Robert Carling, senior fellow at the Centre for Independent Studies (CIS), has written a piece in The AFR today defending Australia’s world-beating tax concessions.

Let’s dissect Carling’s key arguments:

Tax concessions in areas such as superannuation, capital gains and GST are under attack like never before…

Campaigns for good tax reform are one thing, but the campaign against concessions lacks balance. Concessions contain elements of good policy as well as bad, and the challenge is to differentiate.

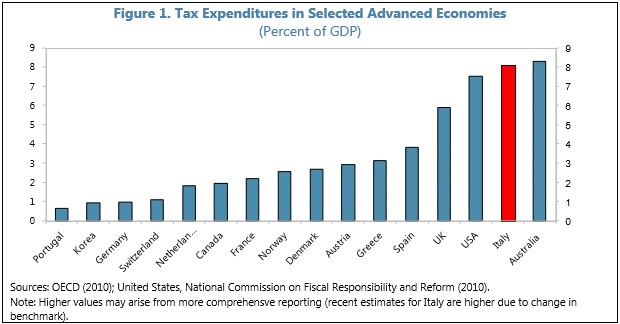

On this point, I agree with Carling. While Australia has some of the biggest tax concessions (expenditures) in the world (see next chart), some are worse than other and not all should be unwound.

Take, for example, the capital gains tax (CGT) exemptions on the family home, which are said to cost the Budget some $46 billion this year. Removing it would have the same deleterious impacts as stamp duty. It would discourage housing turnover and unnecessarily penalise people that move to homes that better suit their needs. Obvious examples include baby boomers downsizing from large family homes and young growing families upsizing to bigger family-friendly homes. In turn, such disincentives would encourage a less efficient use of the housing stock, such as empty nesters occupying large homes with multiple spare bedrooms. Applying a capital gains tax on one’s home would also hinder labour mobility, since it would discourage workers from relocating closer to employment.

Back to Carling:

The Henry tax review was at pains to explain that the principle of optimal taxation leads to savings income being taxed at lower rates than labour income (at least when tax on labour income is as high as it is). To do otherwise is to create a systemic bias against saving and investment. The review argued that the tax treatment of superannuation should be assessed against an expenditure (consumption) tax benchmark, under which super fund earnings and contributions (but not end-benefits) would be tax-free…

The consumption tax benchmark seriously undermines, if not destroys, much of the campaign against tax concessions. Many of these concessions are not unjustifiable loopholes at all but a route to more efficient taxation. For example, scrapping the 50 per cent capital gains discount – the most unfairly maligned of all concessions –would score an economic policy own-goal, damaging investment while raising little if any extra revenue.

…negative gearing… [is] not officially classified as tax expenditures. That should not exempt them from scrutiny, but they exist in the tax structure for good reasons.

Here, Carling has mentioned arguably three of the most inequitable and distorting tax concessions of them all: superannuation; the 50% CGT concession on investments held for more than one year; and negative gearing. That he can claim that these are based on sound tax and economic principles, and are a “route to more efficient taxation”, beggars belief.

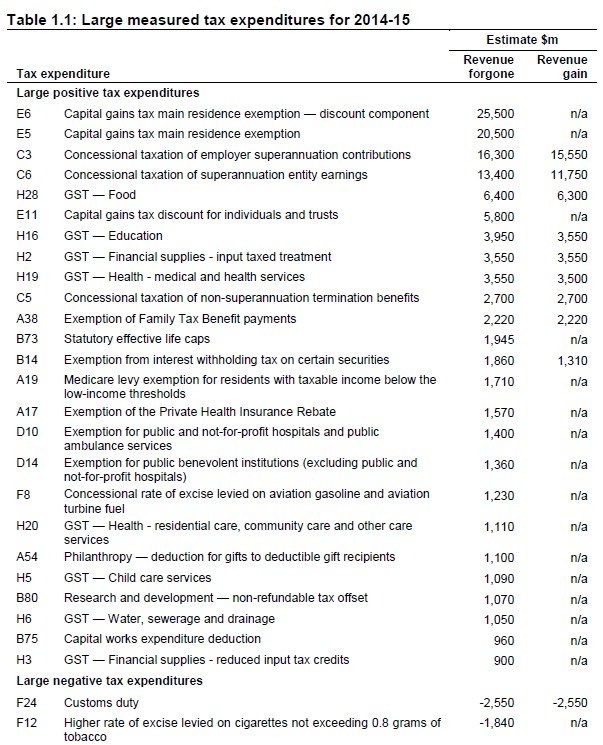

Take the biggest concession, superannuation, which is estimated by Treasury to cost a total of $29,700 in revenue foregone (see below table), and estimated to raise $27,300 if the concession was eliminated. Superannuation concessions were also forecast in the December Mid-Year Economic and Fiscal Outlook to grow by a whopping 10.8% per annum between 2014-15 and 2017-18!

Critics of this type of Budget analysis, such as Robert Carling and Paul Keating, argue that Treasury’s tax expenditures measurement is wrong, and that it is incorrect to simply add the costs of the two types of super tax concessions together (i.e. C3 and C6 above).

