By Alpha Beta Strategy and Economics, republished with permission

Aussie growth slows … again

ABS data released today showed Australian economic growth slowing to just 0.2% over the quarter. This is the slowest rate of quarterly growth since the global financial crisis, with the exception of the quarter affected by the Queensland floods.

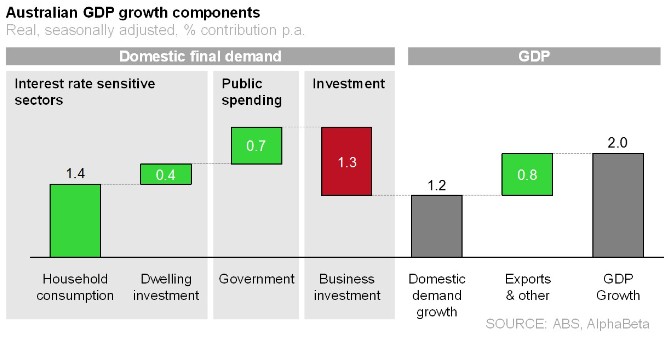

More importantly, on an annual basis, growth was just 2.0%, which means that the Australian economy has grown below trend for 12 consecutive quarters (see chart below).

Did the Aussie economy just snap?

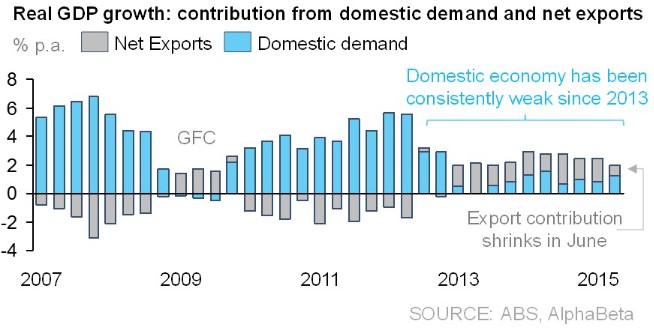

Today’s weak headline number is being reported as a sharp deterioration in growth, but the truth is that the underlying data has been weak for at least two years.

The domestic economy slowed dramatically in 2013 as commodity prices came off and never recovered (see blue bars in the chart below). The weakness in domestic demand was hidden in headline data by massive growth in exports (gray bars in the chart below). What we saw today was the domestic economy stay broadly in line with its recent weak trend, but lose some of its support from net exports.

We are on monetary policy life support

The Australian domestic economy continues to be substantially powered by policy. Domestic demand growth over the last year was reliant on the RBA’s easy monetary policy (powering interest rate sensitive sectors including consumption and dwellings) and the government’s easy fiscal policy (lifting public spending). Worryingly, business investment – the engine of future growth – subtracted 1.3 percentage points from the domestic economy.

Where to from here?

For two years, we’ve been told that the Australian economy is “transitioning” from the mining boom to alternative sources of growth. Government economic forecasts assumed that a surge in non-resources investment and exports would offset the mining capex cliff and plummeting commodity prices.

That smooth transition isn’t happening. Instead, today’s data indicate that Australia is set for a longer, tougher road back to growth. We will regain our lost competitiveness in non-resources sectors through lower wages (expect record-low wages growth to continue), a lower exchange rate (expect the AUD to sink further and stay low for some time) and lower interest rates (expect Australia’s interest rate premium to diminish). Following this tough transition, our tourism, business services, education, agriculture and even some manufacturing sub-sectors should be well placed over the next decade to benefit from the growth in Asia’s consuming class.

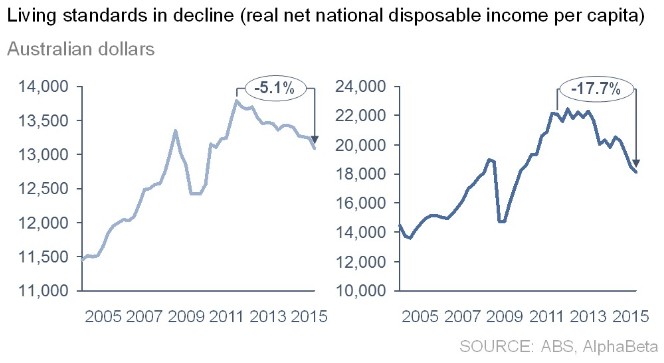

But that path back to growth will come at a high cost to our living standards. Already Australian living standards (measured by our real net national disposable income per capita) have fallen 5.1% since their peak in 2011. And factoring in the fall in our currency, our standard of living has fallen 17.7% in international dollars. That is to say, Australian living standards have fallen by nearly one fifth in international terms.