Chris Richardson and the chaps at Deloitte Access Economics have a done stellar job in outlining the total Budget disaster unfolding before our eyes today. As you read the following, bear in mind that DAE has a track record of sobriety and non-partisan politics. Then weep.

The hole is getting bigger

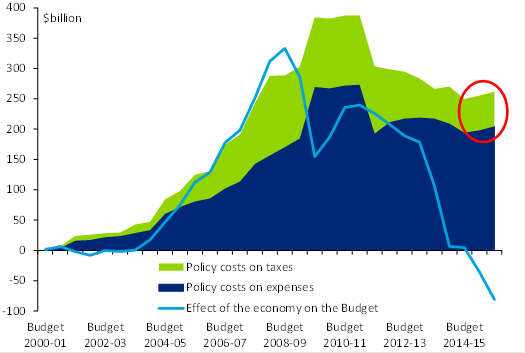

Budget has two drivers: China and Canberra. China is continuing to make Canberra’s task harder. China’s boom initially sent commodity prices soaring, which poured money into Canberra’s coffers. The chart below uses Treasury data to show how an improving economy saw ‘rivers of gold’ flood in. But the GFC rained on the parade, and now China’s slowdown is combining with a surge in global mine output to cut the legs out from underneath commodity prices. The poster child for Joe’s woes is the iron ore price. We’ve circled our estimate of the extra $45 billion that Treasury will downgrade the Budget due to this worsening backdrop.

The impact of the economy on the Budget

That chart says the China-driven Budget bubble of the past decade was magnificent, but that it was also temporary. And right now that boom is threatening to become a Budget bust, making the task of getting the Budget back on to a healthier

footing ever harder. As a simple illustration of that, even if you extended the GST to cover fresh food you wouldn’t fill the ongoing Budget hole left by the iron ore price falls of the last six months.

We estimate revenues will fall shy of the latest official estimates by $5.2 billion in 2014-15 and by an ugly $10.8 billion in 2015-16. Much of the damage remains in profit taxes such as company taxes (with the oil price collapse meaning the pain is worse still in PRRT, and with superannuation taxes falling well shy of official estimates). But record low wage growth means PAYG revenues have joined the writedowns in earnest this time around.

And the politics is getting harder too

Yet it isn’t only the economy that is making budgeting harder. So too is politics. It’s true that:

- Many of the proposed Budget repair measures weren’t flagged ahead of the election.

- The ‘temporary Budget repair levy’ aside, fairness wasn’t central to the proposed repair.

- Many savings come from the States, so there isn’t yet a saving for Australia as a whole.

Those are big caveats. Yet you’d still have to say our body politic has failed. Glenn Stevens has summarised that: “Our politicians need to start talking the real talk on how we are to collectively afford some of the expensive initiatives the Australian public want”. The chart below again uses Treasury numbers to show that permanent promises built up over the past decade. Mostly that was extra spending, thanks to family payments and baby bonuses, compensation for the carbon and mining taxes, and disability insurance. But taxes were cut too, with a series of personal tax cuts only partly offset by higher excise on cigarettes and an increase in the Medicare levy to help pay for disability insurance.

The impact of the economy and of policy decisions on the Budget

Yet although past policy costs have been huge, recent months were as “dull” as promised:

- The small business tax cut and families package mostly rejig the old paid parental leave (with the families package said to be contingent on the Senate passing other savings),

- Age pension savings may come via tightening the assets test rather than via indexation,

- A ‘kinder, gentler’ government is extending funding for the homeless, for drug and alcohol services, for legal aid, and for mental health,

- There have been two further rounds of troop commitments into Iraq, while

- There have also been partial backdowns on Defence pay and on car sector assistance.

Yet that is just rats and mice compared to the extravagance of the past decade. The big cost is the delay to start dates from savings announced in last year’s Budget that still haven’t made it through Parliament. Adding those in, we’ve circled our estimate of ‘new’ policy costs.

The Budget bottom line for 2014-15 and 2015-16

Although the Budget may be ‘dull’ in terms of new policies, it is all-too-exciting in terms of the costs of the economy and the cost of a year’s worth of policy gridlock. That means that ‘dull’ new policies won’t mean dull deficit figures.

Deloitte Access Economics projects an underlying cash deficit of $45.9 billion in 2014-15. That is a substantial $5.5 billion worse than projected at Budget time and shows little improvement from the recorded deficit of $48.5 billion in 2013‑14.

And if you think that’s bad, then 2015-16 looks like it has been written by Stephen King and painted by Edvard Munch. Dull it ain’t: China continues to carve chunks out of Canberra, leading to rampant revenue shortfalls. But the biggest ‘new bad news’ on bucks is in PAYG. Wage growth jumped ahead of productivity gains during the boom, but it is now only limping along as businesses try to claw back their competitiveness. That’s set to tear a new hole in the heart of the Budget. Add in the rising cost of Senate gridlock, and we see an underlying cash deficit stuck at $45.3 billion in 2015-16.

