Australia is still struggling with the wind-down of a once-in-a-century mining boom, despite a misleadingly solid December quarter GDP headline. Recession remains a live risk for the next 12 months. Leading indicators of labour demand will give warning when, or if, that risk rises.

Never put too much weight on one data point, even a quarterly GDP headline. Q4 GDP was better than forecast – 0.6% versus 0.4% expected – largely because of inventories. Already-released data showed that private non-farm inventories would subtract 0.2 percent from growth. Consequently it was a major surprise that inventories added 0.2 percent – a 0.4% error – reflecting the largest-ever one quarter swing in farm sector inventories.

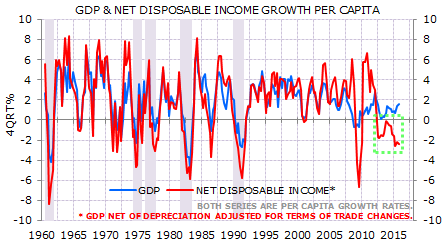

The more important point is that real GDP remains a misleading measure of how Australia is faring. The key to the mining boom was not GDP strength – real GDP growth was weaker than in the 1990s – but the income uplift from rising terms of trade. The issue now is the income drag from the terms of trade falling. Real per capita net income fell 2¼% through 2016. Australia is now the midst of the longest period of declining per capita income since quarterly data started in 1959 (Exhibit 1).

Per capita income is falling even though per capita GDP increased 1½% in 2015. GDP is boosted by low calorie mining growth: yes, export volumes are up – and contributed 1.2 percent to 3.0% GDP growth over the year to December – but export income actually fell by 3¼% over the year due to export prices declining by 8½% (in A$ terms).

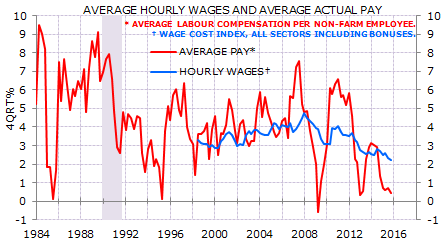

This income decline is not some statistical artifice. It is reflected in workers’ pay: average labour compensation rose 0.4% over the year to December (Exhibit 2). That’s a 1¼% fall in real terms.

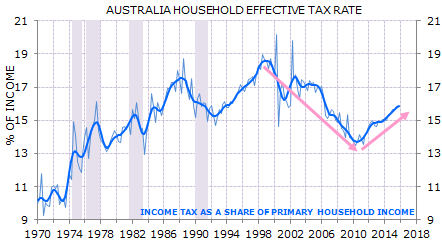

The Federal Government was a major beneficiary of the terms-of-trade income windfall, and is now being squeezed by the reversal. Some of this is being passed on to voters: the average effective household tax rate is now rising (Exhibit 3).

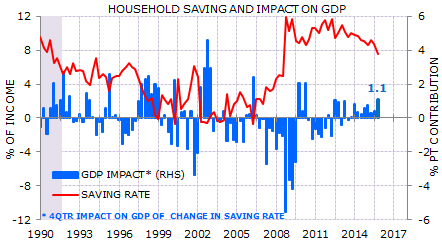

Household disposable income growth is poor given low wage growth and a rising effective tax rate. Real household disposable income increased by just 1.4% over the year to December (0.1% per capita). However, real consumer spending increased by 2.9% through 2015. The gap between income and spending growth is explained by a fall in saving: the declining saving rate is now an important support for growth (Exhibit 4).

This is important. If households continue to lower their saving rate then the risk of recession will be significantly reduced.

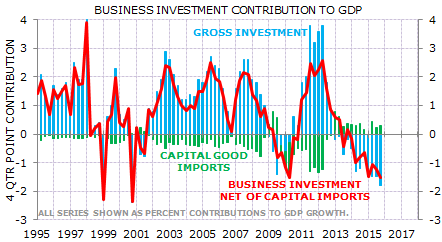

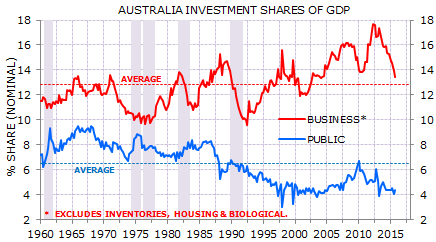

The second major element of the mining boom was the rise in investment spending. This is reversing, which is a major drag on growth (Exhibit 5).

Investment is set to remain a drag on growth through 2016. Business spending remains above its long-run average share of GDP (Exhibit 6).

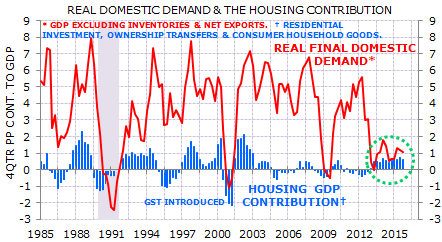

Housing has been one area of unalloyed strength. Housing-related demand – which includes consumer spending on household goods – contributed 0.6 per cent to growth over the year to December. Final domestic demand increased by 1.1% over the same period (Exhibit 7).

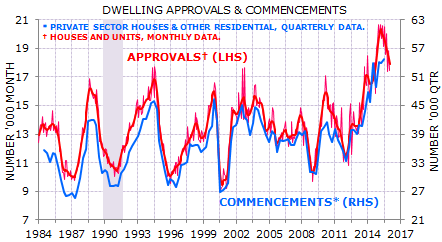

It seems unlikely that housing-related activity will contribute as much through 2016 given signs that the cycle is about to peak (Exhibit 8).

In short, the major headwinds from the mining boom unwind – the terms of trade reverting to average, or less, and the ongoing decline in mining-related investment – are likely to continue through this year. The two important (partial) offsets have been the willingness of households to lower saving and the strength in housing-related activity. It seems unlikely that housing will contribute as much to growth this year as it did last. It is unclear what will happen with household saving. I continue to think recession is a serious risk, but will not tell investors to position for that risk until leading indicators point to softer employment growth.