They have a point: if employer contributions were taxed more heavily then there would be less in the super funds to create earnings that would be taxed.

However, these complexities of measurement are besides the point. The fact is superannuation concessions are costing the Budget many billions of dollars of revenue foregone. They are also growing rapidly. Even if their true cost is half the amount forecast by Treasury above, their cost to the Budget would still be a ginormous $15 billion this year, rising to some $20 billion in 2017-18!

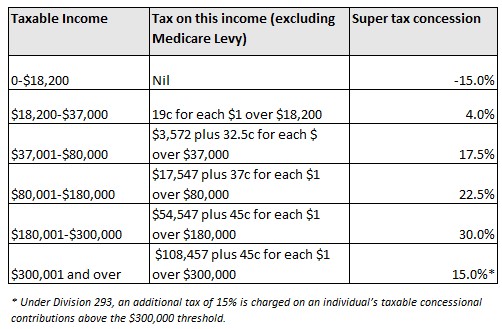

Carling also needs to explain why it is efficient and fair that the amount of superannuation tax concession received grows as one moves up the income tax scale. For example, a very low income earner earning up to $18,200 effectively pays 15% for their superannuation concession, whereas a high income earner earning $300,000 enjoys a 30% tax benefit (see below table).

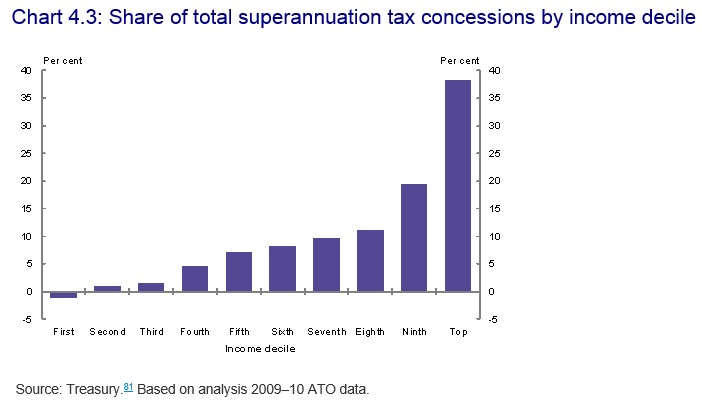

The draft report of the Murray Inquiry into Australia’s financial system agreed that the system makes little sense, noting that “the majority of superannuation tax concessions accrue to the top 20 per cent of income earners (Chart 4.3). These individuals are likely to have saved sufficiently for their retirement, even in the absence of compulsory superannuation or tax concessions”.

The bottom line is that superannuation concessions in their current form are both highly inequitable and inefficient, costing the Federal Budget many billions in foregone revenue whilst reducing the progressiveness of the tax system. They have increasingly become a mechanism for richer older people to avoid paying tax, rather than a genuine means for Australians to pay for their own retirement and avoid drawing on the Aged Pension.

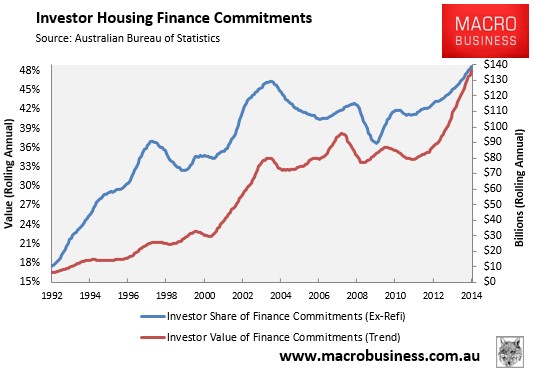

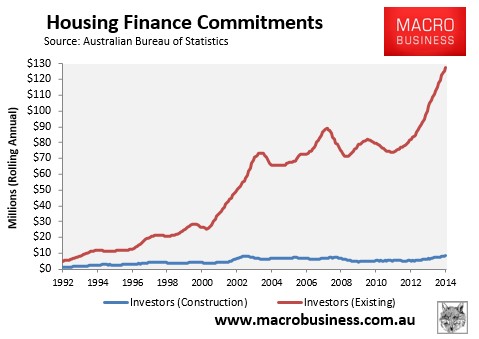

As to Carling’s argument that the 50% CGT concession, and its partner in crime, negative gearing, “exist in the tax structure for good reasons” and to eliminate them “would score an economic policy own-goal, damaging investment while raising little if any extra revenue”, he needs to explain why it makes sense for tax policy to artificially juice housing demand:

Without expanding supply:

How have these policies facilitated productive investment, as opposed to simply channeling the nation’s capital into unproductive houses, raising housing costs in the process?

The Grattan Institute estimated that quarantining negative gearing losses, so that they can only be claimed against the same asset’s future earnings (rather than unrelated wage/salary income), would save the Budget around $2 billion a year in revenue foregone once lower capital gains tax receipts are taken into account.

It, therefore, makes perfect sense to unwind these concessions on budget, equity and efficiency grounds.