That is a massive $14.1 billion worse than MYEFO. And it also says that, as hard (and as bravely) as the Government has pursued Budget repair, China keeps moving the goal posts back faster than the Government can steer savings through the Senate.

The matching fiscal deficits are $45.3 billion in 2014-15 and $41.3 billion in 2015-16.

Tick off the caveats

As always, things could turn out better or worse than that. At the very least, the Government is sure to announce policies this figuring doesn’t allow for. But the big picture backdrop isn’t pretty, and downside risks loom larger than usual:

- China and/or commodity prices could crumble further: The tug of war over the economy is getting fiercer, with negatives (slowdown in China, falling commodity prices and mining-related construction) getting bigger, but positives (lower for longer interest rates and the $A’s fall) getting bigger too.

- But although that is broadly a draw for the economy, it isn’t for the Budget (falling commodity prices and weak wages outweigh $A positives), and the increasing intensity of positives and negatives means risks are on the rise.

- There are reasons to fear China’s slowdown could worsen, and the momentum in commodity markets is downwards.

Politics is trumping policy: The deficit projections above assume there are merely delays in reaching a ‘value signal in health’ and over university funding. That is, they assume the Senate comes to the party, and that the only effect of Canberra’s gridlock is a short delay.

What about 2016-17 and 2017-18?

If you are waiting for a white knight – a China recovery or a surge in capital gains – to get Australia back out of our Budget mess, then you may be reading the wrong genre.

Much Budget damage was done some time ago, back when China’s budgetary impact was so strong that the dumbness of what we were doing was buried under a comforting layer of surpluses. But that tide turned in 2011. China is still slowing and miners are still digging deep – a combination which continues to undercut profit taxes. And the new kid on the bad news block is weak wage gains. That’s good for the economy (as it helps us rebuild some of the competitiveness we lost in the boom years), but is another kick in the guts for the Budget.

At least the $A’s fall helps the Budget bottom line, as do record low interest rates on Federal debt. And robust sharemarkets and dizzyingly pumped up house prices will eventually yield more on capital gains taxes. And the best news of all is that last year’s Budget had a red hot go at fiscal repair. Yet that didn’t end well – the package lacked enough fairness to garner more widespread support, and votes lay much more in opposing than in supporting.

That spells a stalled deficit, with last year’s $48 billion merely edging down to $46 billion in 2014-15 and $45 billion in 2015-16: that’s Budget repair at a snail’s pace. So you’ll be glad to hear that, absent further policy changes, Deloitte Access Economics forecasts the cash underlying deficit to drop back to $35.3 billion in 2016-17 and then to $24.1 billion in 2017-18 (with the matching fiscal deficits at $32.2 billion and $17.6 billion).

But those deficits are anything but dull: they are $14.5 billion and $12.6 billion worse, respectively, than Treasury’s last forecasts. And although they show a welcome trend, that comes with important caveats. The improvements in 2016-17 and beyond assume:

- The Senate merely delays rather than denies further savings of the size announced in last year’s Budget. We can run, but we can’t hide: policy needs to be part of the repair task, because the economy can’t and won’t get us there by itself.

- That taxes on capital gains surge in a way that they haven’t for many years.

- That wage gains pick up, pushing people into higher tax brackets at a faster pace.

- And that China steadies and commodity price falls ease back to being moderate.

In isolation, each of those assumptions are brave. In tandem, they may rank as heroic.

So to make the obvious point, if Australia’s politicians can’t craft some compromises, then better Budgets will be even further away than our forecasts have them here.

We still see deficits as far as the eye can see, with the repair task getting harder both because of economics (commodity prices and wages) and because of politics.

Hang on, didn’t the latest Intergenerational Report say “we’re almost there”?

Mission accomplished, if only the pesky Senate would roll over. That’s the quick summary of the latest IGR. Just ask Dr Karl. But so far the Senate isn’t playing ball. And here’s a hot tip – it wouldn’t play ball even if there were a change of government. That’s because those who oppose savings (Oppositions, small parties, and assorted loonies who trade preferences with the Devil) are getting two bites at the cherry. When they oppose savings, they earn the gratitude of those whose funding was on the line (students, doctors, pensioners and the like). But down the track they also get to bash whoever is in Government for “failing to achieve the promised surplus”.

Err, isn’t that failure partly because of your opposition?

That’s not the only caveat on the IGR. Remember a big chunk of Budget repair comes from:

- Shifting costs to the States, who are unlikely to be able to pay for them.

- Assuming not only that slower indexation passes the Senate, but that it lasts many years.

- And assuming that holes in the revenue base don’t pose problems (even though petrol excise indexation is yet to pass parliament, the

GST is a shrinking share of consumer spending, superannuation concessions become more costly as Australia ages, and ‘base erosion profit shifting’ is looming ever larger as a revenue hole).

So politics is cruelling efforts at Budget repair, while the economy is hurting the fiscal outlook further. That says the repair task has grown, but the appetite to tackle it has faltered.

Shame that there’s still a country to run.

In conclusion, if you’re counting on government to bail you out during the next global shock (ie if you’re large bank) think again.