John Daley and Danielle Wood from The Grattan Institute have written an excellent article debunking the Property Council’s and the Real Estate Institute of Australia‘s latest report, prepared on its behalf by ACIL Allen Consulting, defending Australia’s negative gearing and capital gains tax (CGT) discount (debunked by me last week), rubbishing their claims that unwinding these tax concessions would stifle rental supply, push up rents, and harm middle-income investors.

On the property lobby’s claim that abolishing these tax concessions would stifle rental supply, Grattan has countered with the following:

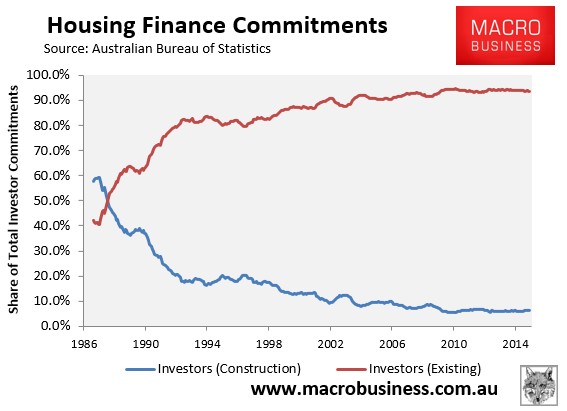

… 93 per cent of all investment property lending is for existing dwellings. As the report itself points out, the main constraint on the supply of new housing is land release and zoning restrictions, not the profitability of developments. Providing tax concessions in this supply-constrained environment mainly just bids up prices for the limited new supply…

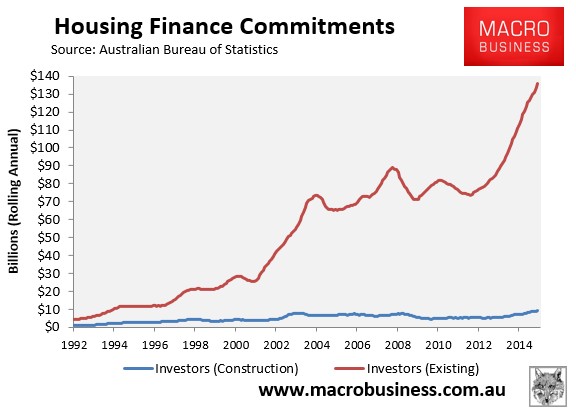

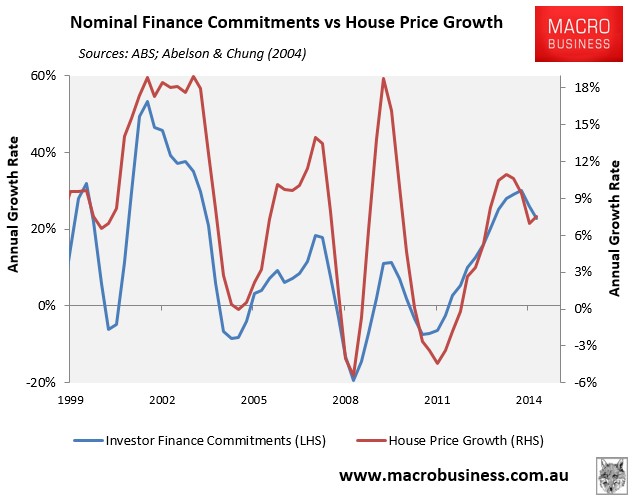

Absolutely 100% correct. The data on investor finance commitments conclusively shows that over 90% of investors purchase established dwellings (see below charts).

