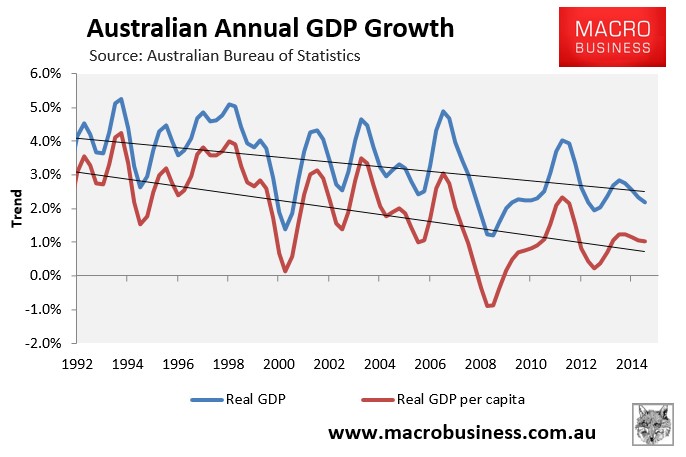

As summarised earlier, the Australian Bureau of Statistics (ABS) today released the national accounts for the June quarter, which registered a 0.2% increase in real GDP over the quarter and a 2.0% rise over the year. The result missed market expectations of 0.4% growth over the quarter and 2.2% growth over the year.

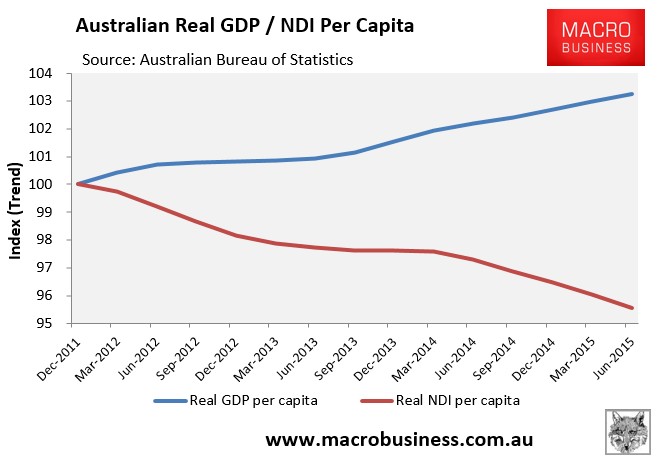

On a per capita basis, real GDP fell by 0.2% and was up by only 0.8% over the year. More importantly for living standards, real national disposable income per capita fell by 1.2% over the quarter and was down 2.3% over the year.

According to the ABS, seasonally adjusted GDP growth for the quarter was driven by:

- Final consumption expenditure (+0.7 percentage points); and

- Public gross fixed capital formation (+0.2 percentage points); partially offset by

- Net exports (-0.6 percentage points); and

- Changes in inventories (-0.2 percentage points).

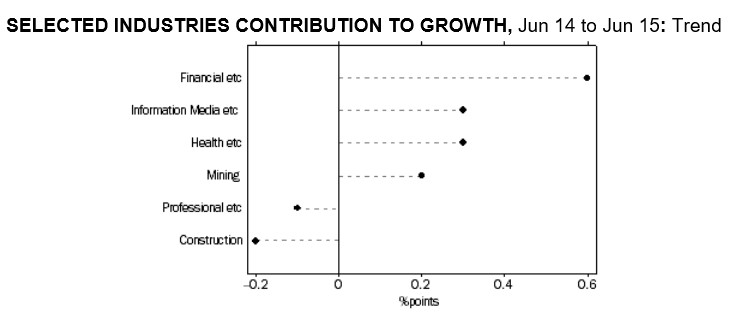

Reflecting Australia’s housing-based economy, the main contributor to GDP growth over the year in trend terms was Financial and insurance services (+0.6 percentage points), although Information media and telecommunications (+0.3 percentage points) and Health care and social assistance (+0.3 percentage points) also contributed to growth. Offsetting these growth industries were Construction (-0.2 percentage points) and Professional, scientific and technical services (-0.1 percentage points).

