficient, damaging payroll, insurance, motor vehicle and stamp duty taxes. Similarly, councils were able to lower construction costs by financing infrastructure through municipal rates rather than developer charges, but chose not to do so.

Poor government decisions are attributable to the FIRE sector’s deleterious effect on democratic processes, a stacked parliamentary deck, and extensive lobbying and soft corruption that undermines the public good. The political parties and rentier class have an unspoken accord to preserve privilege for the rich and to further redistribute wealth and income upwards in a ‘flood up’ effect. This outcome is realised by privately capturing economic rents and publicly-owned assets.

The degenerate state of contemporary politics means voters may not understand the rampant inefficiencies wrought by the FIRE sector and rentier class. Substantive reforms are not guaranteed even if politicians become cognisant of the economic harm unfolding, because they lack courage to confront concentrations of state-protected and unaccountable private power. The stranglehold over democratic processes virtually guarantees maintenance of the status quo, unless a fresh reform movement challenges unjustified privilege. Honest public discourse, genuine taxation reform, decentralisation of political power and a complete reconstruction of the FIRE sector is essential to Victoria moving to a more efficient, productive and meaningful economy that serves the common interest.

Lindsay David is a co-founder of clean technology company GreenRigCo and a former strategy & business development consultant. Lindsay holds an MBA from IMD Business School and author of Australia: Boom to Bust. His website is http://australiaboomtobust.com/ and can be contacted at lindsay.david@greenrigco.com

Paul D. Egan was previously employed as a supervisor and policy officer at the state government level. He holds a BSc Hons (Class I) and co-authored, with Philip Soos, Bubble Economics: Australian Land Speculation 1830 – 2013. He may be contacted at paul.egan@openmailbox.org

Philip Soos is a postgraduate candidate at Deakin University, and holds IT and MBA degrees from Swinburne and RMIT Universities. His website is http://www.philipsoos.com/ and can

be contacted at psoos@deakin.edu.au