by Chris Becker

Theres been a lot of to-ing and fro-ing and hand wrenching about the Fed’s seeming inability to raise rates off a near decade low over the weekend.

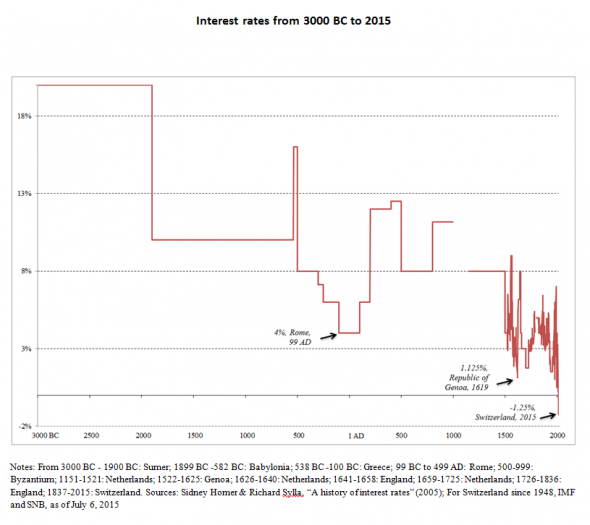

As we head into The Great Volatility, the main theme of a deflationary future meaning lower interest rates than ever before is being examined and re-examined by economists and pundits alike.

As explained by UBSs Costa Vayenas, the difference between this chart and those pushed by central bank economists, which only really explain the so-called dominant US and UK interest rate paradigms, is how the longer term chart view shows the huge impact of interest rates over civilization.

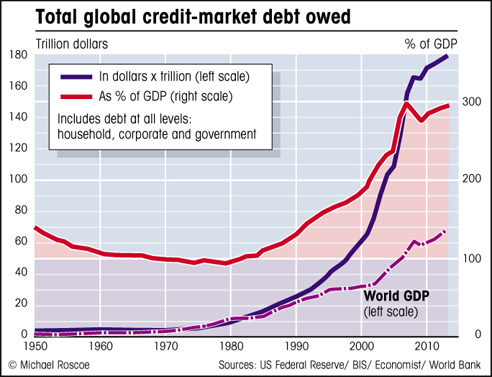

Readers of David Graebers “Debt: the first 5000 years” will also understand its significance and cycles and why the question of a gold standard enters the discussion about “too low” interest rates. Contrary to popular opinion, the world was not on a gold standard for 5000 years before President Nixon suddenly revoked it in 1971, thus leading us to the huge debt explosion of today.

Instead, there’s been waves of gold standard/paper standard/no standard from antiquity to modern times as differing economic and importantly, financial systems fade and dominate.

The trend that is undeniable now is the rise of financialised debt. The current global debt supercycle, blown up again in the post-GFC environment through endless QE and emerging market creidt is effectively the “endgame” of the complete and total financialisation of the global economy.

Context is needed when discussing gold standards and their re-introduction. The past 5000 years had periods of economic empires, but their span was not global or total, unlike today’s meta-money system. And while gold standards like Bretton Woods during the post-WW2 US economic empire or 1800s Pound Sterling during the British Empire all worked, these periods did not face the same interconnection of financial risk that exists today.

That explains why gold, priced in almost any major currency, is not facing a resurgence in popularity even as the global currency wars continue. The current financial system requires lower, zero and potentially negative interest rates to keep the meta-money machine working as the traditional method of writing off debt – Jubilee – and starting afresh with higher interest rates, is not considered an option.

Until it is the only option.