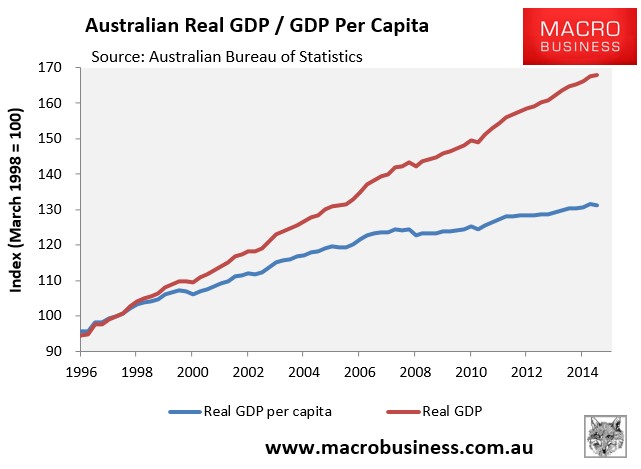

Real GDP per capita fell by 0.2% in the June quarter and was up by only 0.8% over the year. The below charts track real GDP against GDP per capita, and shows that Australia’s high immigration program is masking our poor underlying growth performance:

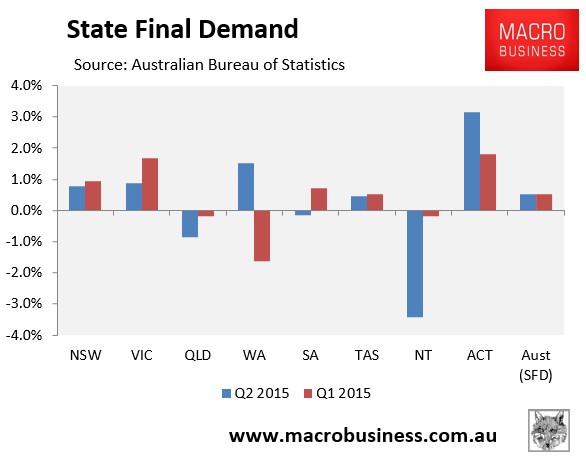

Results were mixed at the state and territory levels, with quarterly final demand growing in NSW (+0.8%), VIC (+0.9%), WA (+1.5%), and TAS (+0.5%), but falling in QLD (-0.8%), SA (-0.2%), and the NT (-3.4%). Final demand nationally also rose by 0.5% over the quarter but was up just 1.1% over the year. [Note: state final demand does not include exports, so is markedly different to GDP]:

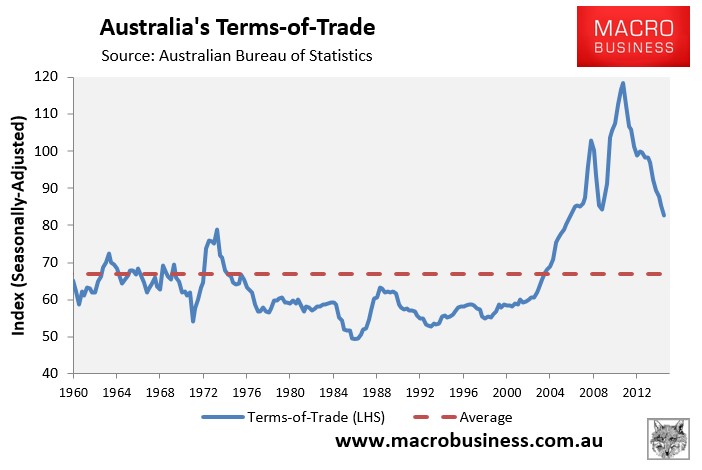

The terms-of-trade fell by a seasonally-adjusted 3.4% over the quarter and by 10.6% over the year, and is now tracking at a 9-year low, with much further still to fall:

And as expected, the falling terms-of-trade dragged-down income growth, with real national disposable income (NDI) down 0.9% over the quarter and by 1.1% for the year.

However, because of population growth, per capita NDI fell by a stronger 1.2% over the quarter and by 2.3% over the year, and will continue to be weak as long as the terms-of-trade unwinds from its current still high level (see next chart).

Indeed, the ongoing slump in per capita income – down 4.5% since December 2011 – is the real story of this release, not the meaningless rise in GDP, which does nothing for living standards.

