For years, it was posited that New Zealand was less exposed to commodity booms and busts because it specialised in so-called “soft commodities“, such as dairy production and other farm goods, whose consumption and demand is far less cyclical than so-called “hard commodities”, such as iron ore, which are dependent on the intensity of construction.

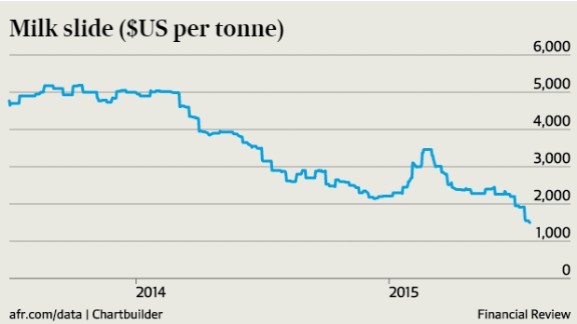

These assumptions must surely be under threat, given the massive fall in dairy prices – New Zealand’s biggest export commodity (dubbed the “saudi Arabia of Milk”) – which have fallen by more than 50% since February and more than 70% since late 2013 (chart via The AFR):

The problem, as articulated by Michael Pascoe last month, is that the massive lift in dairy prices caused a large supply response “just about anywhere that has water and dirt”.

Indeed, Bloomberg earlier this month carried a story about US dairy processors dumping milk they couldn’t sell as American milk production runs at a record high for the fifth year in a row.

European producers, too, have signaled that they want to become the world’s biggest milk product exporters.

Unfortunately, it seems New Zealand’s “rock star” economy might have instead been a “one-hit-wonder”.