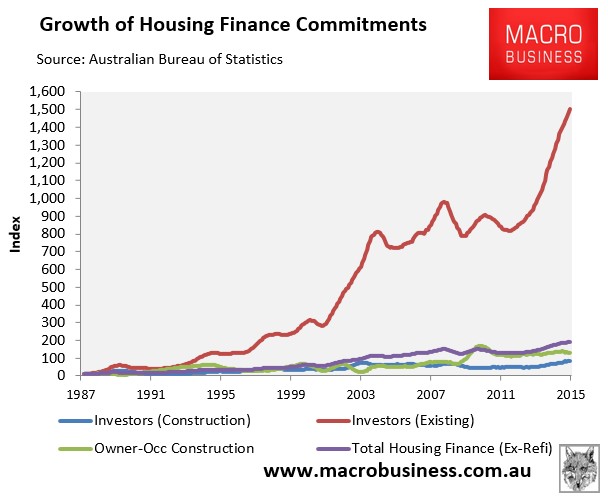

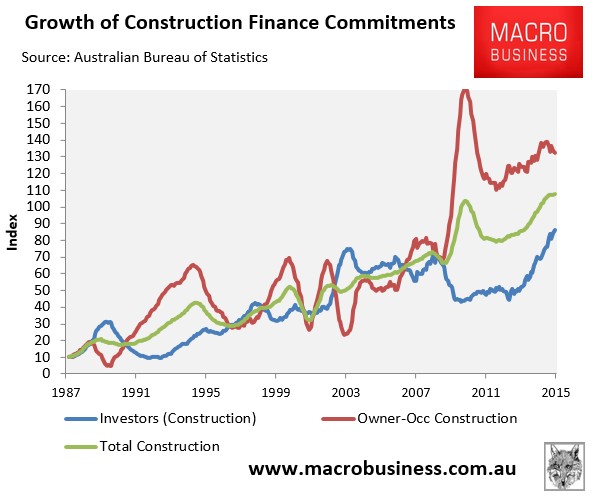

Moreover, since negative gearing was reinstated in 1987, the growth of investor finance commitments for new construction has lagged all other forms of finance (see below charts).

Thus, allowing investors to offset their rental losses against their wage/salary income, along with the 50% CGT discount, has done absolutely nothing to boost housing supply or improve rental availability or affordability. All they have done is push-up house prices (see next chart) and substitute homes for sale into homes for let.

Next, the Grattan Institute demolishes the claim that abolishing negative gearing and the GCT discount would push-up rents:

…current rents are ultimately a consequence of the balance between demand and supply for rental housing. In property markets — as in other markets — returns determine asset prices, not the other way around. Rents don’t increase just to ensure that buyers of assets get their money back.

Some investors may sell their properties if tax concessions are less generous. This may reduce house prices, but it will not increase rents. Every time an investor sells a property, a current renter buys it, so there is one less rental property and one less renter, and no change to the balance between supply and demand of rental properties…

Again, 100% correct. If negative gearing and the CGT discount were abolished, it would not harm overall rental availability and affordability since investment properties sold by investors would be purchased by renters (or other investors). In turn, these renters would become owner-occupiers, thereby reducing the demand for rental properties, and leaving the rental supply-demand balance (and rents) unchanged.