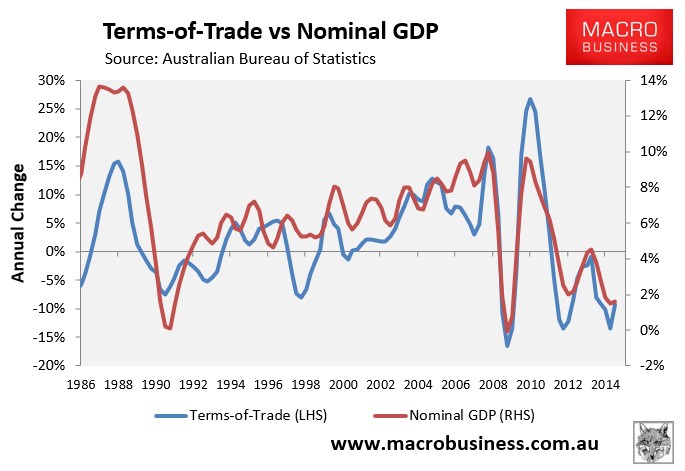

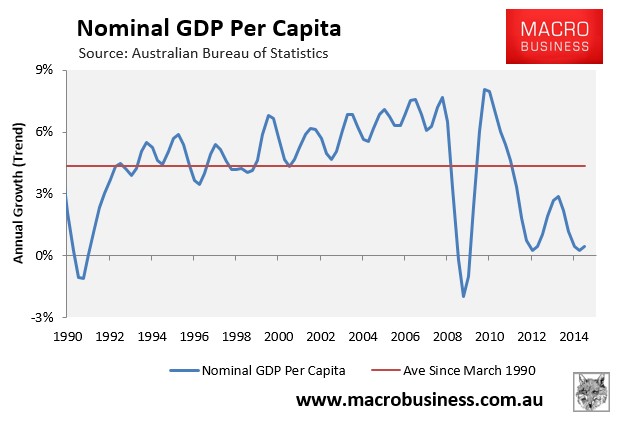

The fall in the terms-of-trade and national disposable income have also helped drag-down nominal GDP, which rose by only 0.3% over the quarter and by 1.6% over the year, and is generally a negative indicator for government finances:

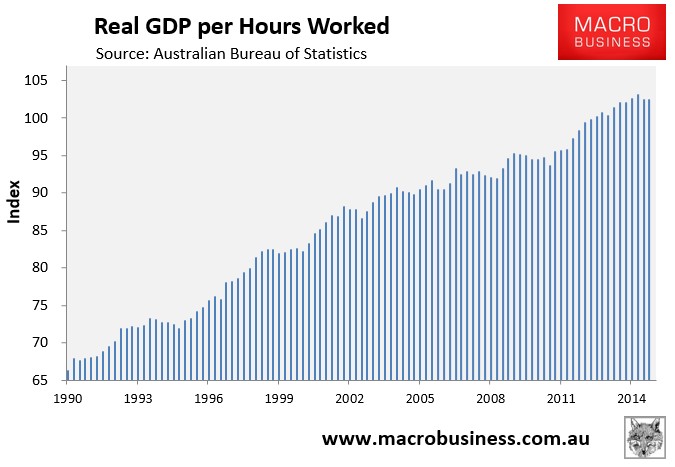

Another negative from this release is that real GDP per hour worked registered zero growth in the June quarter and was up just 0.4% over the year, suggesting labour productivity growth has stalled:

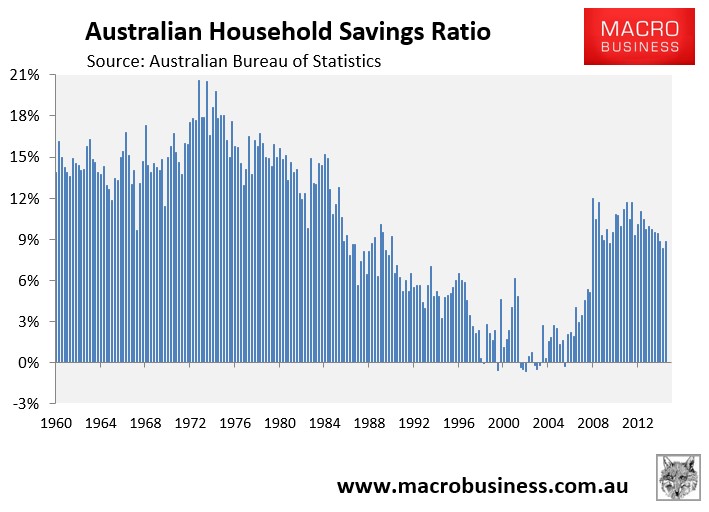

However, the household savings ratio did at least bounce back slightly, rising to 8.8% from 8.3% in March, although it remains in a downtrend:

Overall, this is another disappointing but unsurprising release.

Growth in GDP per capita is weak, national income per capita continues to slide backwards, and labour productivity is low. This quarter aside, Australians have also been leveraging up into housing, as reflected in the trend fall in the savings rate.

The outlook is also poor, with ongoing falls in commodity prices (particularly iron ore) likely to continue dragging down per capita NDI over coming years – a trend that will persist as the terms-of-trade retraces back towards its long-run average.

The weak nominal GDP growth is also a bad sign for Budget revenues, which are already set to take a hammering as capex falls faster than forecast.

Finally, the upcoming expected sharp fall in capital expenditures will also provide headwinds to GDP over coming years, as will the likely peaking of the housing market in mid-2016.

unconventionaleconomist@hotmail.com