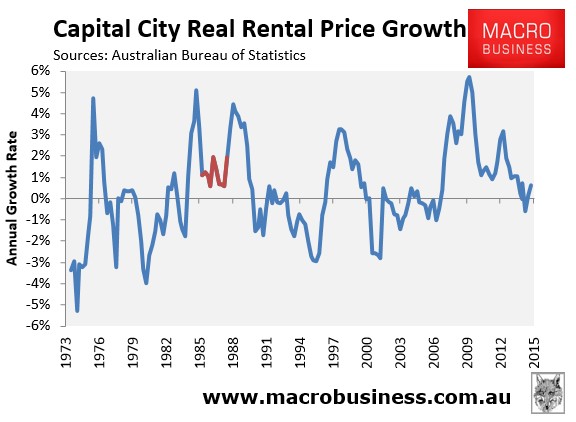

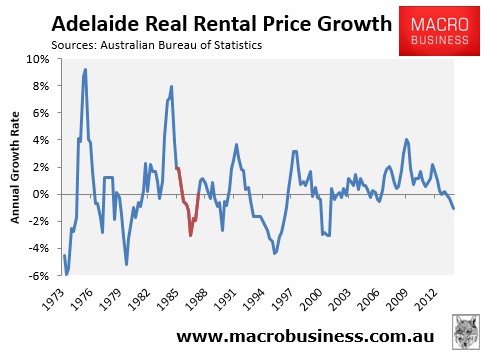

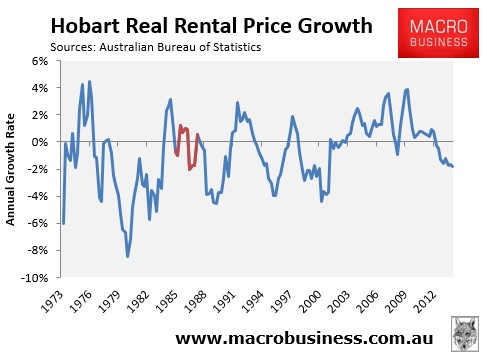

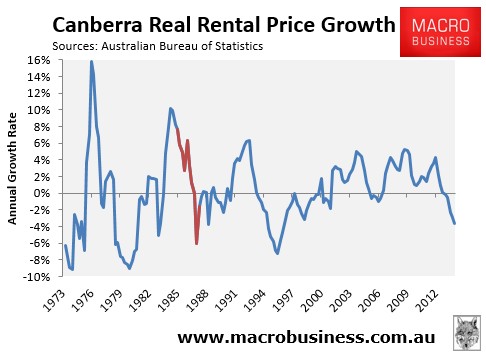

The property lobby’s argument that rents would rise is also not supported by historical experience. When negative gearing was temporarily quarantined between 1985 and 1987, there was no discernible impact on rents, with rental growth nationally higher both before and after negative gearing’s removal (shown in red):

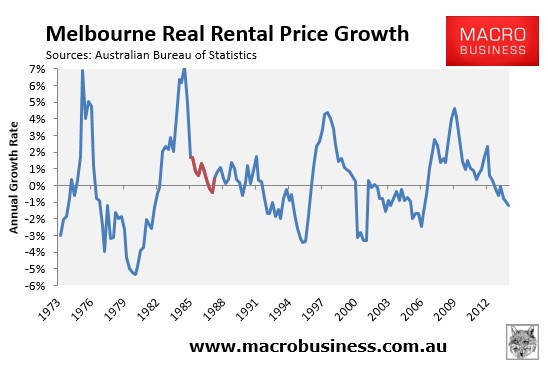

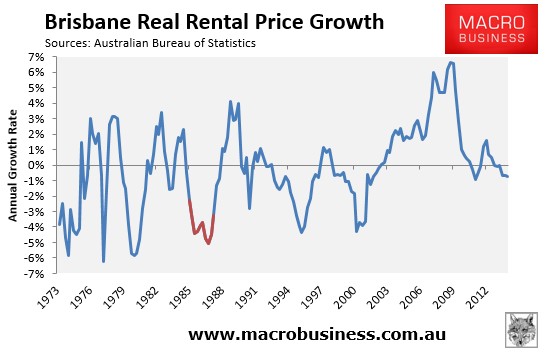

Moreover, despite rental rises in Sydney and Perth after negative gearing’s removal (due to low vacancy rates at the time), rents were flat or fell in the other capital cities (see below charts).

If negative gearing helps keep rents low, as argued by the property lobby, then why didn’t rents rise nationally when it was temporarily abolished between 1985 and 1987?

Finally, Grattan demolishes the property lobby’s claim that negative gearing and the CGT discount are used primarily by middle income earners:

The other argument the industry advances is that “ordinary Australians” use negative gearing. Once again the numbers it uses are highly misleading. Its report shows that those with taxable incomes under $80,000 claim most tax benefits from negative gearing for property — 58 per cent of the rental losses. But people who are negatively gearing have lower taxable incomes because they are negatively gearing. Correcting for this by assessing income before rental loss deductions shows that less than one-third of rental losses are claimed by people with incomes below $80,000.

In other words, taxpayers with incomes more than $80,000 — the top 20 per cent of income earners — claim almost 70 per cent of the tax benefits of negative gearing. For capital gains, taxpayers with incomes of more than $80,000 capture 75 per cent of the gains.

Nothing like a nice dose of truth to counter the property lobby’s lies.

If only the Abbott Government would assess the evidence objectively rather than continuing the “age of entitlement” for its rent-seeking constituents – a point also acknowledged by Grattan:

The Treasurer and the Finance Minister have both defended negative gearing arrangements by warning, against all credible evidence, that change would bring higher rents. The message to lobby groups is clear: if you pay enough to “independent” consultants you may be able to buy favourable policy outcomes, irrespective of the costs to the community.

unconventionaleconomist@hotmail.com